Canadian Dollar bounces back slightly on Tuesday

- The Canadian Dollar clawed back 0.25% against the Greenback on Tuesday.

- Market sentiment has pulled back from USD bidding after a strong start to the week.

- US CPI inflation eased to a three-year low, but markets are bracing for tariff fallout.

The Canadian Dollar (CAD) caught a mild bid on Tuesday, largely thanks to a general easing in US Dollar (USD) bidding across the broader market rather than any particular bullishness to be found on the book for the Loonie. US Consumer Price Index (CPI) numbers were the key data print for the day, and investors are beginning to grow increasingly anxious about how the next print will shape up as the Trump administration’s tariffs begin to show up in the data.

With strictly low-tier data on the offering, the Canadian Dollar is entirely at the mercy of market-wide sentiment flows this week. The end of the temporary reprieve of US “reciprocal tariffs” also looms over the horizon, and firm details of a possible trade deal that would otherwise avert steep import taxes on Canadian goods bound for the US remain entirely absent.

Daily digest market movers: Canadian Dollar steps higher amid Greenback softness

- The Canadian Dollar rose one quarter of one percent against the US Dollar on Tuesday.

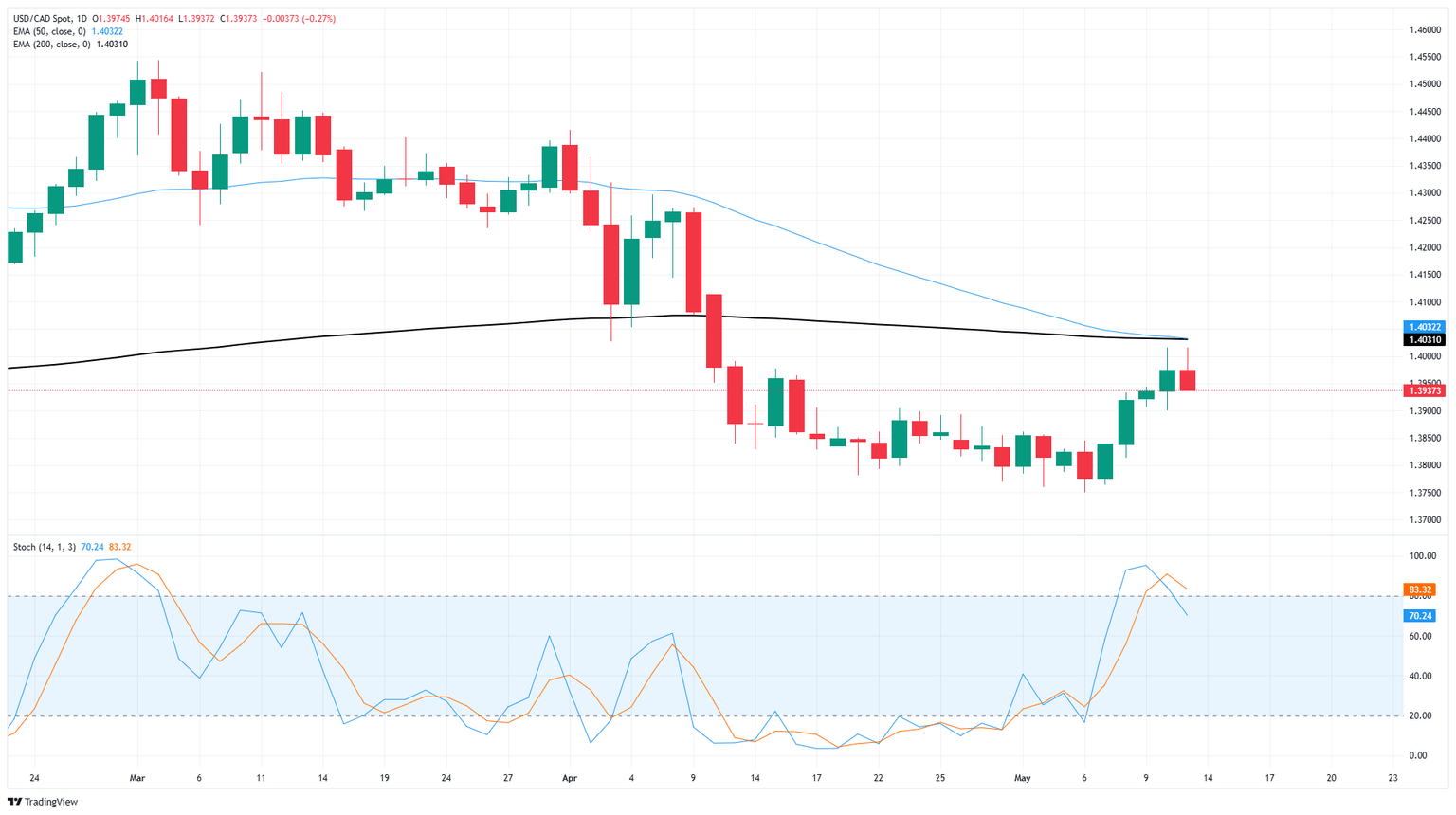

- USD/CAD has been forced back below the 1.3950 level as a result, chalking in a technical flub of the 200-day Exponential Moving Average (EMA) near 1.4030.

- US CPI inflation eased more than expected in April, however experts are warning that this could be the end of progress on stamping out inflation with tariff effects set to start showing up in headline data beginning in May.

- Moody’s chief economist on the future of US inflation:

- “It felt like we could just about declare victory on putting inflation back in the bottle, and it’s back out again. Soak this report in, it’ll be a while before we get another good one.”

- Despite an overall upbeat stance in global markets, market experts are pivoting to an increasingly bearish outlook for the future. According to Fitch Ratings:

- “In the absence of a lasting deal, uncertainty over where tariff rates will settle and the impact of those already implemented will remain key factors in our macroeconomic forecasts. Nor does the U.S.-China agreement mean the trade war, which already has a tangible economic impact, is over.”

- US Producer Price Index (PPI) inflation and University of Michigan Consumer Sentiment Index figures are due in the back half of the trading week.

Canadian Dollar price forecast

The Canadian Dollar’s cautiously bullish step on Tuesday pushed USD/CAD back into the low side, snapping a four-day losing streak and kicking the pair back down and away from the 200-day EMA. Price action is poised for a possible bearish extension with technical oscillators rotating down from overbought territory. Still, news headline risks remain high for traders trying to nail down a near-term trend.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.