Dow Jones Industrial Average struggles to hold onto gains ahead of critical week

- The Dow Jones went in both directions on Monday.

- US GDP, Fed rate call, PCE inflation, earnings and NFP are all due this week.

- "Magnificent Seven" earnings figures are also on the radar.

The Dow Jones Industrial Average (DJIA) tested all-new record highs early Monday, clipping into the high side in early trading before the weight of the upcoming week pushed investors back into familiar territory. A handful of Magnificent Seven (Mag7) companies will be posting their latest quarterly earnings this week, adding further high-impact events to an already burgeoning data docket.

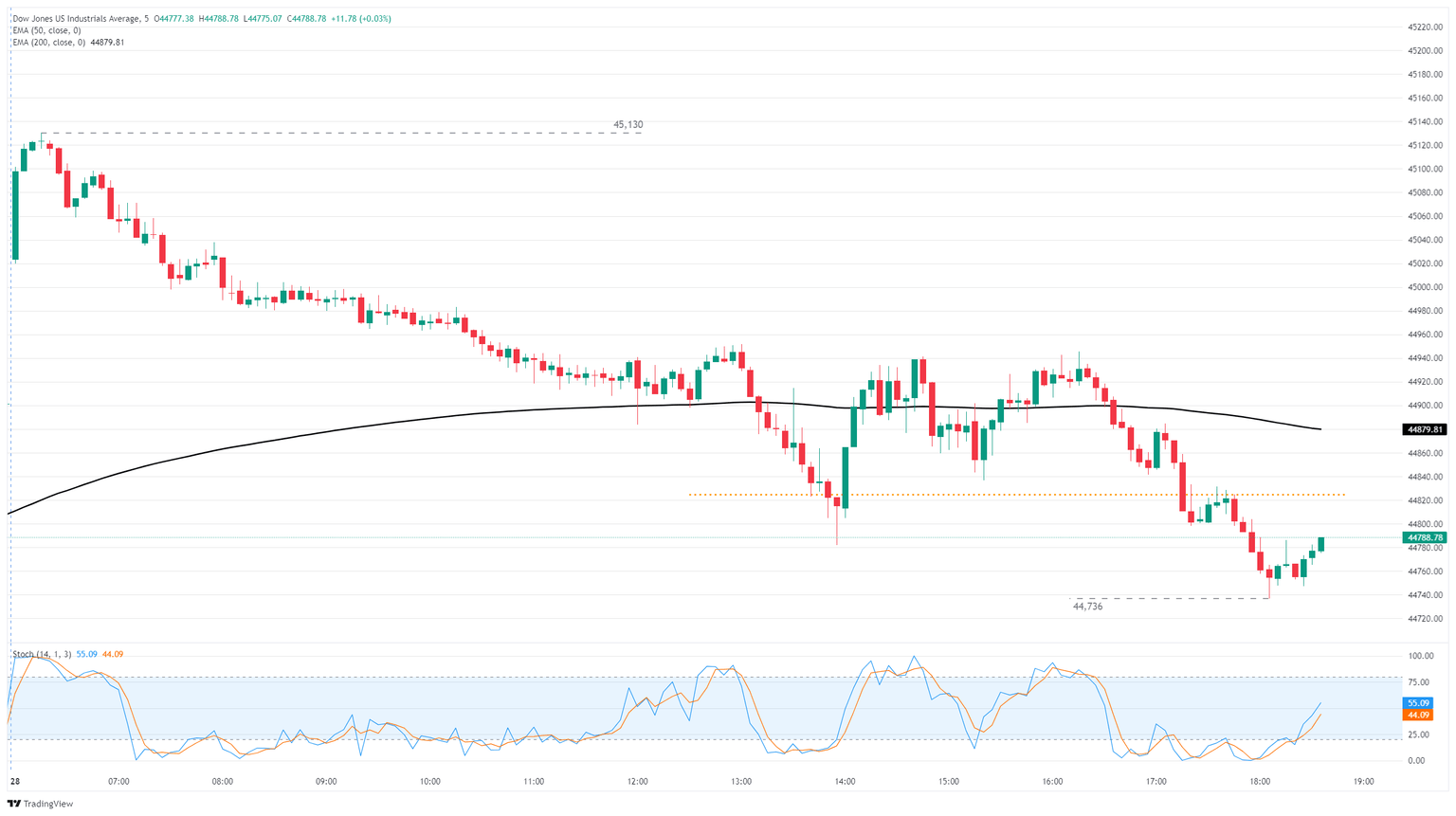

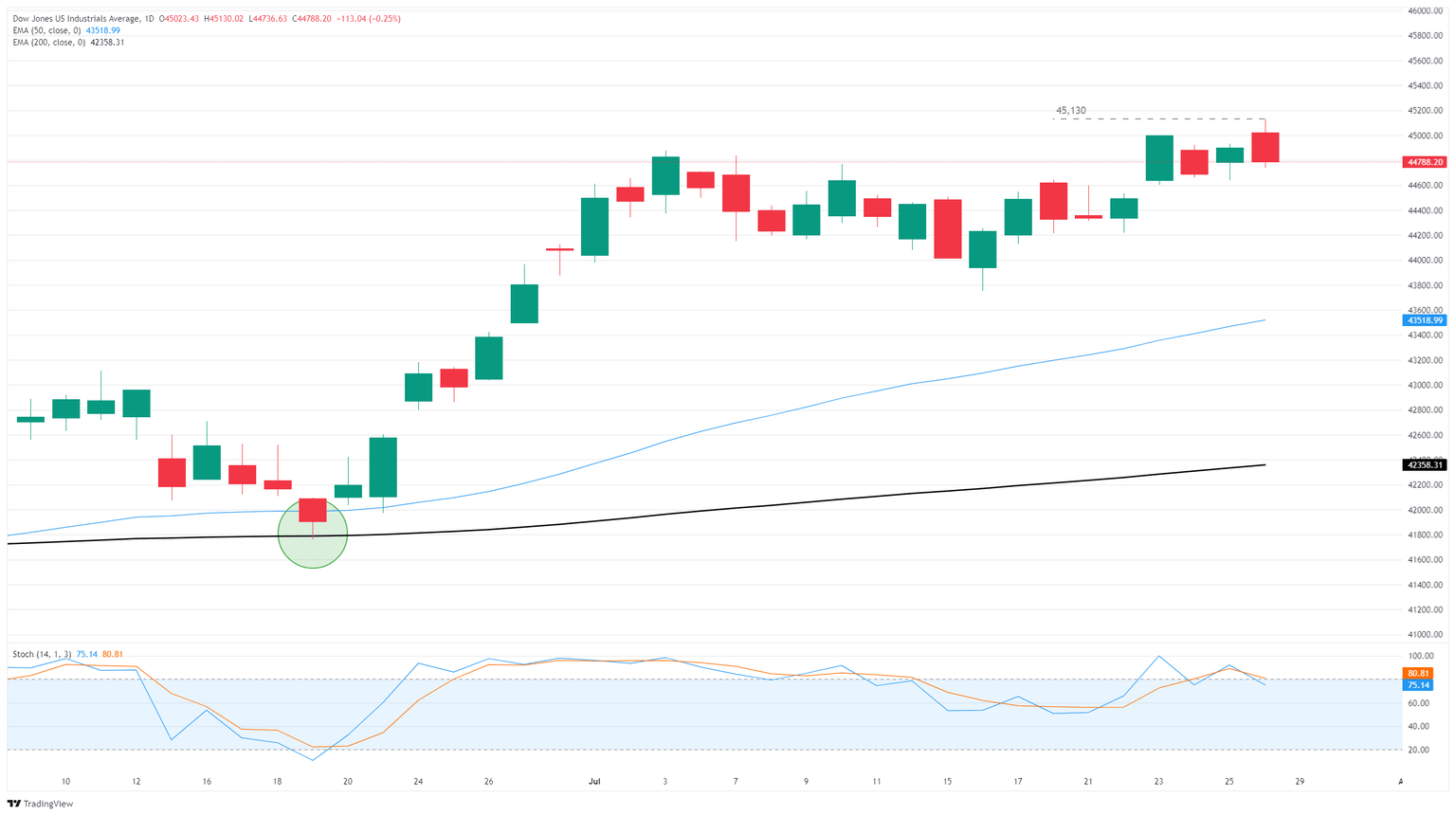

Dow Jones price forecast

The Dow Jones clipped a record high in intraday trading on Monday, tapping 45,130 for the first time ever before slumping back into last week’s congestion. The DJIA is now battling it out near 44,750 as investors gear up for a data and earnings-heavy week. The Dow is still buried deep in bull country, up over 22% from April’s tariff-fueled bearish plunge to 36,615.

Earnings season continues with high-profile Mag7 reports

Facebook parent Meta Platforms (META) and computer services giant Microsoft (MSFT) will be holding their quarterly reviews on Wednesday, followed by Amazon (AMZN) and Apple (AAPL) on Thursday. The theme of the year will continue to be AI spending and services as investors begin to grow antsy about the justifications for companies to continue piling investment cash into AI projects.

