Canadian Dollar remains weak on mixed CPI and hawkish Powell

- Canadian Dollar sufers on US Dollar strength as Fed's Powell strikes a hawkish note.

- Powell warns that later inflation data shows lack of further progress and sends the US Dollar higher.

- Canadian Core CPI eased to 2% YoY in March, feeding hopes that BoC might start cutting rates in June.

The Canadian Dollar (CAD) is going through a significant decline against a stronger Greenback on Tuesday. Hawkish comments from the Federal Reserve's (Fed) Chair, Jerome Powell, and the mixed Canadian Consumer Prices Index (CPI) are weighing on the Loonie

Fed Chair Powell warned about latter inflation data showing a lack of progress, backing the idea that the bank will be forced to keep interest rates at restrictive levels for quite some time. Investors' bets on a July rate cut have dropped to 35% from around 50% on Monday. This is likely to underpin the US Dollar's rally.

Earlier on Tuesday, Canada's consumer inflation showed that price pressures accelerated in March although the Core Bank of Canada CPI rose at a slower pace than in the previous month. These figures align with the cooling inflationary trends last seen at the Bank of Canada’s most recent monetary policy meeting, and allow them to start cutting rates in June. This explains the negative impact on the Canadian Dollar vis-à-vis the Greenback.

Daily digest market movers: USD/CAD rallies further on monetary policy divergence

- Lower hopes of Fed easing in the coming months and then higher expectations that the BoC will trim rates in June are hammering the Canadian Dollar.

- Fed Powell has endorsed this view, expressing his concerns about the sticky inflation, which has provided a fresh impulse to the Dollar.

- Futures markets have pushed hopes of Fed cuts back to September, with only one rate cut priced in for 2024, according to the CME Group Fed Watch Tool

- Canadian CPI accelerated at a 0.6% pace in March and 2.9% YoY, up from 0.3% and 2.8% in the previous month.

- Core CPI, however, eased to a 2.0% yearly rate from 2.1% over the previous month.

- US Construction activity data has disappointed, with Housing Starts and Building Permits declining beyond expectations in March.

- US Industrial Production grew 0.4% in March, in line with market expectations and unchanged from the previous month. Capacity utilization increased to 78.4% from the downwardly revised 78.2% but below the 78.5% forecasted by experts.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.06% | 0.15% | 0.27% | 0.57% | 0.31% | 0.33% | 0.10% | |

| EUR | -0.07% | 0.07% | 0.17% | 0.51% | 0.26% | 0.27% | 0.02% | |

| GBP | -0.15% | -0.08% | 0.12% | 0.43% | 0.19% | 0.20% | -0.05% | |

| CAD | -0.28% | -0.21% | -0.13% | 0.28% | 0.04% | 0.08% | -0.19% | |

| AUD | -0.57% | -0.51% | -0.43% | -0.30% | -0.28% | -0.22% | -0.49% | |

| JPY | -0.31% | -0.28% | -0.20% | -0.06% | 0.24% | 0.01% | -0.25% | |

| NZD | -0.37% | -0.31% | -0.23% | -0.10% | 0.19% | -0.04% | -0.29% | |

| CHF | -0.09% | -0.02% | 0.05% | 0.16% | 0.49% | 0.25% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

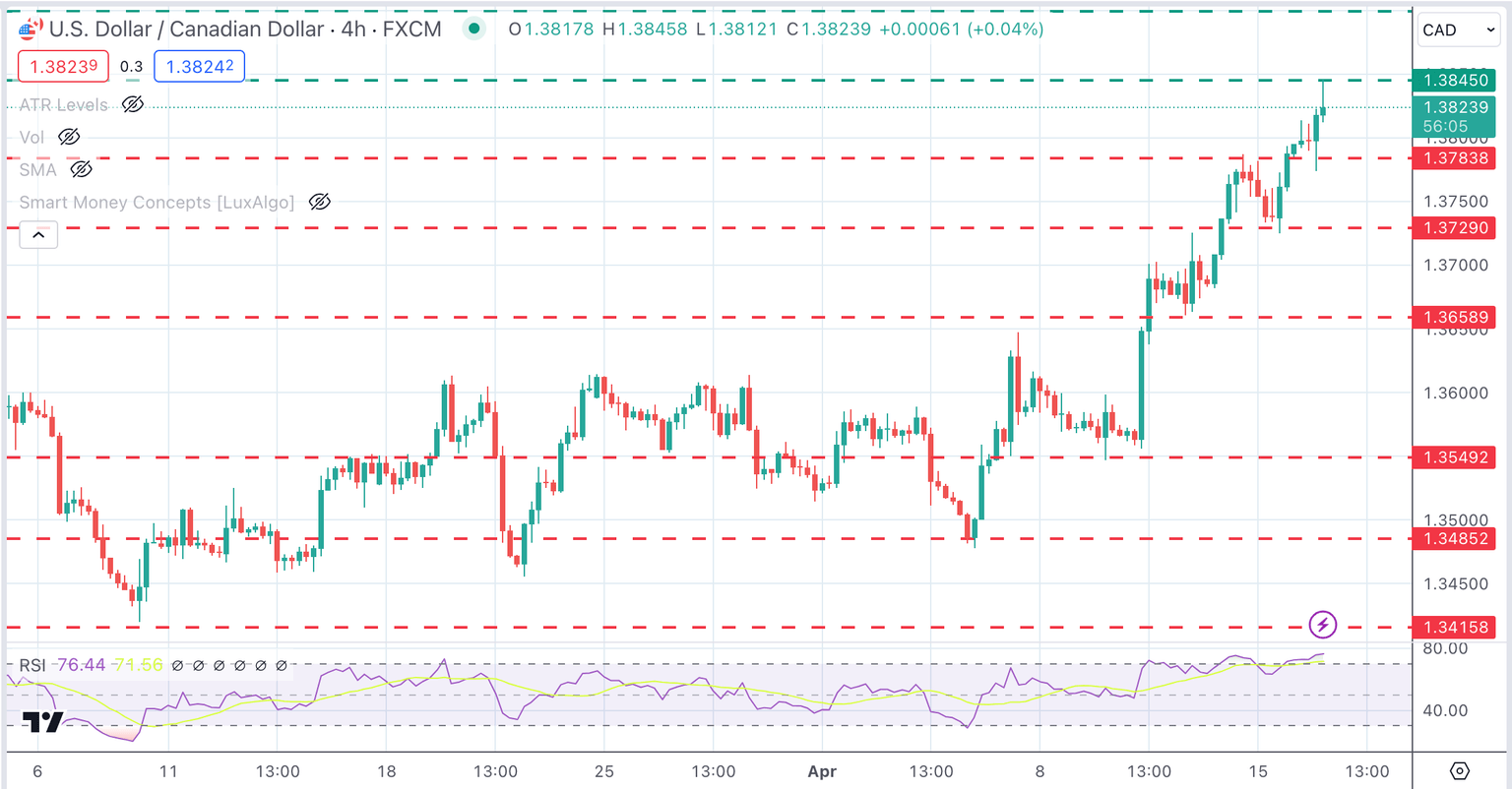

Technical analysis: USD/CAD reaches overbought levels at 1.3845

The US Dollar seems unstoppable. The pair has rallied non-stop during the last six trading days, appreciating nearly 2%. RSI levels are at overbought territory, although with no sign of a reversal in sight.

Bulls have hit resistance at the 1.3845 area, and these conditions suggest the possibility of a bearish correction. In that case, 1.3785 and 1.3730 are likely to provide support. On the upside, above 1.3845, the next target is the November 2023 high at 1.3900.

USD/CAD 4-Hour Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.