Dow Jones futures remain choppy, TWTR and investment banks (GS) (MS) soar

- Dow Jones futures are trading flat on Thursday ahead of the market open.

- Dow Jones futures made gains on Tuesday but the Nasdaq led the way.

- Dow Jones futures are still stuck in a range pattern with no breakout insight.

Dow Jones futures advanced on Wednesday as risk assets saw inflows despite another record high reading for the Producer Price Index (PPI). Investors it seems have become largely immune to inflation shocks now and bond yields fell for the second straight day on Wednesday. That was despite a high CPI number on Tuesday and the PPI on Wednesday. Bond market positioning as we have pointed out has become overdone and a pullback was likely. We see this set to continue.

Dow Jones futures news

Thursday sees strong results from the investment banking giants, Goldman Sachs (GS) and Morgan Stanley (MS) as they benefit from the surge in volatility in financial markets as a result of the Ukraine crisis. Wells Fargo by comparison was not so positive as mortgage lending slowed on the back of higher interest rates. This is an early warning system for house prices and the overall US economy but will take time to play out. Usually, Wells and other commercial banks would be expected to benefit from rising yields but only if lending growth remains stable. Of course, the big news is Elon Musk upping the ante in the battle for Twitter (TWTR). He has now bid $54.20 cash for 100% of the company and has threatened to walk away if he does not get approval. Twitter (TWTR) stock spiked close to $53 on the news of the offer but has since retraced slightly.

Dow Jones futures forecast

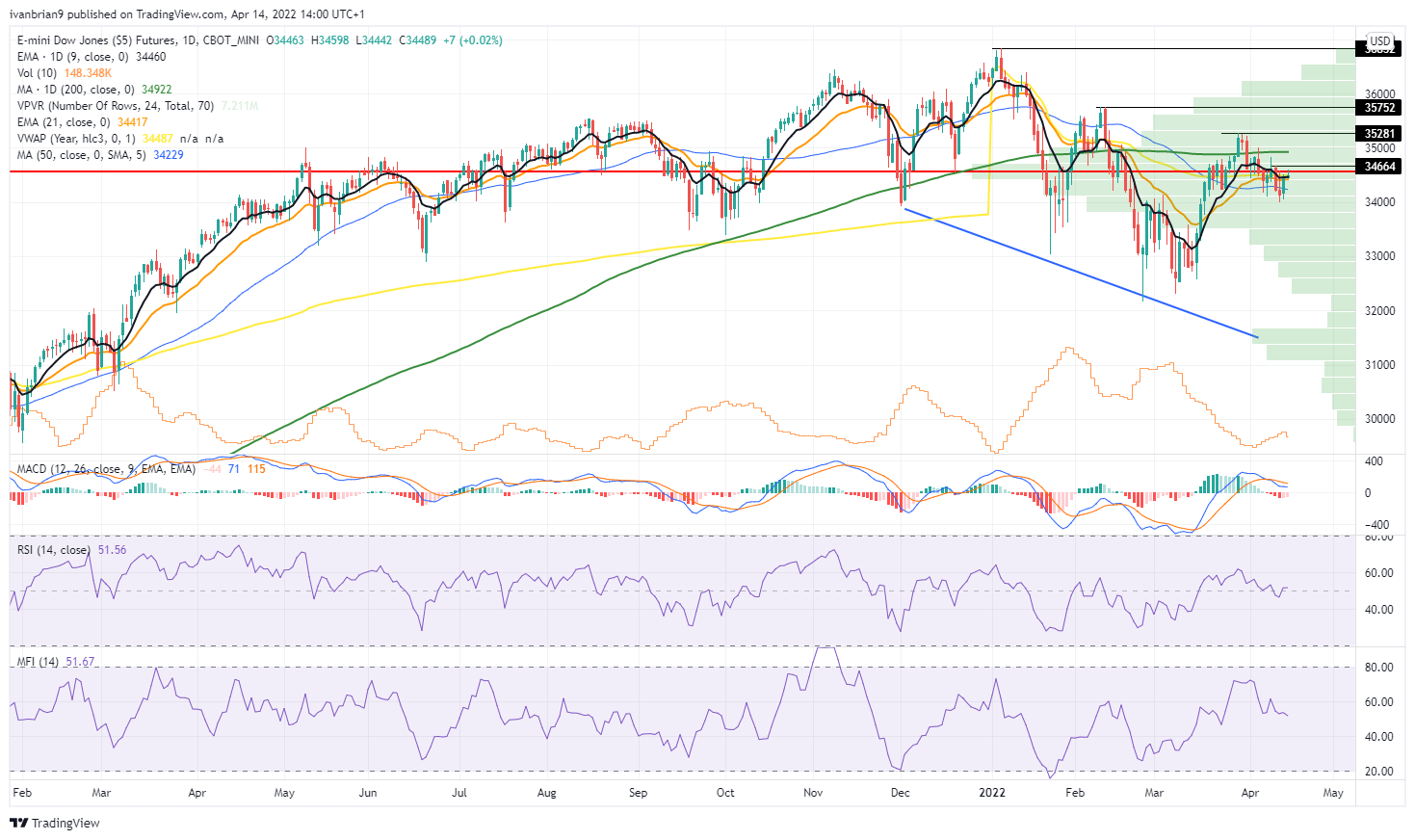

34,664 remains our short-term pivot and this could be in danger on Thursday. Above and we feel a move to 35,752 is more likely.

