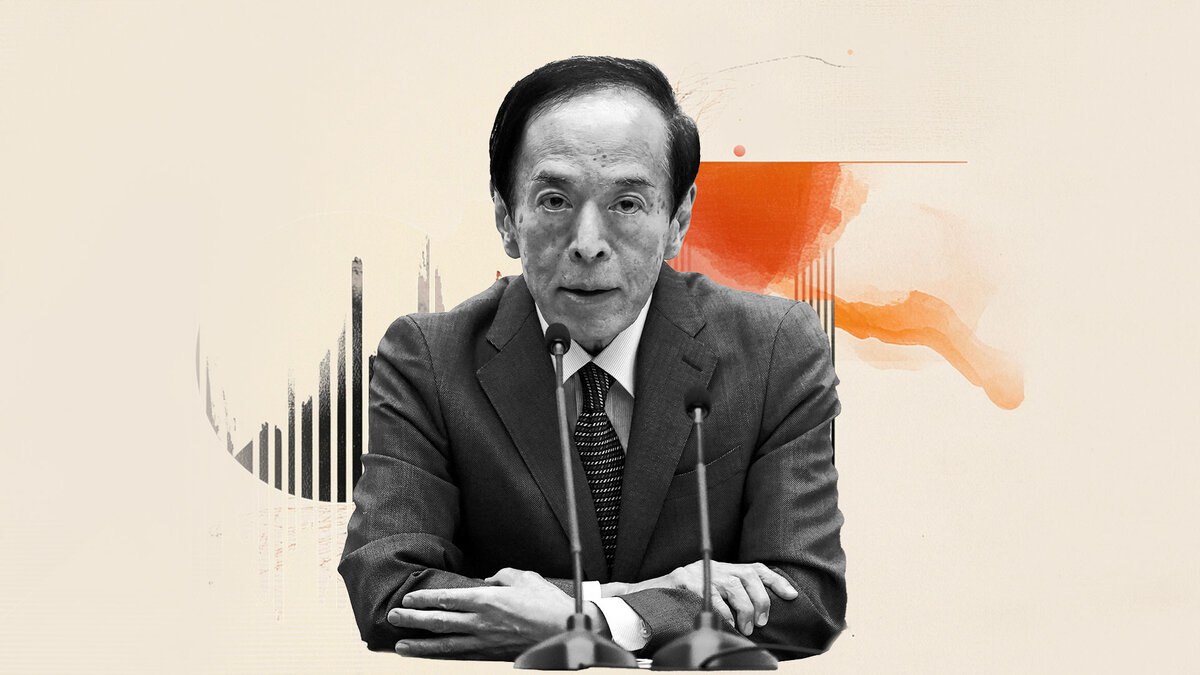

BoJ’s Ueda: Wage–price mechanism likely to be sustained

Bank of Japan (BoJ) Governor Kazuo Ueda said on Thursday that the wage-price mechanism is likely to be sustained. Ueda emphasized that the central bank expected to continue raising interest rates if the economy and prices move in line with the forecast.

Key quotes

Mechanism under which wages and prices rise moderately along likely to be sustained.

Bank of Japan expected to continue raising interest rates if economy and prices move in line with forecast.

Adjusting degree of monetary support will allow us to smoothly achieve our price target and lead to sustained growth.

Normalisation framed as smoothing achievement of inflation target.

Market reaction

As of writing, the USD/JPY pair is down 0.05% on the day at 158.52.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.