CFTC Positioning Report: Bearish bets dominate the US Dollar

The most recent CFTC Positioning Report for the week ending July 1 highlights a significant uptick in risk-on trading. Market participants were actively evaluating the Trump-brokered ceasefire in the Middle East alongside further progress in the US-China trade negotiations.

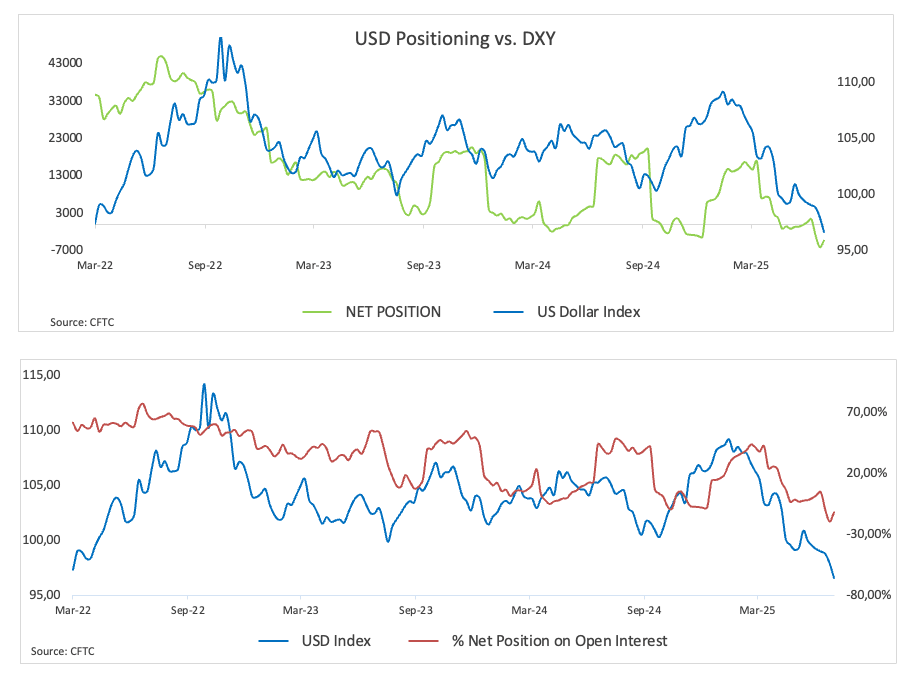

Non-commercial net shorts in the US Dollar (USD) have fallen to two-week lows, reaching approximately 4.3K contracts. This decline occurs alongside a fifth consecutive increase in open interest, which has now reached levels not observed since mid-March, around 36.3K contracts. The US Dollar Index (DXY) continued its downward trajectory, slipping to multi-year lows near 96.40.

Speculative net longs in the Euro (EUR) have experienced a modest decline, now standing at approximately 107.5K contracts. Commercial players, predominantly hedge funds, have decreased their net short positions to approximately 160.6K contracts, although they remain near multi-month highs. Moreover, open interest has reached three-week highs, surpassing 779K contracts. EUR/USD has continued its strong recovery, breaking through the 1.1800 level for the first time since September 2021.

Non-commercial traders have seen a continued decline in net longs for the Japanese Yen (JPY), with current holdings dropping to approximately 127.3K contracts, marking multi-month lows. Commercial players have ramped up their bearish positions to nearly 151K contracts, marking a three-week high. This shift occurs amid a third consecutive decline in open interest, which has now fallen to approximately 314.2K contracts. The continued downward pressure has driven USD/JPY to multi-week lows around 142.60 during that period.

Speculators have decreased their bullish positions on the British Pound (GBP), cutting their net long exposure to approximately 31.4K contracts, marking a six-week low, coinciding with the second consecutive weekly increase in open interest. The intense decline in the Greenback has propelled GBP/USD to approach the 1.3800 mark, a level not seen since October 2021.

Speculative net longs in Gold have increased to nearly 202K contracts, reaching a multi-week high as open interest experienced a resurgence, climbing to approximately 437.7K contracts. Gold prices experienced a downward trend, falling to six-week lows near $3,245 per troy ounce, driven by a decline in safe haven demand.

Non-commercial net longs in WTI have risen for the fifth consecutive week, reaching multi-month highs close to 234.7K contracts. This development occurred alongside an increase in open interest, reaching three-week highs of approximately 1.990 million contracts. During that period, traders focused on consolidating the significant retracement from levels exceeding $77.00 per barrel down to the $64.00 region, a pronounced shift that followed the ceasefire in the Middle East.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.