GDP growth, Fed rate call, and NFP jobs all in the pipe

United States (US) Gross Domestic Product (GDP) figures for the second quarter are slated to be released early on Wednesday, followed by the Federal Reserve’s (Fed) latest interest rate decision. Annualized US GDP is expected to rebound to 2.4% from Q1’s -0.5% print, while the GDP Price Index is forecast to ease to 2.4% from 3.8%. The Fed has been under increasing pressure from the Trump administration to trim interest rates fast and early, with President Donald Trump calling for a three-point reduction in the fed funds rate. Despite the White House’s protestations, the Fed is broadly expected to keep interest rates on hold this week, with hopes for a quarter-point rate cut in September.

Core Personal Consumption Expenditures Price Index (PCE) inflation data from June will be released on Thursday. Headline inflation figures hit a bump and run through the second quarter, with much of the blame laid at the feet of the Trump administration’s whipsaw trade and tariff policies. June’s PCE inflation index is expected to tick upward once again, rising to 0.3% MoM from the previous 0.2%.

Friday will close out a heavy week with the latest US Nonfarm Payrolls (NFP) data. Median market forecasts expect a slight easing in headline job additions, with investors expecting around 110K net new employed positions in July compared to June’s headline print of 147K.

Read more stock news: Nike leads Dow Jones higher after upgrade

Dow Jones 5-minute chart

Dow Jones daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.