Crude Oil tests the high end as geopolitical concerns weigh, keeping energy prices pinned

- WTI explores territory north of $78.00 as barrel prices remain bid.

- Global demand concerns outweighed by Middle East tensions.

- Fresh attacks by Houthis and the ongoing Gaza conflict keeping barrel prices high.

West Texas Intermediate (WTI) US Crude Oil tested above $78.00 per barrel on Monday, finding room to the upside with US markets darkened for the American President’s Day federal holiday.

Iran-backed Houthis in Yemen continue to launch attacks on civilian cargo ships in the Red Sea, disrupting key trade routes between Europe and Asia since last November. Houthi rebels claimed responsibility for an attack on an oil tanker bound for India over the weekend, alongside fresh reports of attacks on Monday as shipping lanes through the Suez Canal continue to come under threat.

The ongoing conflict in Gaza between Israel and Palestinian Hamas looks set to continue unabated as an ongoing ceasefire negotiation continues to come up short. Israel’s negotiation team did not return to the talks table in Qatar over the weekend and a ceasefire deal appears unlikely.

Despite Middle East tensions keeping concerns pinned about hypothetical supply constraints in energy markets, ANZ researchers noted that the Organization of the Petroleum Exporting Countries (OPEC) has hit an eight-year high in excess capacity. According to ANZ, OPEC has enough slack in its production cycle to absorb an excess of 6.4 million barrels per day.

