Dow Jones Industrial Average climbs alongside Fed rate cut bets

- The Dow Jones rose again on Wednesday as equities look higher.

- Investors have beaten back recession fears following a slump in labor data last week.

- Rate markets now see better-than-even odds of three straight rate cuts by the end of the year.

The Dow Jones Industrial Average (DJIA) rose on Wednesday as investors pushed equities into a second straight day of decisive gains. Interest rate cut expectations have been pinned higher, bolstering broad-market sentiment as traders broadly expect up to three interest rate cuts through the year’s end.

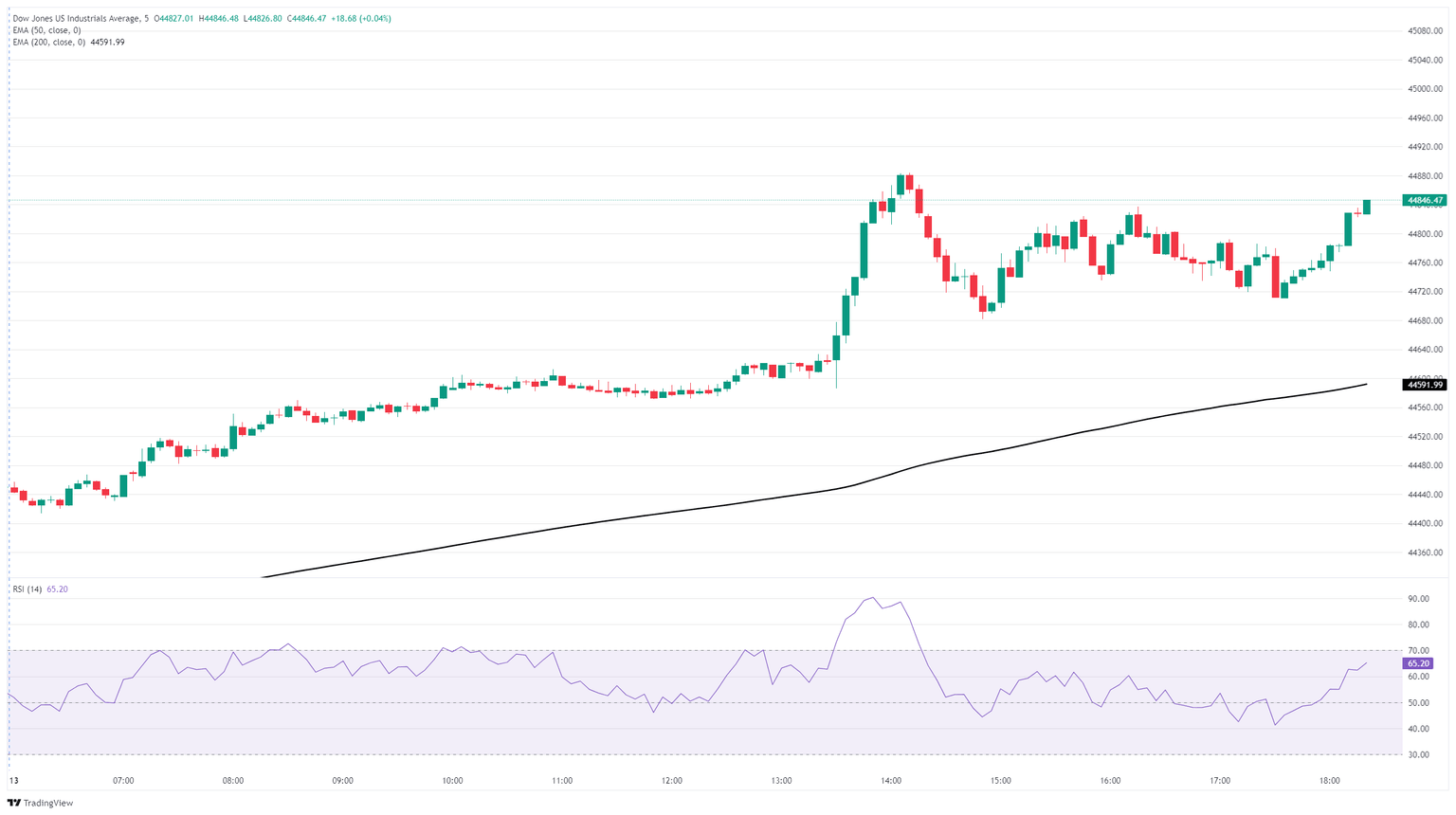

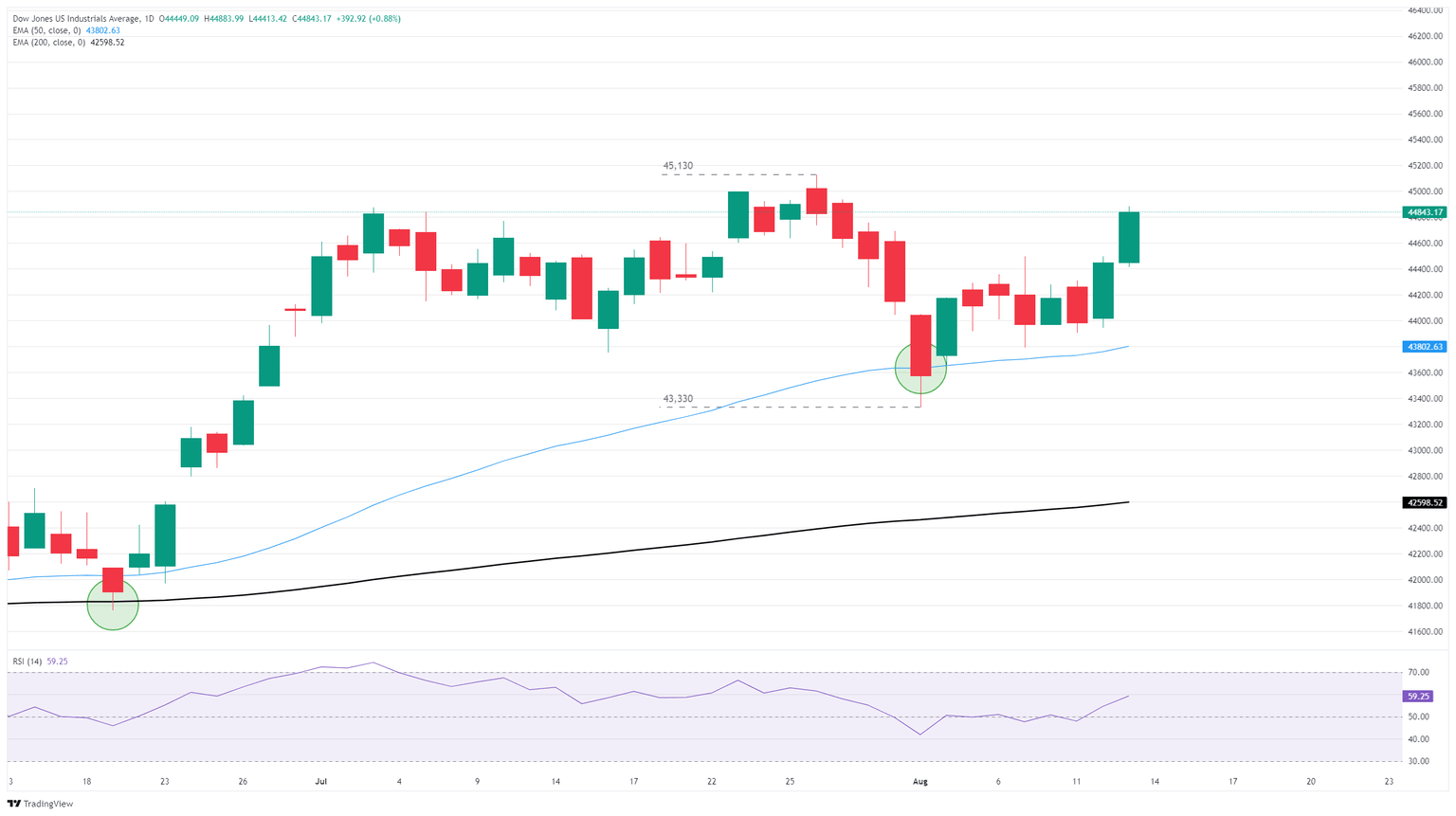

The Dow Jones was pushed firmly above the 44,500 level, and is back on track to challenge the 45,000 major handle once again. Price action is still on the low side of record highs above 45,130, with bullish momentum getting pushed higher by technical support from the 50-day Exponential Moving Average (EMA) near 43,780.

Fed rate cut hopes climb higher

Despite a general uptick in core inflation figures this week, investors are brushing off rising price pressures as hopes for an accelerated pace of Fed rate cuts return to the forefront of traders’ attention. According to the CME’s FedWatch Tool, rate markets are pricing in 99.95% certainty that the Fed will be delivering at least a quarter-point interest rate cut on September 17, with 1-in-3 odds of a double-cut. Overall, rate traders are expecting slightly better-than-even odds that the Fed will deliver a third 25 bps rate trim by mid-December.

Investors will be looking ahead to Thursday’s Producer Price Index (PPI) inflation print, which is unlikely to derail Fed rate cut hopes. US PPI inflation specifically excludes any items that would immediately be impacted by tariff price changes, limiting the potential for lopsided trade policies to directly impact business-level inflation. Still, median market forecasts expect an uptick in core PPI inflation to 2.9% YoY in July, up from 2.6% for the previous period.

Dow Jones 5-minute chart

Dow Jones daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.