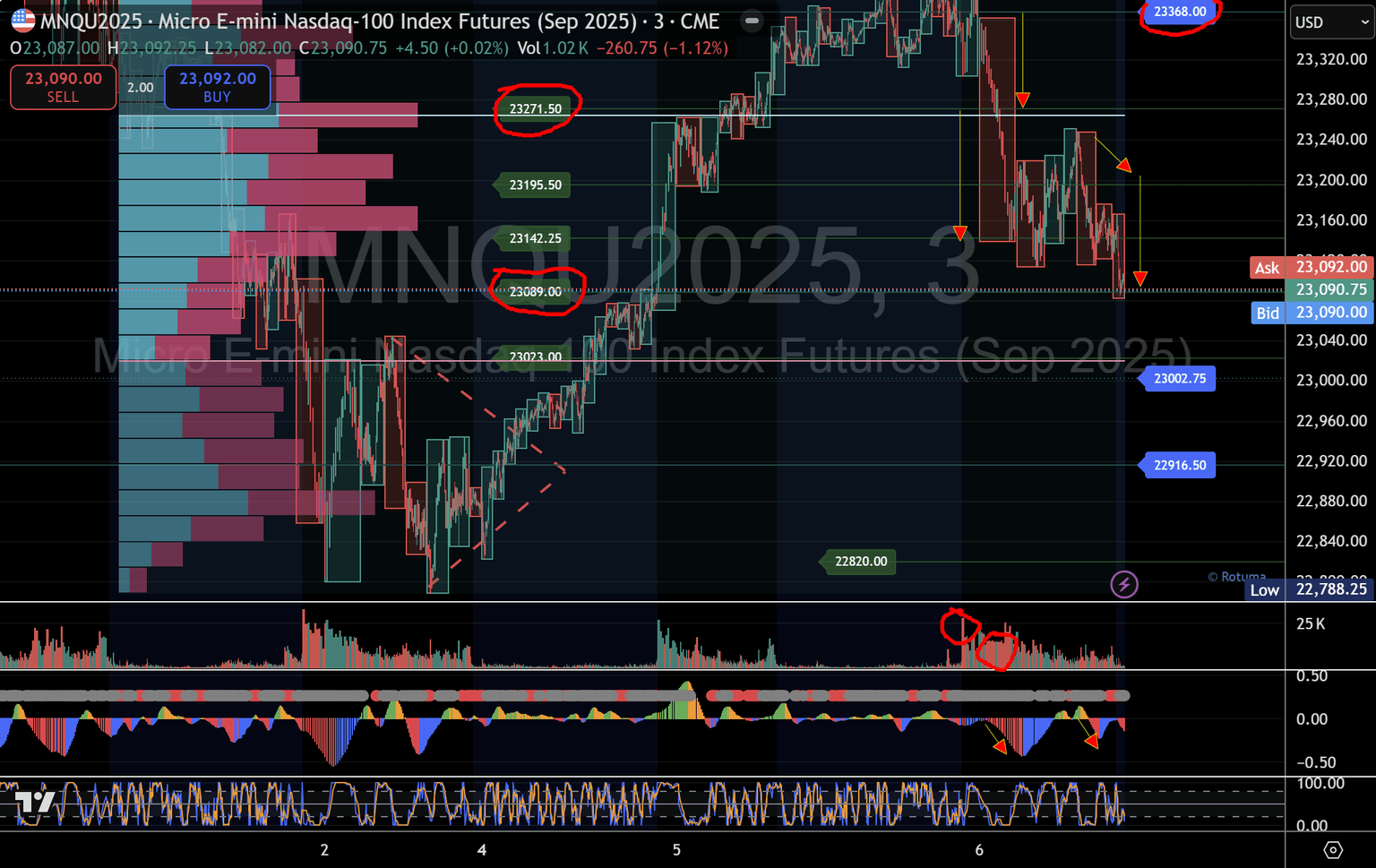

Bulls' momentum fades in E-mini Micro Nasdaq at 23,368 pivot—Bears unwind micro-pivot rally into session close

High-volume flip at micro 5 (23,271) in the E-mini Micro Nasdaq sparks rapid unwind through successive pivots, underscoring multi-timeframe supply and demand dynamics.

1. Price action recap

- NY open breakout (August 4): Following clears above micro 1 (23,023) and micro 2 (23,089), bulls steam-rolled through micro 5 (23,271) into 23,368.

- Asian and London tests (August 5): Price probed above the 23,368 pivot but could not sustain—every retest met fresh supply, leading to a notable reversal.

- Volume and momentum flip: A spike in volume at the failed 23,368 break coincided with the TTM Squeeze histogram flipping red, marking the shift from bullish to bearish control.

2. Bearish unwind through micro pivots

- Short entry signature: The reversal at 23,368 aligned with our "short at micro 5" trade signature—bears immediately targeted lower micro pivots.

- Sequential targets hit:

- Micro 4 → 23,195 (first target)

- Micro 3 → 23,142 (second target)

- Current positioning: As of print, price stabilises around micro 2 (23,089), eyeing a close that will set the tone for tomorrow's opening range.

Micro E-mini Nasdaq day trading setup August 5

3. Multi-timeframe forecast integration

- Daily pivot context: The 50% retracement of the 23,593–22,056 range (~22,825–22,850) remains the balance line—today's swing shows how far extended moves can reverse once supply/demand flips.

- Micro pivot alignment: Short-term 3-min pivots (23,271 → 23,195 → 23,142) rode atop daily structure, delivering clear entry and exit cues.

- Trend confluence:

- Bullish scenario (invalidated): A sustained break above 23,368 would have set up further gains toward 23,500+.

- Bearish scenario (in play): Failure at micro 5 pivot flagged a high-probability unwind, with next attention on 22,916.50 and 22,820 demand levels.

Micro E-mini daily chart August 5

4. Structural takeaways

- Footprints of major players: Sharp reversals at well-defined pivots reflect institutional order flow stepping in at known supply/demand zones.

- Plan ahead of price: Combining long-term pivots (daily/weekly) with intraday micro pivots yields a roadmap, allowing traders to anticipate potential flip zones and effectively bracket risk.

- Framework cohesion: Our supply & demand framework and six pillars guide tie these timeframes together, pre-mapping zones where price is likely to accelerate or reverse.

Price structure continues to guide high-probability setups. Monitor the 23,089–23,142 channel into tomorrow's open as the next battleground for bulls and bears.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.