Copper Price Today: China’s supply curb trigger rebound from two-week low

- Copper picks up bids after refreshing multi-day low.

- China eyes crackdown on commodity prices, unveils 16.6% YoY jump in refined copper output in April.

- US dollar weakness helps the base metal, stimulus hopes favor buyers.

Copper prices extend corrective pullback to $4.5840, up 0.08% intraday, on COMEX during early Wednesday. The commodity dropped to the fresh low since May 05 before bouncing off $4.5265 earlier in Asia.

The US dollar retreat, mainly because of the US Treasury yield’s recent weakness, could be cited as a catalyst for commodity run-up on the first look. However, mixed updates from China are the key for the base metal’s recent recovery, due to Beijing’s status as the world’s largest commodity user.

“The world's biggest metals consumer will step up adjustments on the trade and stockpiling of commodities and reinforce inspections on both the spot and futures markets, state media reported the cabinet meeting as deciding. It will crack down on malicious trading and investigate behavior that bids up prices, according to the report,” said Reuters.

Separate news, per China Stats Bureau data, mentions that the dragon nation produced 901,000 tons of refined copper in April, up 16.6% YoY.

Overall, economic recovery from the pandemic propels copper’s demand and hence China’s efforts to tame the bulls may not disappoint long-term commodity investors.

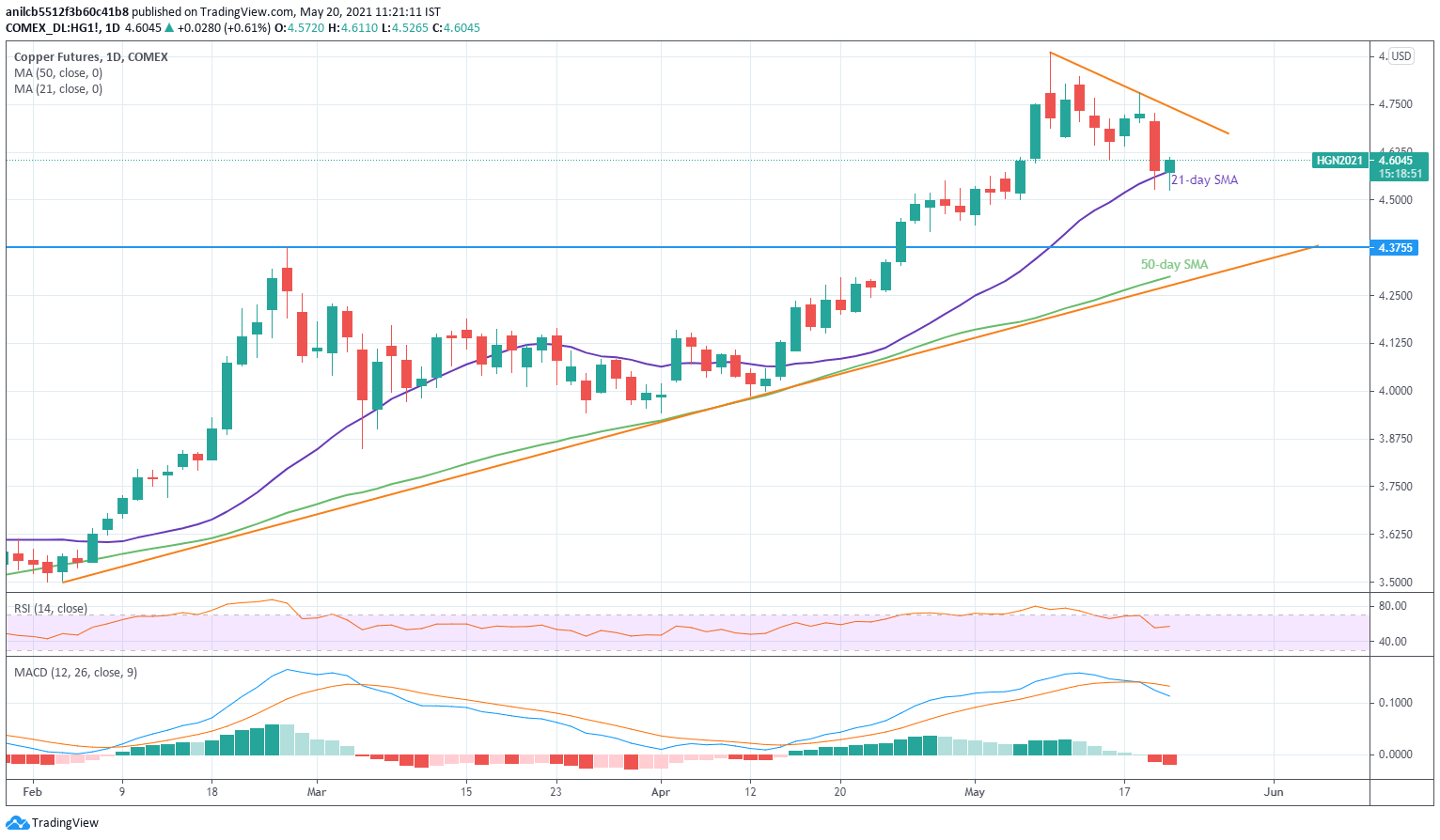

Price of copper: Daily chart

Technically, the red metal is on the upward trajectory, portrayed by an ascending trend line from early February, not to forget trading beyond the key SMAs.

However, bulls need a clear break of the weekly resistance line, at $4.7425, to refresh the record top above $4.8880 marked earlier in the month.

For now, 21-day SMA near $4.5760 offers immediate support to the metal ahead of February top of $4.3755.

Should the metal drops below $4.3755, the $4.3000-2800 area comprising the stated support line and 50-day SMA could test the copper bears.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.