DKNG returned higher after completing the pullback

The Draft Kings, Inc. ticker symbol: DKNG is a digital sports entertainment and gaming company engaged in providing online sports betting. Online casinos, daily fantasy sports product offerings, Draft Kings Marketplace. Retail sports betting, media and other gaming product offerings. consumption. It operates through the following segments: Business-to-Consumer (B2C) and Business-to-Business (B2B). The business-to-consumer segment includes sports betting, iGaming and DFS product offerings, as well as media and other consumer product offerings. The Business-to-Business segment includes the design and development of gaming software.

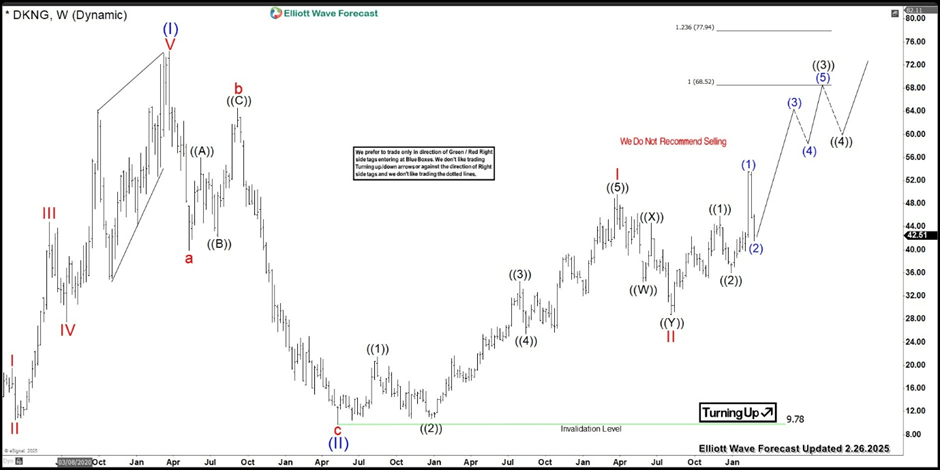

DKNG latest weekly Elliott Wave analysis from 2.26.2025

As shown in the last article, DKNG ended the wave II pullback at $28.69 low. Up from there, the stock made the rally higher in a nest where wave ((1)) ended at $45.87 high. Wave ((2)) pullback ended at $35.96 low & started the wave ((3)) higher with a break above $49.57 high from March 2024. Supporting more upside extension to take place towards $$68.52- $77.94 target area next. Until than dips are expected to remain supported in 3, 7 or 11 swings looking for more extension higher.

DKNG weekly Elliott Wave analysis from 11.29.2024

In weekly the super cycle degree wave (I) ended at $74.38 high and made a 3 wave pullback against all time lows within wave (II). The internals of that pullback unfolded as zigzag correction where wave cycle degree wave a ended at $39.93 low. Wave b bounce ended at $64.58 high and wave c ended at $9.78 low. Thus completed wave (II) pullback. Up from there, the stock made a 5 waves rally & ended cycle degree wave I at $49.57 high. Down from there, the stock made a 7 swings lower pullback and completed wave II pullback at $28.69 low. Near-term, as far as dips remain above $35.96 low and more importantly above $28.69 low expect stock to resume the upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com