Canada FX Today: The Canadian Dollar awaits decisive CPI data

The Canadian Dollar (CAD) is moving cautiously at the start of the week against the US Dollar (USD), with the USD/CAD Forex pair hovering around 1.3835, down very slightly over the session.

Market operators are holding their breath ahead of the release of the August Consumer Price Index (CPI) on Tuesday at 12:30 GMT, a figure that could seal the trajectory of the Bank of Canada's (BoC) monetary policy.

Therefore, the CAD’s performance today is therefore marked by measured volatility, with traders preferring to wait for the data before taking positions. On Tuesday, the CPI release comes in at the same time as US Retail Sales, which could make USD/CAD one of the most volatile pairs in the Forex market.

With headline inflation expected to rise to 2.0% year-on-year (from 1.7% previously) and a more modest monthly increase (+0.1%), the market is looking to determine whether the Bank of Canada will still have room to ease policy in the months ahead.

Inflation under scrutiny

Canada's CPI is a crucial indicator, especially as core inflation, which excludes the most volatile components such as energy and perishables, remains the BoC's preferred thermometer.

In July, core measures showed signs of losing steam, but the trend remains uncertain. Derek Holt of Scotiabank already noted last month that "the underlying inflation trend does not call for massive rate cuts, but recent data remain fragile and subject to revision".

Inflation remains strongly influenced by the prolonged fall in energy prices, particularly gasoline, alleviated by the abolition of the federal carbon tax in April.

This factor has artificially contained the overall index, masking more robust dynamics in food, housing and services prices.

According to an RBC note, "the August CPI could be the real arbiter between the status quo and further monetary easing. The BoC is keeping a close eye on the median and trim measures, which remain around 3%, the upper limit of its target".

Recent figures also confirm the resilience of consumption. Household spending rose sharply in the second quarter, despite a decline in Gross Domestic Product (GDP), and the housing market is showing signs of recovery. Too rapid an easing in interest rates could therefore fuel renewed inflationary pressures.

Implications for the Bank of Canada and the CAD

The release of the August CPI could prove decisive. A higher-than-expected figure would reinforce the position of the BoC's more cautious members, and mechanically support the Canadian dollar by postponing the prospect of further rate cuts. Conversely, confirmation of a lasting slowdown in inflation would breathe new life into the bond markets, while weighing on the CAD.

Rate swaps are currently anticipating a high probability of a 25 basis points (bps) rate cut to 2.5% this week, only one day after the CPI release. But investors know that the BoC's approach remains highly data-dependent.

As Derek Holt sums up: "The BoC won't be able to rely on such volatile readings to adjust its policy. It will wait for more tangible evidence before deciding."

For the time being, the foreign exchange market is on a wait-and-see basis. For the CAD, the release of the CPI is much more than just a statistic; it is the next test of monetary credibility and the key to a trajectory that could redefine the CAD's outlook between now and the end of the year.