WTI technical outlook

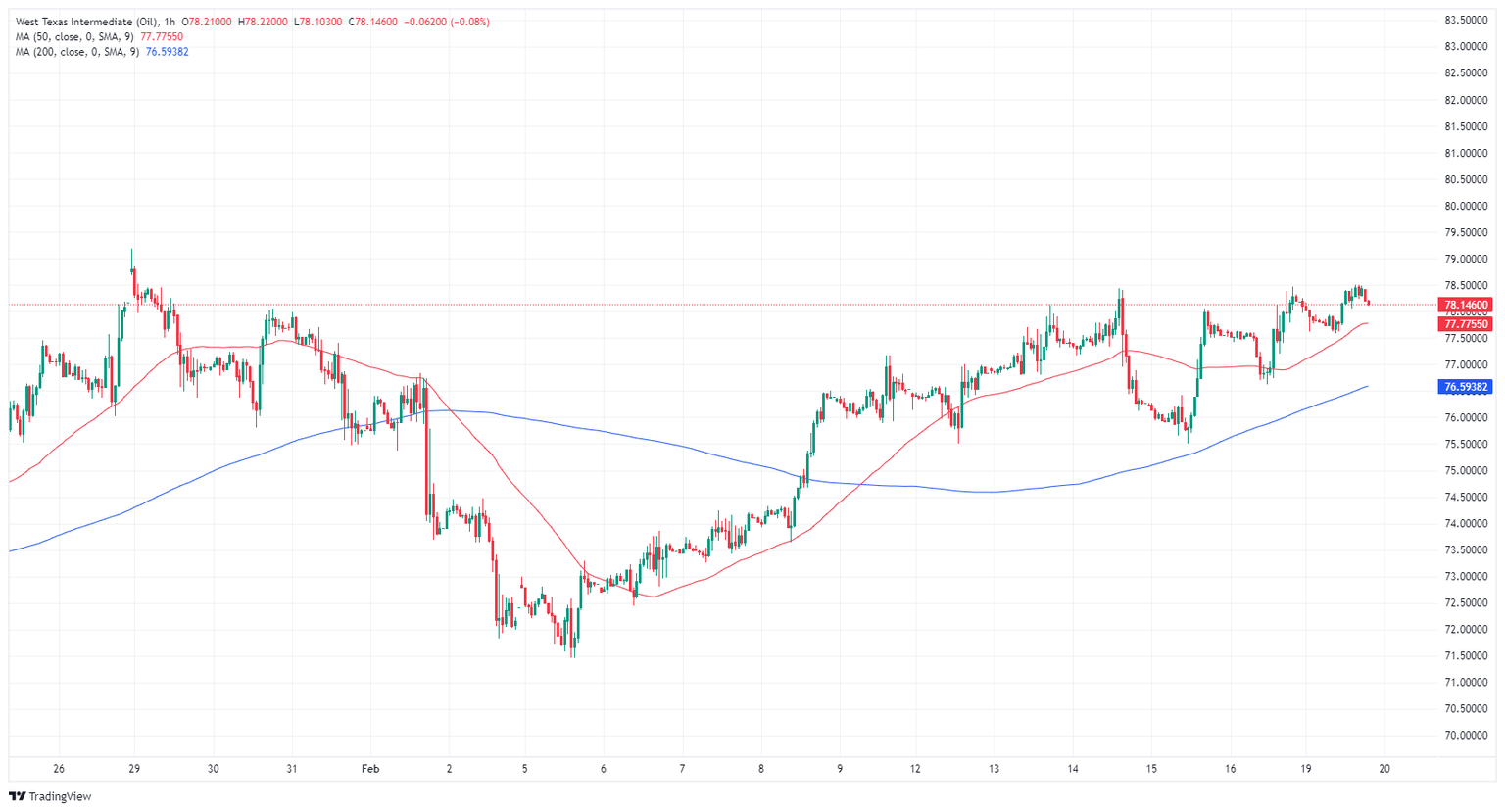

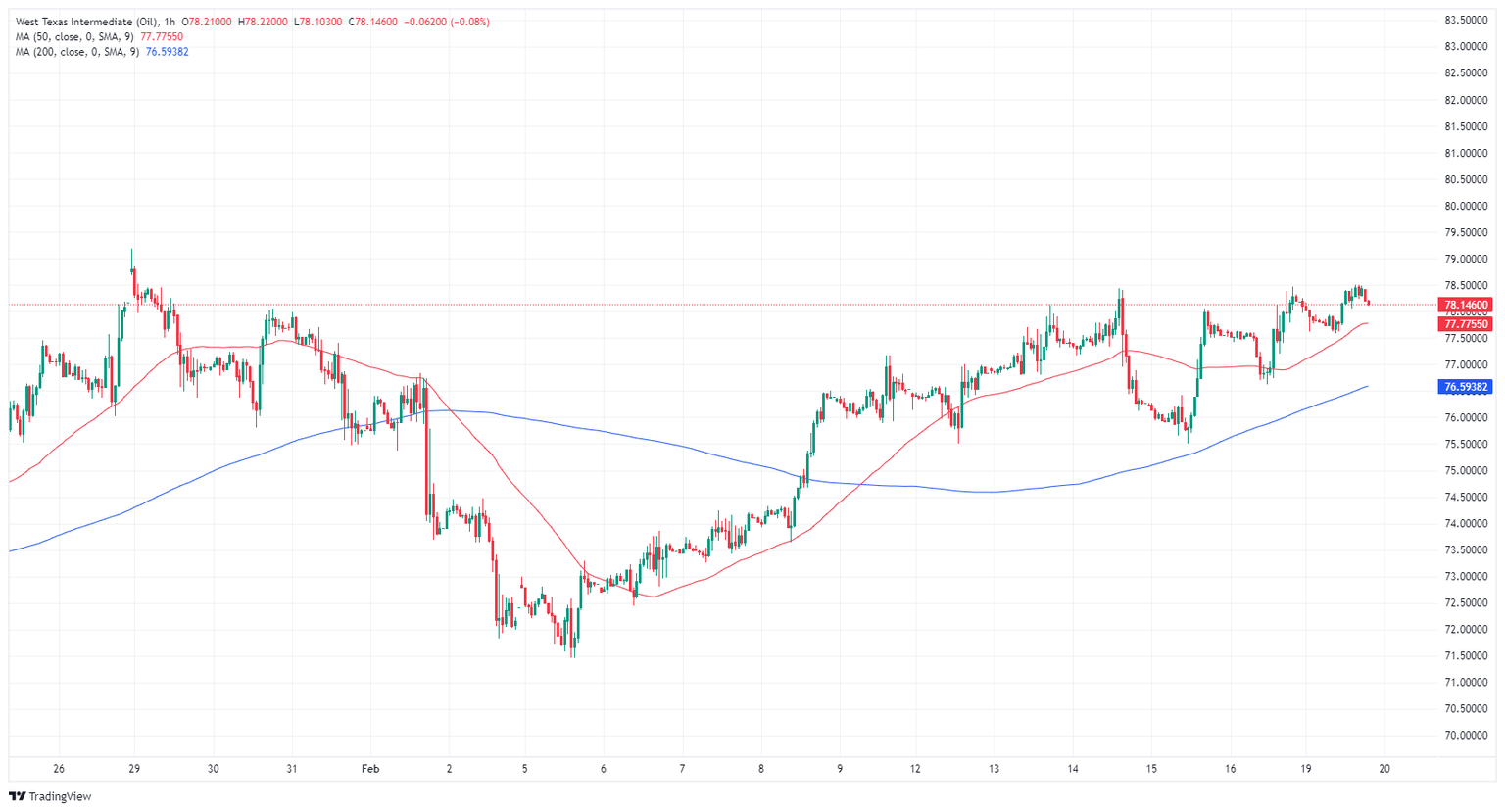

WTI US Crude Oil remands bid into near-term highs, testing $78.00 and bolstered above the 200-hour Simple Moving Average (SMA) near $76.60.

