Breaking: Aussie jumps on strong labour market report

Australia´s employment data has been released by the Australian Bureau of Statistics as follows:

- Employment Change March: 53K (prev 20K, prevR 63.6K).

- Unemployment Rate: 3.5% vs. the expected 3.6%, prior 3.5%.

- Full-time employment +72.2k seasonally adjusted, s/adj.

- Part-Time Employment Change: -19.2K vs. the prior -10.3K.

- Participation rate +66.7 pct, s/adj (Reuters poll: +66.6 pct).

AUD/USD update

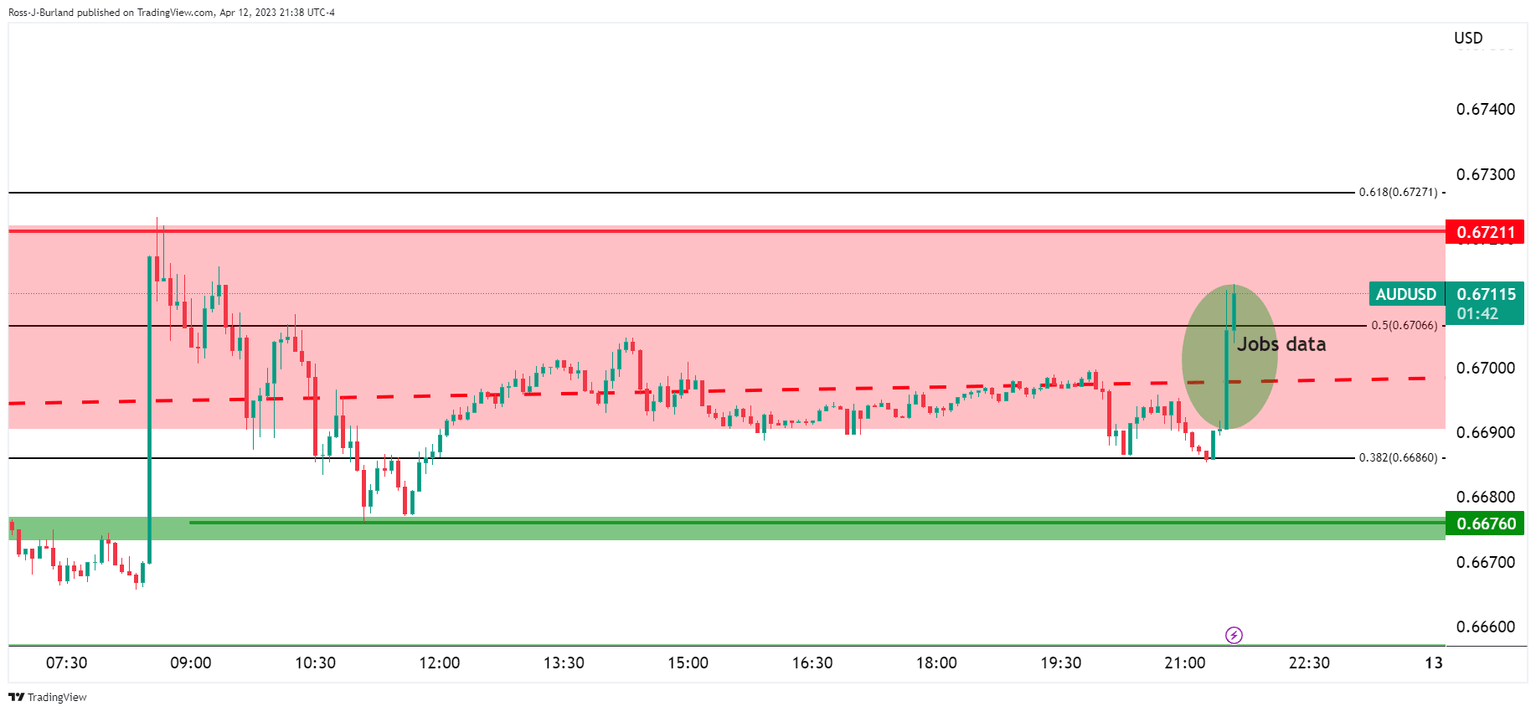

AUD/USD has rallied hard on the data to break above 0.6700 making a high so far of 0.6712.

