Canadian Dollar sheds further weight, slides into fresh multi-year lows

- The Canadian Dollar continued its march lower on Friday.

- Canada remains inconsequential on the economic calendar.

- CAD traders to wait for next Tuesday’s Canadian CPI print.

The Canadian Dollar (CAD) found fresh lows on Friday as broader markets continues to pivot into the safe haven Greenback. A slight miss in US Retail Sales was all it took to bolster the US Dollar and send USD/CAD into fresh multi-year highs.

Canada continues to remain absent from the economic calendar this week. A week of strictly low-tier, low-impact data has left the Canadian Dollar on the ropes, but next week’s Canadian Consumer Price Index (CPI) inflation print is unlikely to change matters much.

Daily digest market movers: Canadian Dollar waffles to fresh 54-month low

- The Canadian Dollar found a new four and a half year low on Friday, pushing USD/CAD into 1.4090 for the first time since May of 2020.

- Meaningful Canadian economic data remains entirely absent from the economic calendar.

- CAD traders are unlikely to get much of a push from next Tuesday’s Canadian CPI inflation print as the Bank of Canada (BoC) is already accelerating the pace of interest rate cuts in the face of rapidly-cooling inflation and a lopsided economy.

- Canada’s economic metrics continue to rely too much on already-high housing and shelter prices continuing to rise into the stratosphere.

- US Retail Sales beat forecasts, but still eased in October. Headline US Retail Sales eased to 0.4% compared to the expected 0.3%, falling away from September’s revised print of 0.8%.

