BYD Co. (1211.HK) emerges from correction, resumes strong uptrend

About BYD: China’s Electric Vehicle Market Leader

BYD Company Limited (ticker: 1211.HK on the Hong Kong Stock Exchange) is a Chinese multinational powerhouse based in Shenzhen. Originally a battery manufacturer, BYD has emerged as the world’s leading producer of plug-in electric vehicles, surpassing Tesla by 2022. By 2023, it had sold over 3 million new energy vehicles, driven by popular models like the affordable Dolphin and its innovative Blade Battery. Recently, the stock has surged to a new all-time high within Wave (III). Below, we explore its long-term Elliott Wave trajectory.

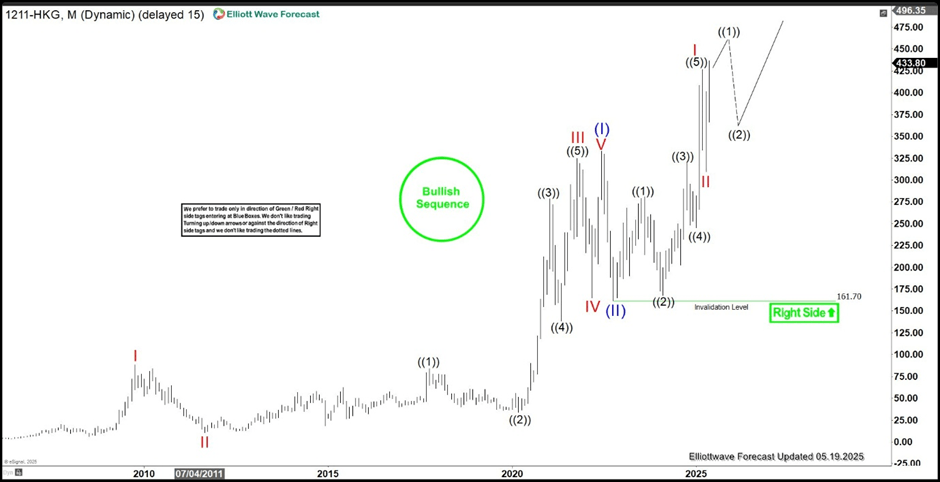

Monthly Elliott Wave perspective

The monthly chart for BYD displays a completed Wave (I)-(II) structure, with the current price action indicating a breakout in Wave (III)

The monthly Elliott Wave chart for BYD illustrates a strong upward trend, with the stock reaching a new all-time high within Wave (III). From its all-time low, BYD rallied impulsively in five waves, completing Wave (I) at 333, followed by a Wave (II) pullback to 161.70. The stock then continued its ascent in Wave (III) as a nest. From the Wave (II) low, Wave I peaked at 426.60, with a subsequent Wave II pullback to 309.80. As BYD continues to break to new all-time highs and remains above 161.70, further upside is anticipated.

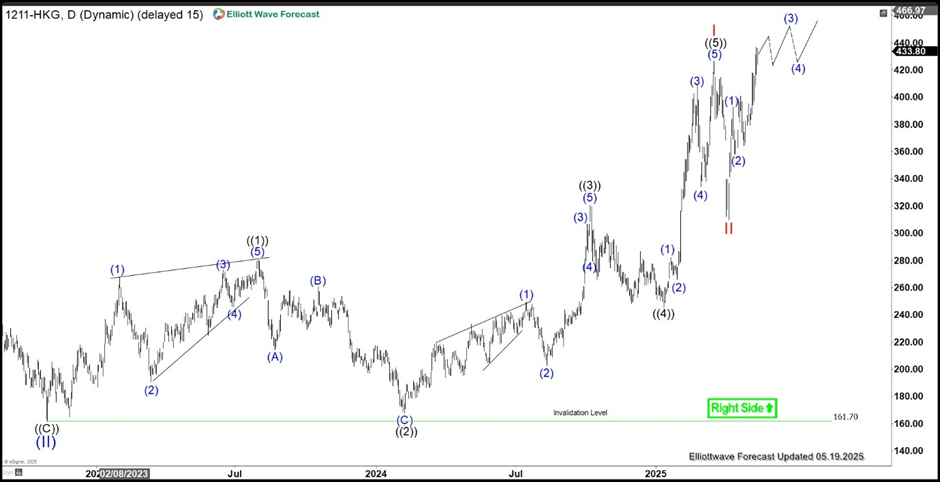

Daily chart breakdown

The daily chart for BYD illustrates the ongoing progression of Wave (III), featuring nested sub-waves within its structure

The daily Elliott Wave chart for BYD illustrates the stock’s ongoing rally within Wave (III). The structure shows Wave (I) peaking at 333, followed by a Wave (II) pullback to 161.70. From there, the stock advanced in Wave ((1)) to 280.60, with a Wave ((2)) pullback to 167.80. The rally resumed in Wave ((3)) to 320.80, followed by a Wave ((4)) dip to 245.50. The final Wave ((5)) completed at 426.60, marking the end of Wave I of (III). A subsequent pullback in Wave II of (III) concluded at 309.80, and the stock has since resumed its ascent to a new all-time high. As long as the pivot low at 161.70 holds, expect pullbacks to attract buyers in a 3, 7, or 11-swing sequence, supporting further upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com