Canadian Dollar retains gains despite broad US Dollar's strength

- Canadian Dollar surged following upbeat Canadian GDP data, remains strong

- US Dollar looks weak despite good US Jobless claims, upward revision of Q4 GDP.

- The focus is now on Friday’s PCE Prices Index and Fed Powell’s speech.

The Canadian Dollar (CAD) is trading higher for the fourth consecutive day on Thursday, yet with price action contained within previous ranges. Canada’s Gross Domestic Product bounced up strongly in January with preliminary estimations for February pointing to further economic expansion. These figures have restored confidence in Canada’s economic outlook, cooling off market expectations of imminent BoC rate cuts.

In The US, the larger-than-expected decline in US Weekly Jobless Claims and the upwardly revised Q4 Gross Domestic Product have been unable to provide a meaningful impact to the US Dollar. The Greenback is paring previous gains after having opened Thursday on a strong note, following hawkish remarks from Fed Governor Waller.

The US Dollar Index, which measures the value of the USD against a basket of the most traded currencies, is barely changed on the day after having whipsawed back and forth. Investors are czutious with all eyes on Friday’s US PCE Prices Index and a speech by Federal Reserve (Fed) Chair Jerome Powell at a monetary policy conference in San Francisco. Traders are looking for further clues about the central bank’s monetary policy plans.

Daily digest market movers: USD/CAD retreats as the Canadian economic outlook improves

- The Canadian Dollar is moderately bullish on its way to complete a four-day winning streak, favoured by upbeat Canadian data.

- Canadian GDP expanded at a 0.6% pace in January, beating expectations of 0.4% growth and following a 0.1% contraction in December.

- US Jobless Claims declined to 210K in the week of March 22 from 212K in the previous week against market expectations of an increase to 215K.

- Continuous Jobless claims have increased to 1.189M from 1.795M in the previous week, offsetting the impact of the upbeat headline reading.

- The final reading of the Q4 US GDP has been revised to a 3.4% growth from the 3.2% expansion previously estimated.

- Futures markets are pricing a 55% chance that the Fed will start cutting rates in June, down from levels above 60% on Wednesday, CME Group FedWatch Tool shows.

- Fed Governor Christopher Waller warned that there is no rush to start cutting rates, which has poured some cold water on the market consensus of three rate cuts in 2024.

- The highlight of the week is that the core PCE Prices Index is expected to have risen at a 2.8% yearly pace and 0.4% on the monthly rate in February, from 2.8% and 0.3%, respectively, in January.

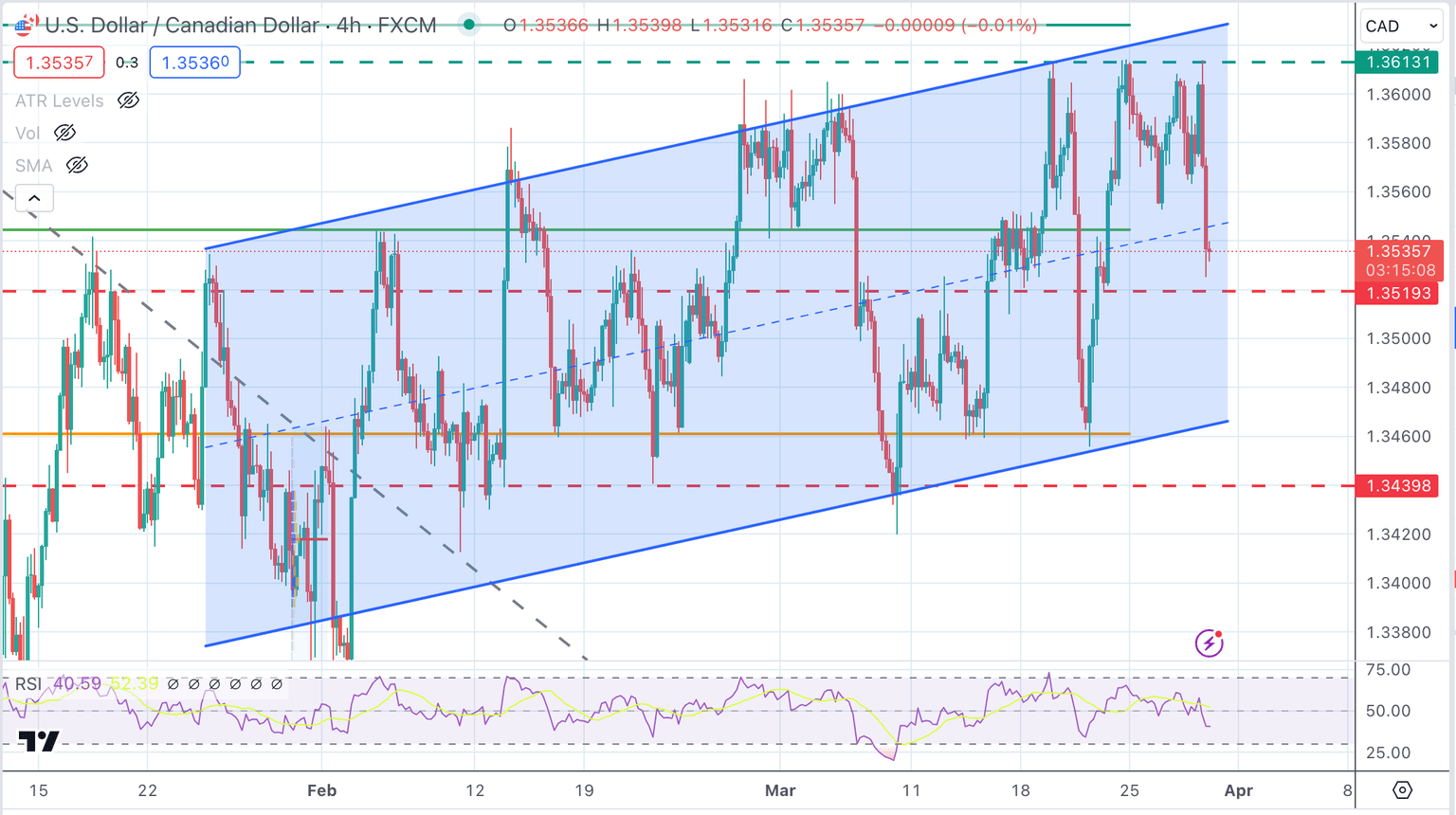

Technical analysis: The USD is under increasing bearish pressure, heading to 1.3520

The USD/CAD is under increasing bearish traction after having been rejected at 1.3610 on its way to 1.3520 support area. The RSI has dipped below the 50 level, which suggests that sellers are in control.

The broader picture is still moderately positive, with the pair trading within a slightly bullish channel. A break of 1.3460 would negate this view. On the upside, resistance levels are 1.3615 and 1.3630.

USD/CAD 4-Hour Chart

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Economic Indicator

Canada Gross Domestic Product Annualized

The Gross Domestic Product (GDP), released by Statistics Canada on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in Canada during a given period. The GDP is considered as the main measure of Canada’s economic activity. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.