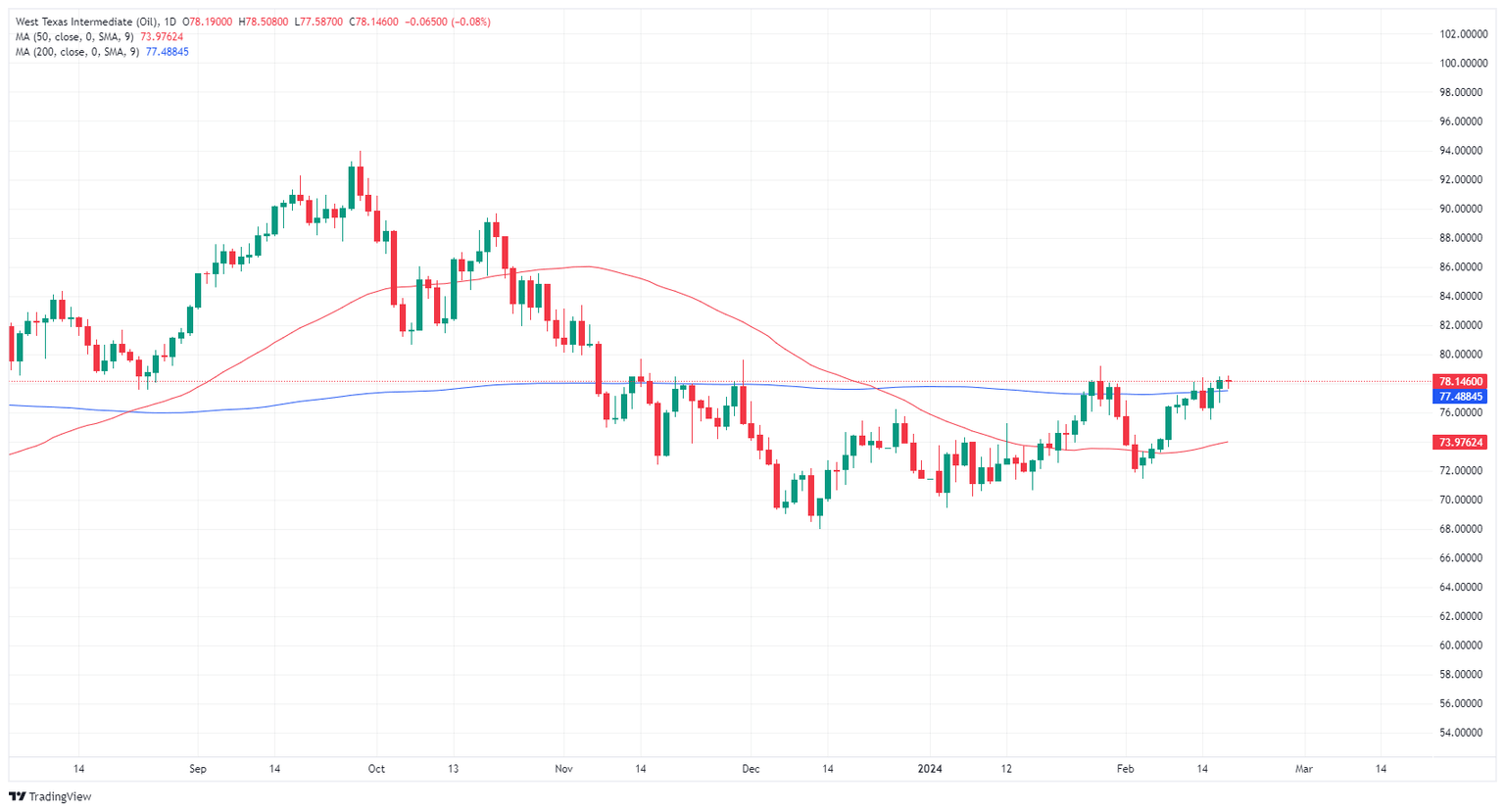

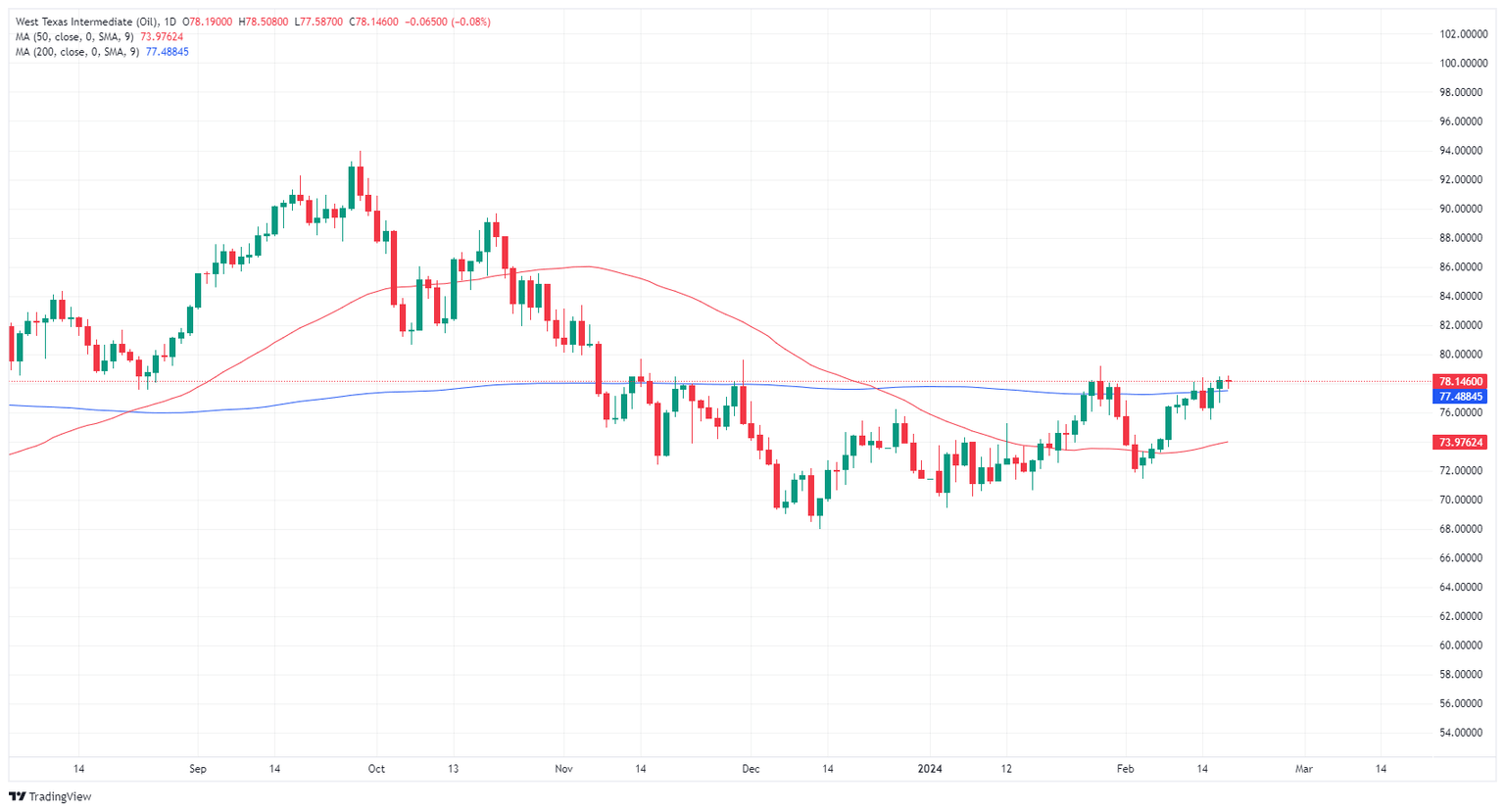

WTI Crude Oil prices have seen a choppy, halting recovery after hitting a low of $67.97 in December, and WTI is still down nearly 17% from last September’s peak bids near $94.00 per barrel.

WTI hourly chart

WTI daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.