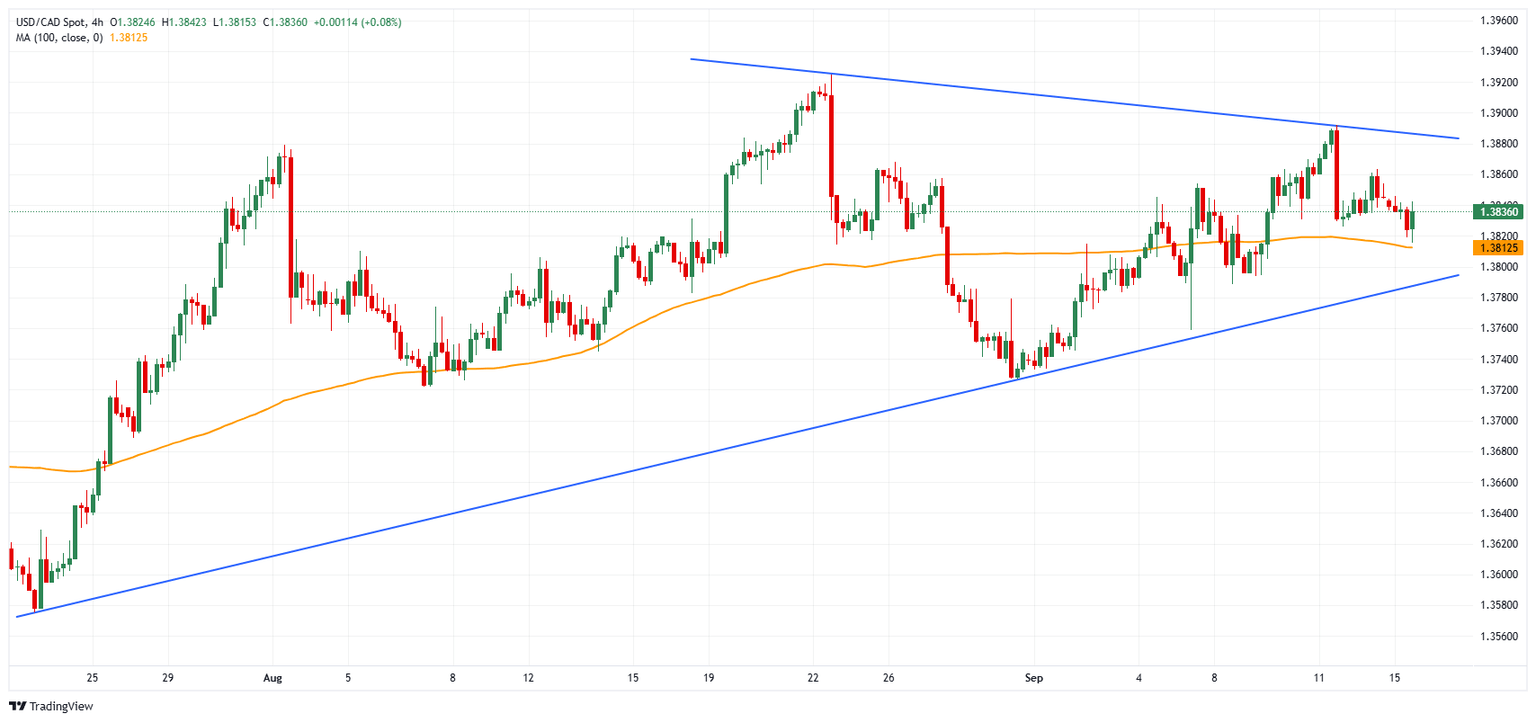

Technical analysis of USD/CAD: The wait-and-see attitude still prevails

USD/CAD 4-hour chart. Source: FXStreet

After last weekend's sharp downward correction, the USD/CAD pair found support around 1.3820 on Monday and is attempting to rebound. But the movement remains timid, and a wait-and-see attitude is prevailing.

On the 4-hour chart, USD/CAD is evolving within a triangle of uncertainty, with a trendless 100-period moving average reinforcing the wait-and-see sentiment.

An exit from this triangle, whose limits currently lie at 1.3790 and 1.3885, will be decisive for the pair's next short-term trend. This week's CPI release and BoC meeting will most likely play an important role in shaping this trend.

Canadian Dollar Price Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.25% | -0.15% | -0.20% | -0.24% | -0.17% | -0.21% | |

| EUR | 0.21% | -0.02% | -0.02% | 0.00% | 0.00% | -0.00% | -0.01% | |

| GBP | 0.25% | 0.02% | 0.08% | 0.03% | 0.02% | 0.02% | -0.10% | |

| JPY | 0.15% | 0.02% | -0.08% | -0.08% | -0.05% | -0.03% | -0.05% | |

| CAD | 0.20% | -0.01% | -0.03% | 0.08% | 0.07% | -0.01% | -0.13% | |

| AUD | 0.24% | -0.00% | -0.02% | 0.05% | -0.07% | -0.01% | -0.04% | |

| NZD | 0.17% | 0.00% | -0.02% | 0.03% | 0.00% | 0.00% | -0.11% | |

| CHF | 0.21% | 0.00% | 0.10% | 0.05% | 0.13% | 0.04% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.