Dow Jones futures chart, daily

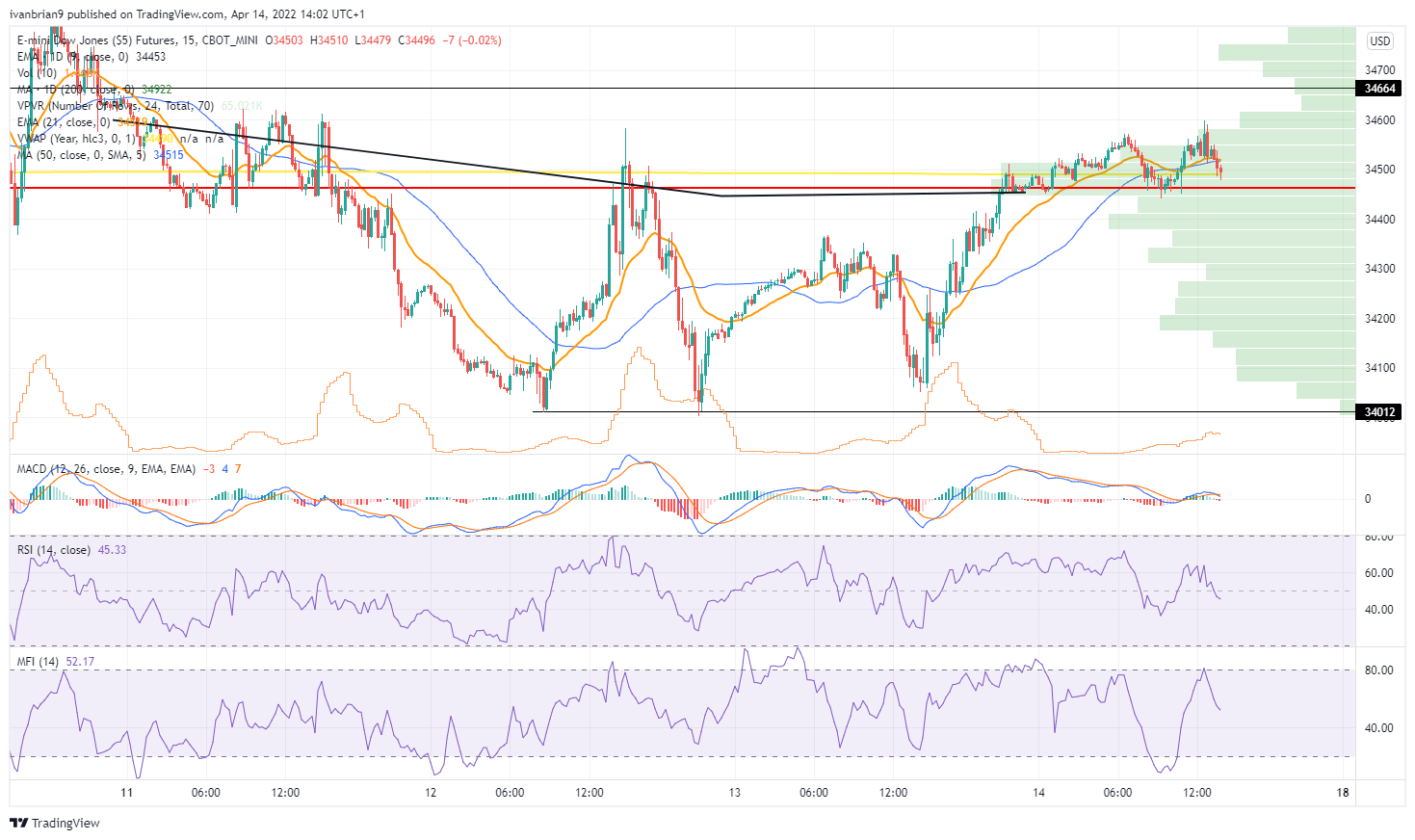

On the short-term 15-minute chart below we can identify strong support now at 34,012. Below and a move to sub 33,000 is likely.

Dow Jones futures chart, 15 minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.