DAX is declining in an impulsive structure [Video]

![DAX is declining in an impulsive structure [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_DAX-1_XtraLarge.jpg)

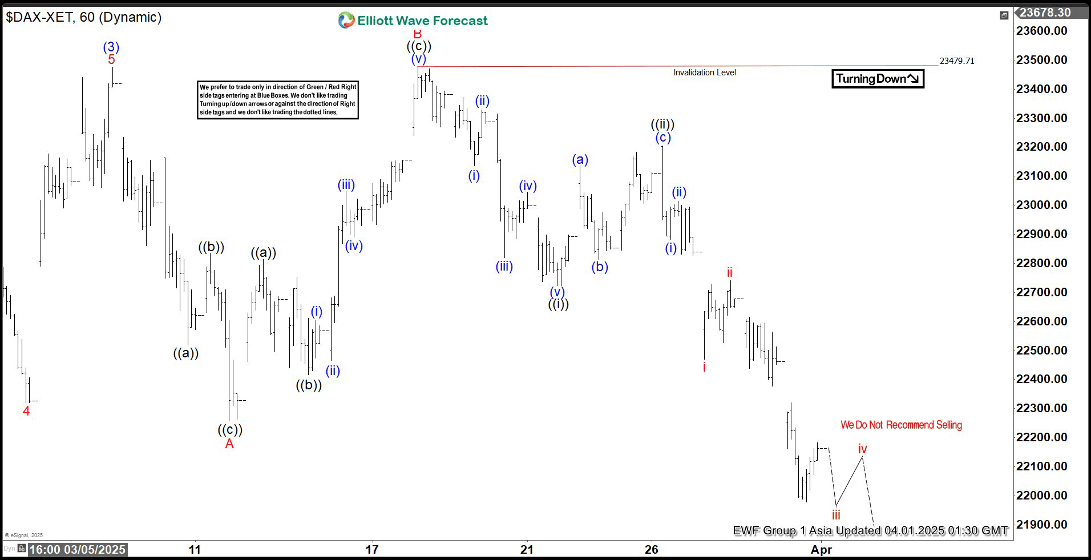

The $DAX appears to be tracing a five-wave impulsive decline from its recent high on March 18, 2025. In Elliott Wave theory, an impulsive structure consists of five distinct waves. Wave 1, 2, 3, 4, and 5 as motive wave moves the direction of the prevailing trend, which in this case is downward. This pattern indicates a strong, directional move, with waves ((i)), ((iii)), and ((v)) being motive (driving the decline) and waves ((ii)) and ((iv)) serving as countertrend corrections.

Starting from the March 18 peak, wave ((i)) likely initiated the downturn which ended at 22723.19. It was followed by a corrective wave ((ii)) rebound towards 23204.59. Wave ((iii)), typically the longest and most powerful in an impulsive sequence, should push the index lower with momentum. A smaller corrective wave ((iv)) is then expected to follow, offering a brief bounce. Then wave ((v)) should complete the structure, potentially finding a bottom. The impulsive nature suggests that each motive wave ((i)), ((iii)), ((v))) subdivides into its own five-wave pattern, reinforcing the bearish outlook.

Key levels to watch include support zones where prior corrections have held. Exact targets however depend on the unfolding wave lengths and Fibonacci relationships. Expect further downside until the fifth wave concludes. Afterwards, a larger corrective rally could emerge. This view aligns with sentiment for a continued near-term decline in the $DAX, driven by an impulsive bearish sequence.

DAX 60 minutes Elliott Wave chart

DAX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com