Canadian Dollar treads water as bullish Greenback pressure eases

- The Canadian Dollar saw tepid Monday action following last week’s market-busting NFP.

- Canadian markets are largely closed for a civic holiday to start the week, leaving US flows in the driver’s seat.

- Key Canadian labor data is due later this week, and could be a reckoning for BoC rate cut expectations.

The Canadian Dollar (CAD) found some much-needed footing on Monday, trading in a steady range near 1.3775 against the US Dollar (USD). Global Greenback flows were knocked sharply back last week after US Nonfarm Payrolls (NFP) data saw sharp downside revisions, prompting US President Donald Trump to immediately fire the head of the Bureau of Labor Statistics (BLS).

It’s going to be a quiet week on the Canadian Dollar side of the economic data docket. Ivey Purchasing Manager Index (PMI) survey results are due on Thursday, but are unlikely to move CAD markets much. Key Canadian employment figures are due this Friday, and will serve as a bellwether for Bank of Canada (BoC) rate cut expectations heading around the corner into the last quarter. The pace of Canadian hiring is expected to slow, and the unemployment rate is expected to tick higher as the Canadian economy grapples with tariff impacts.

Daily digest market movers: Canadian Dollar catches a breather on Monday

- The Canadian Dollar ground to a halt on Monday, pushing USD/CAD into a middling pattern just below 1.3800.

- Last Friday’s wide miss in US employment data sparked a sharp turnaround in US Dollar flows, snapping the Greenback’s six-day winning streak against the Loonie.

- Markets will be shuffling their feet and watching trade headlines amid a general lack of high-impact data on the US and Canadian sides of the data docket throughout the week.

- Donald Trump’s “firm” August 1 deadline for reciprocal tariffs has turned into an equally firm August 8 deadline.

- President Trump’s ire at reality continues unabated, and has vowed to install a new head of statistics at the BLS after Donald Trump became irate at the government data reporting agency for reporting dissatisfactory employment data that wiped out most of the job gains that were reported in recent months.

Canadian Dollar price forecast

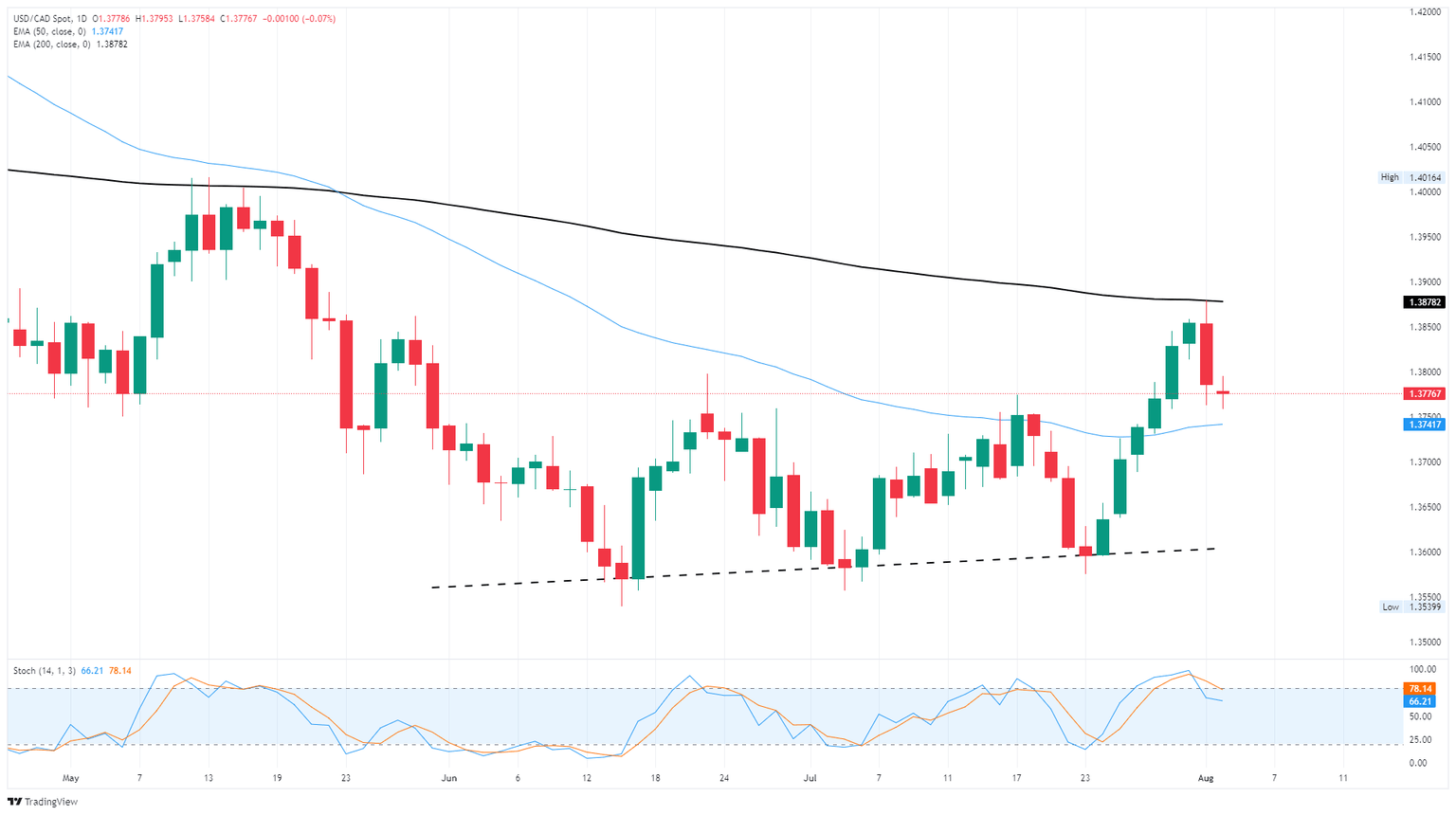

The Canadian Dollar caught a headline-fueled break from one-sided US Dollar flows late last week, capping off a sharp turnaround in USD/CAD momentum. The Loonie has pared away some of the Greenback’s recent gains, pushing the pair back below the 1.3800 handle, but USD/CAD remains caught in a technical trap between the 50-day and 200-day Exponential Moving Averages (EMA) near 1.3740 and 1.3860, respectively.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.