Crude Oil sees rough trading on Thursday, WTI grappling with $76

- Crude Oil barrels are consolidating as energies markets weigh OPEC angst.

- Disagreement over quotas led to a delay in a scheduled OPEC meeting.

- Mismatched production quota desires within OPEC is crimping energy risk sentiment.

West Texas Intermediate (WTI) Crude Oil barrels are continuing to grind into the low side on Thursday, struggling to develop momentum as barrel traders chew on the Organization of the Petroleum Exporting Countries (OPEC) row that sees proponents for further production cuts coming to loggerheads with smaller Crude Oil producers looking to increase their production in order to defend their energy exporting sectors.

The United Arab Emirates (UAE) has been chasing higher OPEC production quotas for years as the country seeks to ramp up its Crude Oil production and exporting facilities which are sitting with plenty of unutilized capacity.

OPEC disagreement on quotas causes meeting delay, Crude Oil traders get nervous

Saudi Arabia, one of the largest players on the OPEC board, has been aggressively pursuing production cuts across the oil cartel’s member states in order to bolster Crude Oil prices. The UAE was provided additional quota capacity in OPEC meetings last year to the detriment of several smaller OPEC states, mostly in Africa, who saw their production caps tightened even further in order to grant the UAE additional production capacity.

Those oil-producing nations are now dissatisfied with their current oil pumping and selling limits, and are seeking increases in their respective quotas.

Saudi Arabia is allegedly expressing discontent with OPEC member states seeking additional production capacity as the Kingdom of Saudi Arabia seeks to cut global oil production even further in an attempt to offset Crude Oil price declines from increasing production from non-OPEC members.

The OPEC’s upcoming meeting slated for November 30th where the oil cartel will discuss current production quotas was delayed by four days, and energy investors are seeing a drag on sentiment ahead of the delayed meeting.

Crude Oil Technical Outlook

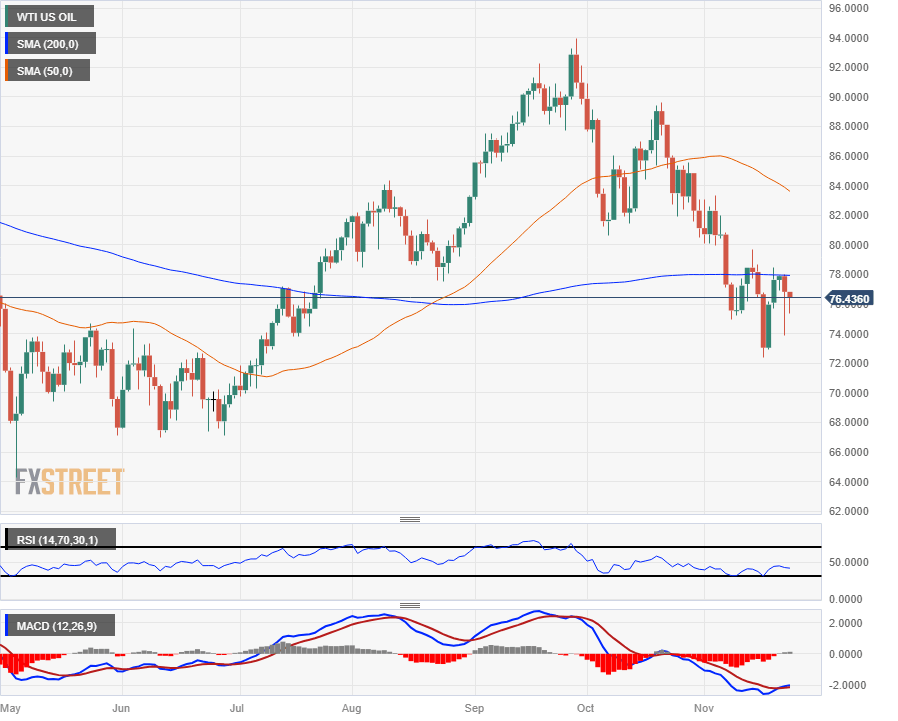

WTI barrel bids are seeing a technical ceiling forming at the 200-day Simple Moving Average (SMA), with prices capped under the moving average as Crude Oil forms a consolidation pattern in the $78 to $74 region, a bid neighborhood barrels haven’t seen since a bullish upshot last July.

WTI peaked near $94 per barrel in late September, and is down nearly 23% peak-to-trough, with Thursday’s bids still down nearly 19% from September’s $93.98 peak despite a recovery from last week’s drop into $72.38, its lowest bids in 18 weeks.

WTI Daily Chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.