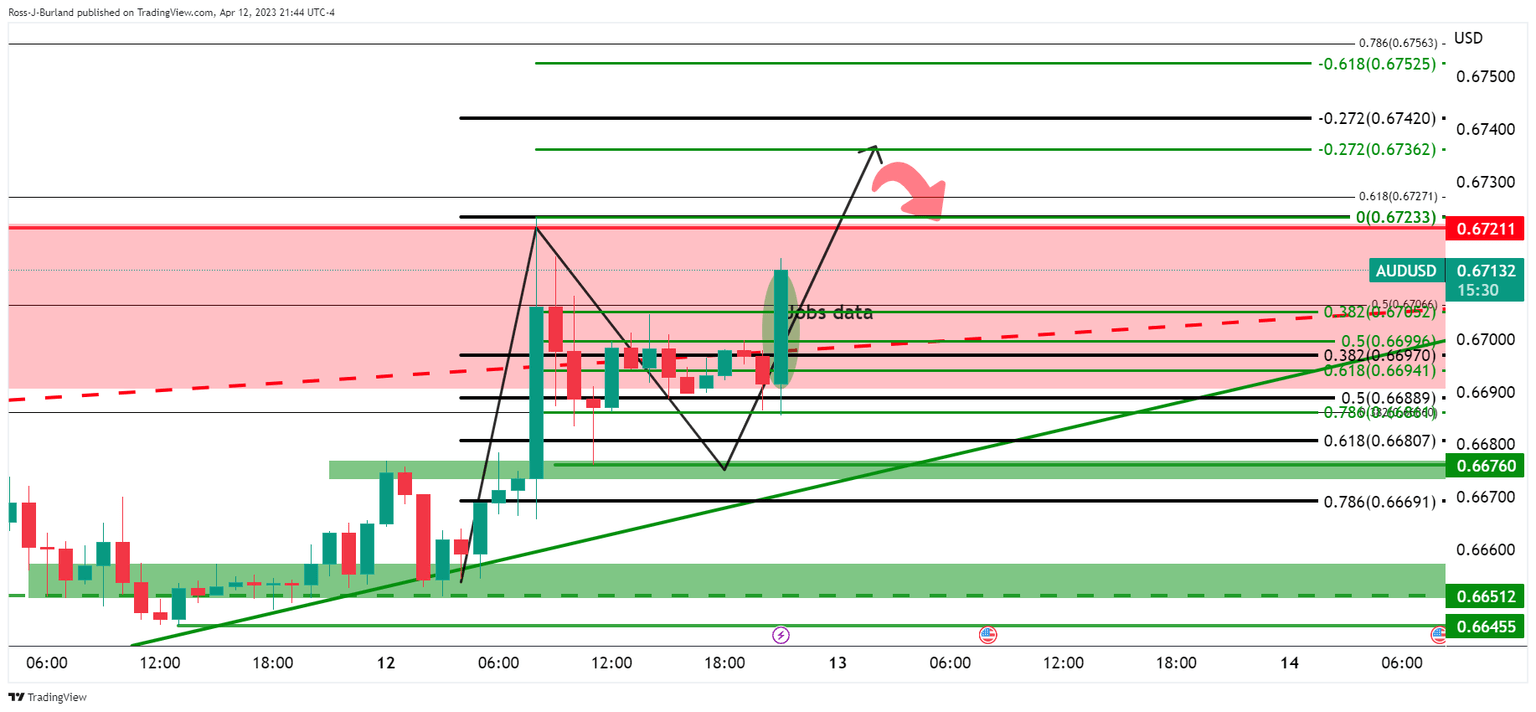

As per the prior analysis from earlier in the day, AUD/USD Price Analysis: Bears eye a break of key support structures, AUD/USD is testing major resistance.

At this juncture, the hourly chart shows the price rallying within a bullish flag pattern with targets set above the key 0.6720 resistance while on the front side of teh bullish trend line support.

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

Author

FXStreet Team

FXStreet