Breaking: Gold briefly dips below $1800 for first time since early February

- Gold momentarily dropped below $1800 per troy ounce in earlier trade for the first time since early February.

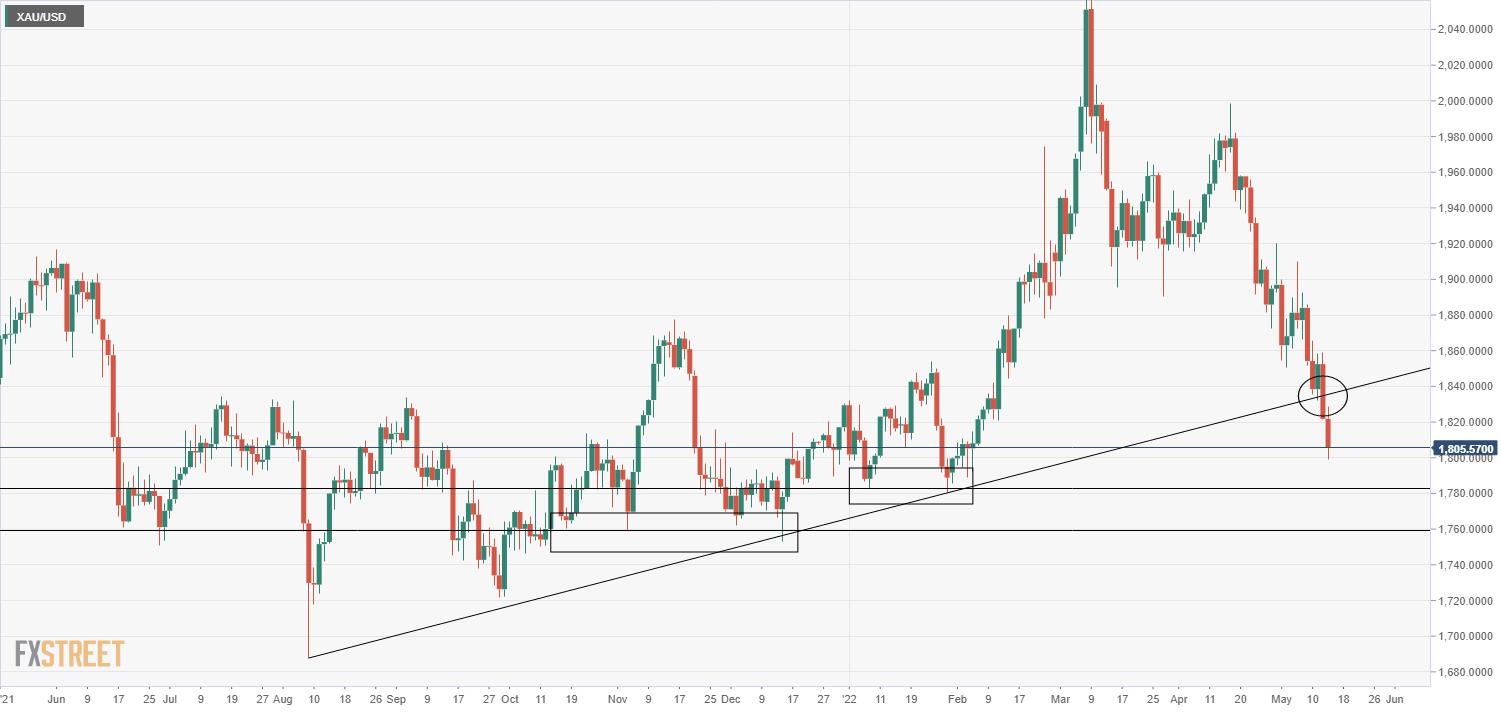

- Bears are eyeing a test of annual lows in the $1780 area following a key trendline break earlier this week.

Spot gold (XAU/USD) prices momentarily dipped below the $1800 per troy ounce level a few minutes ago for the first time since early February, weighed by a wave of US dollar strength heading into the US market open. At current levels just above $1800, XAU/USD is trading lower by about 1.0% on the day and about 4.2% on the week.

Buck strength as a result of a broadly risk-off market mood coupled with continued bets on an aggressive pace of Fed tightening has weighed heavily on the precious metal this week. Fed Chair Jerome Powell's remarks at the Senate (as his second term as Fed Chair was approved) suggest that, in wake of this week's hotter than forecast Consumer Price Inflation data, the Fed remains as committed as ever to getting inflation under wraps and to further rapid monetary tightening.

A clean break below $1800 would open the door to further losses towards the 2022 lows in the $1780 area. The next area of key support is in the $1760 area. Technical selling upon the break below a trend line that had been in play since last August earlier this week is likely exacerbating things for gold.

Author

FXStreet Team

FXStreet