Canadian Dollar tests low side despite upswing in Canadian labor data

- The Canadian Dollar stumbled back on Friday as tariff fears remain.

- Canadian labor data overshot forecasts, bolstering the Loonie.

- Fresh tariff threats from Donald Trump have crimped CAD gains.

The Canadian Dollar (CAD) tested lower ground against the US Dollar (USD) on Friday, shedding weight despite Canadian labor data figures outperforming median market forecasts by a sizeable margin, kicking back economic downturn concerns and forcing rate watchers to trim their bets of another Bank of Canada (BoC) rate cut at the next interest rate meeting.

Adding further fuel to the risk-off fires that his administration started this week, US President Donald Trump has announced another round of tariff threats against Canada if the country doesn’t deliver a satisfactory trade deal before the August 1 deadline. The new tariffs are due to come into effect the same day that “reciprocal” tariffs, announced in April, are set to begin after being delayed twice by Trump himself.

Daily digest market movers: Loonie gains on reduced BoC rate cut expectations, but trade risks remain at the forefront

- The Canadian Dollar briefly tested new two-week lows against the US Dollar despite better-than-expected Canadian jobs data.

- President Trump’s newest tariff additions on Canadian goods are gripping market sentiment by the throat as trade tensions weigh on investors and business operators.

- Canada added 83.1K net new job positions in June, well above the expected 0.0K.

- The Canadian Unemployment Rate also ticked down to 6.9% versus the expected rise to 7.1%.

- With Canadian employment data beating the street, rate markets are pricing in a less than one-in-five chance of a quarter-point rate cut from the BoC later this month.

- Donald Trump says Canadian goods could be facing an additional 35% import tax beginning on August 1 if Canada doesn’t meet Trump where he wants on trade terms, which appears to be a constantly moving target.

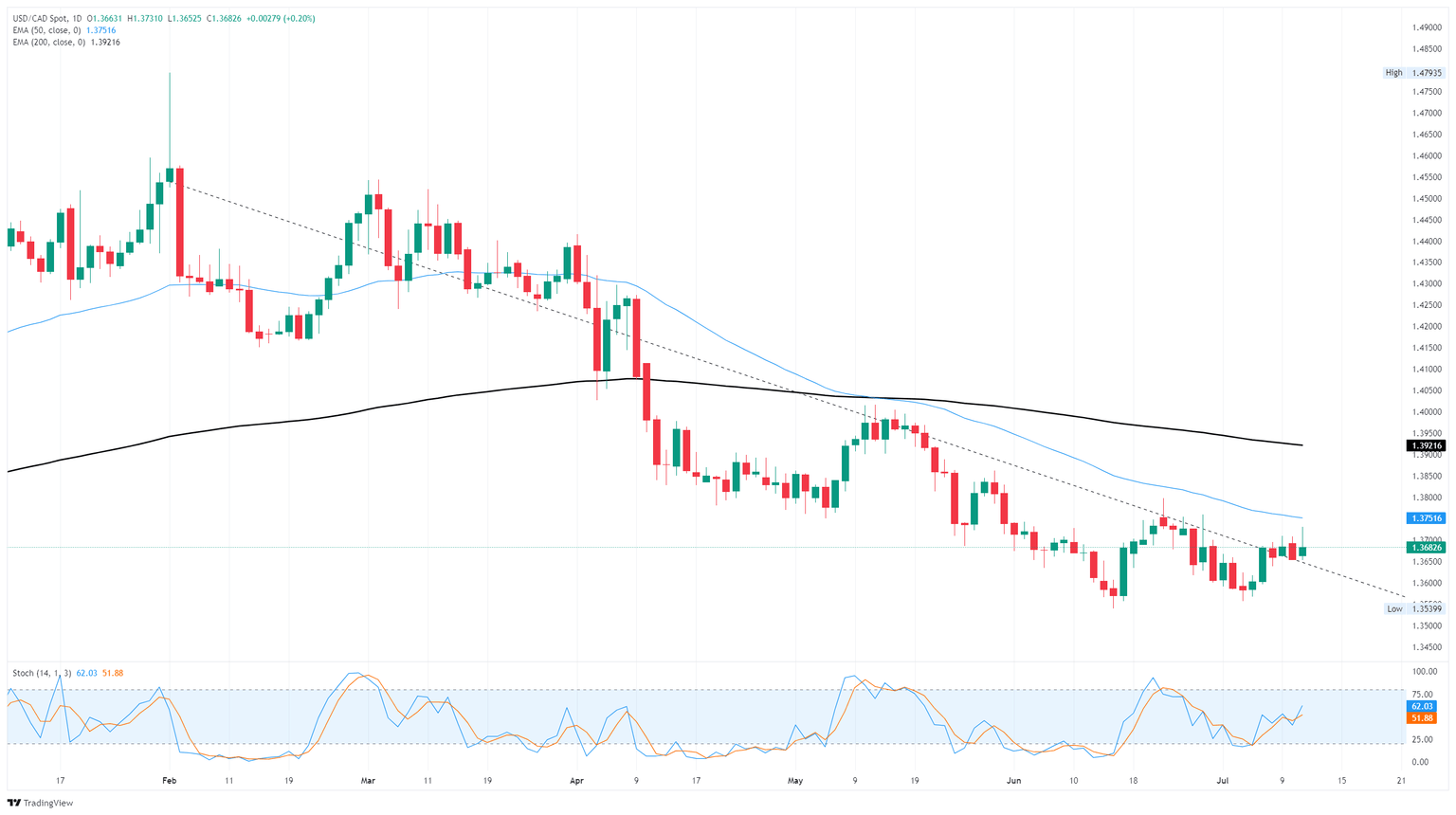

Canadian Dollar price forecast

The Canadian Dollar continues to struggle with holding onto near-term gains, and the USD/CAD pair is strung along a growing consolidation zone just below the 1.3700 handle. Ongoing CAD weakness, or USD strength, is poised to push the Loonie into a fresh bout of new lows. USD/CAD is testing waters just above ongoing downward trendlines from multi-decade peaks set earlier in 2025, and counter-trend flows could roll over into a full-blown reversal if USD bulls continue to push up the Greenback against the weakening CAD.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.