Dax 40 and FTSE June: Will support hold or break?

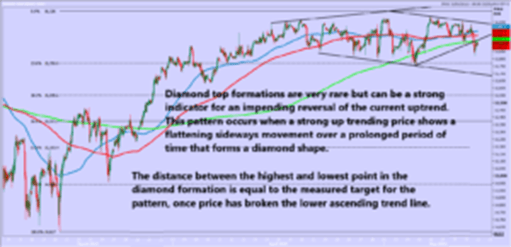

Dax 40 June breaks out of the diamond top pattern.

Dax 40 breaks to the downside for a sell signal. At last I think we have a pattern to trade!!

FTSE 100 June held resistance at 7760/80 again yesterday.

Daily analysis

Dax June meets resistance at the break point & 500 hour moving average at 15900/950. Shorts need stops above 16000.

We meet support at 15810/15770.

A break below 15750 should be a sell signal & certainly a weekly close below here should lead to losses next week. Next target is 15550.

FTSE June resistance at 7760/80 again today (a high for the day just 10 ticks above here yesterday so I hope a short here worked for you).

Holding below here again today keeps the pressure on for a retest of this week's low at 7688. A low for the day exactly here yesterday but I think eventually we will break lower to target 7655/50. A break below 7630 can target 7580/60.

Author

Jason Sen

DayTradeIdeas.co.uk