Costco Wholesale Corp. (COST) Elliott Wave technical analysis [Video]

![Costco Wholesale Corp. (COST) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_3_XtraLarge.png)

COST Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iii} of 5.

Direction: Upside in wave 5.

Details: Looking for upside into wave {iii} as we have broken above Trading Level 1 at 1000$. At this point we are looking for at least equality of {iii} vs. {i} at 1150$.

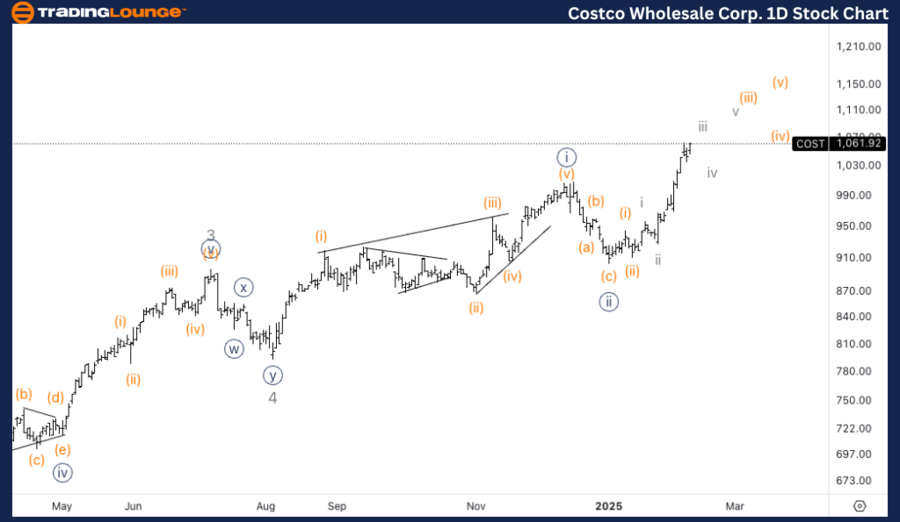

COST Elliott Wave technical analysis – Daily chart

Costco Wholesale Corp. (COST) is currently in an impulsive wave {iii} of 5, indicating further upside. After breaking above the key resistance at TradingLevel1 of $1000, the next significant target is at $1150, where equality between waves {iii} and {i} is anticipated. If wave {iii} continues its trajectory, this could lead to even higher targets before a possible pullback in wave {iv}.

COST Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave iii of (iii).

Direction: Upside in wave {iii}.

Details: We are extending higher into a third of a third of a third and the angle of ascent seems to be confirming the count. Looking for a series of waves threes and fours to follow.

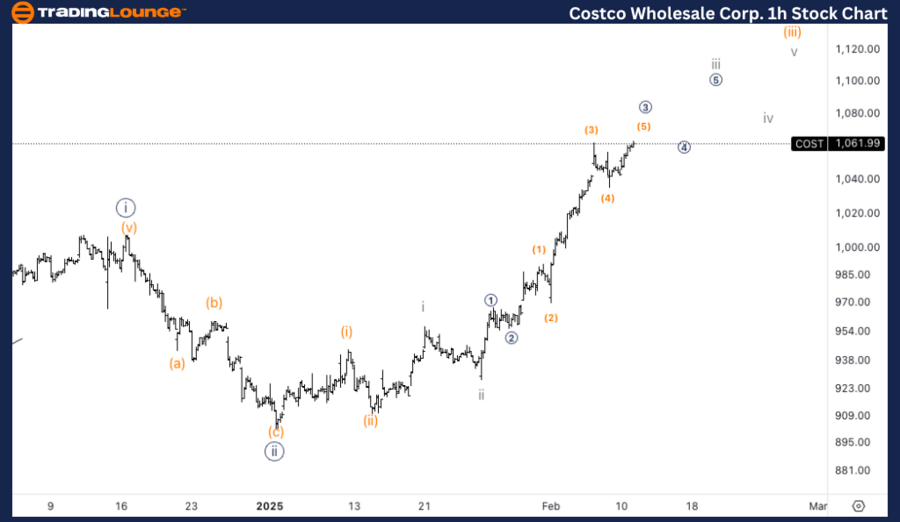

COST Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, COST is unfolding in wave iii of (iii), which represents a powerful upward movement within the third wave of a larger degree. The steep angle of ascent suggests that the count is accurate. We anticipate a series of smaller corrective waves (threes and fours) within this wave, as the trend continues to extend higher.

In this Elliott Wave analysis, we will review the trend structure of Costco Wholesale Corp., (COST) using both the daily and 1-hour charts to assess the current wave position and potential price movements.

Costco Wholesale Corp. (COST) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.