Canadian Dollar price forecast

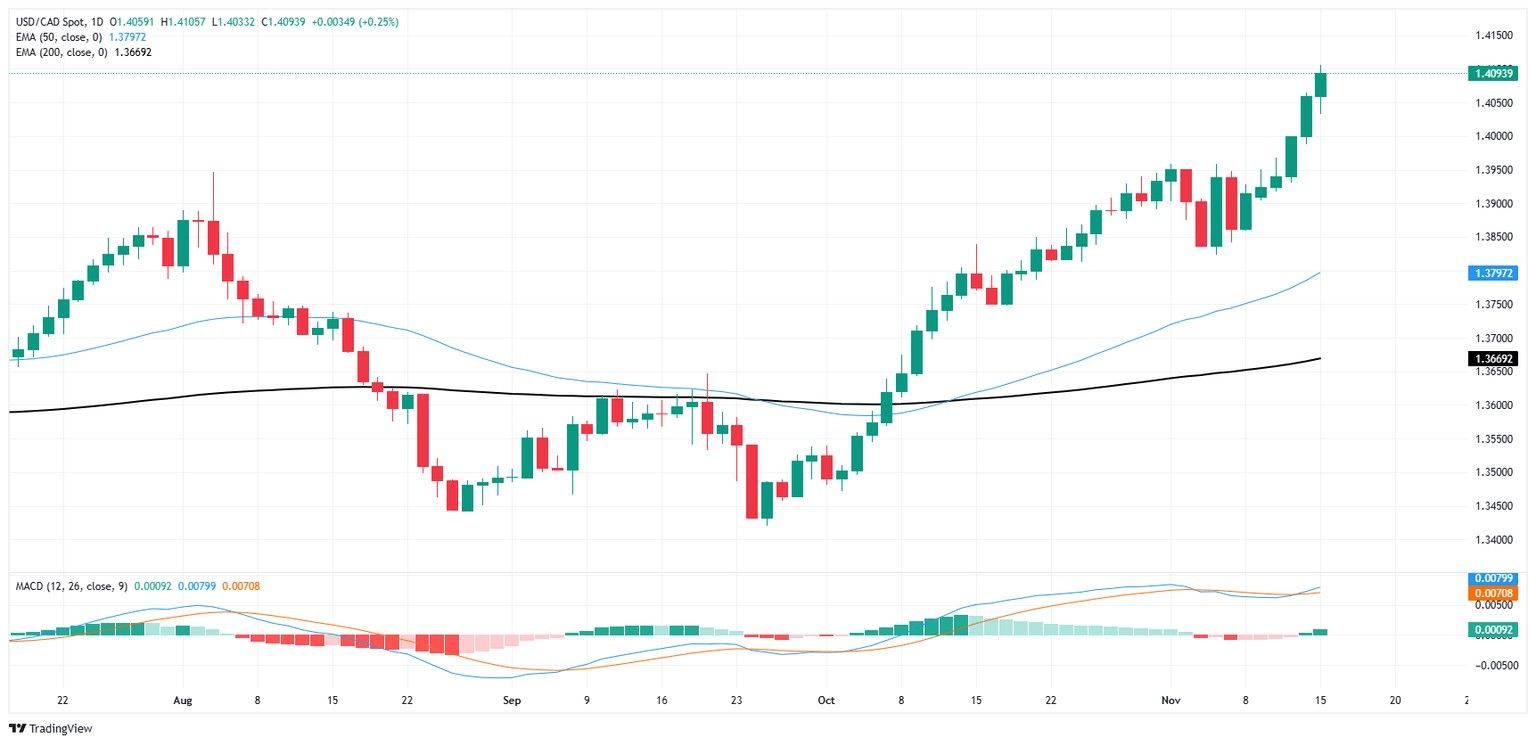

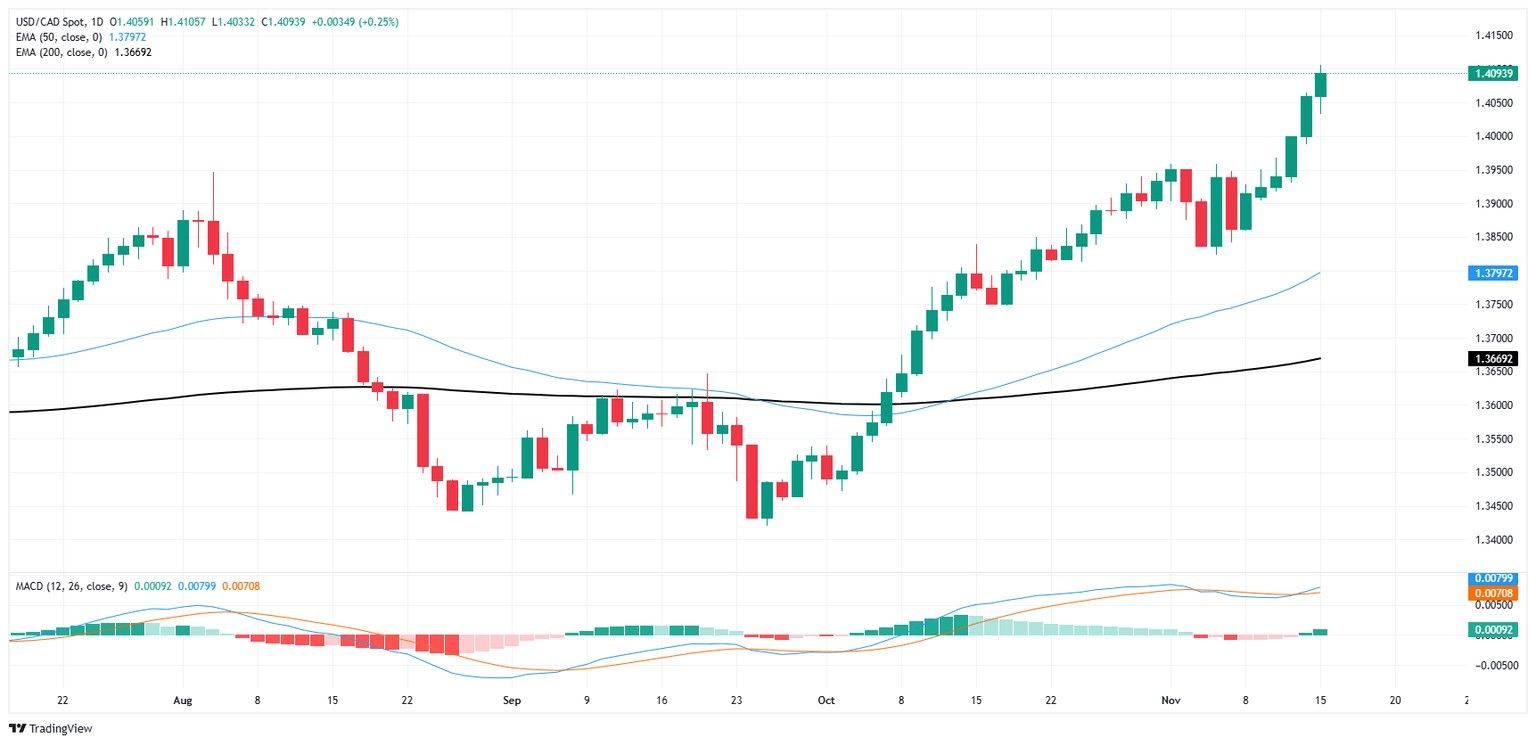

The sky’s the limit as the Canadian Dollar (CAD) continues to shed weight against the Greenback; USD/CAD’s fresh push into multi-year highs has the pair testing bids just shy of 1.4100. The pair is on pace to close in the green for a sixth consecutive trading day as the CAD recedes against the US Dollar.

The nearest technical floor sits at the last swing low, lined up nearly perfectly with the 50-day Exponential Moving Average (EMA) near 1.3780.

USD/CAD daily chart

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.