BNGO Stock Forecast: BioNano Genomics Inc skyrockets as Saphyr is a winner at the Cytogenics Symposium

- NASDAQ:BNGO surges by 23.45% after regaining NASDAQ compliance.

- BNGO’s Saphyr platform shines at the annual Next-Generation Cytogenics Symposium.

- BNGO has the attention of noted investment firm Ark invest.

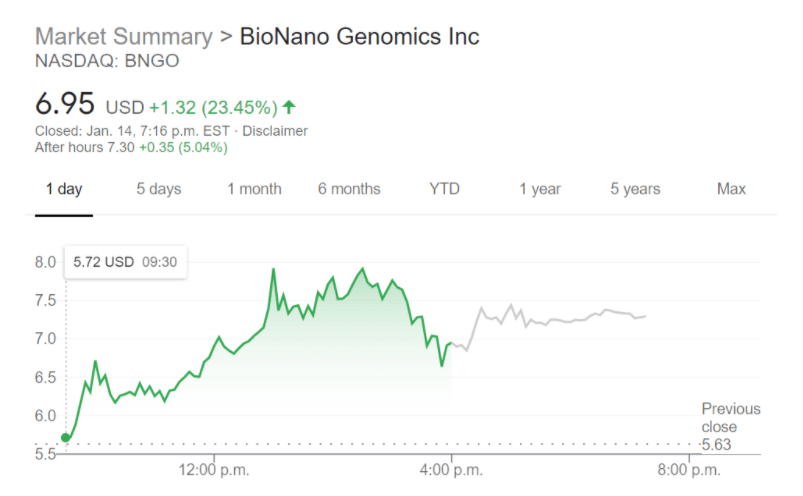

NASDAQ:BNGO continued its 2021 momentum as the red-hot genomics sector keeps hitting new highs on a daily basis. On Thursday, small-cap upstart BioNano Genomics caught the eye of value investors as the stock added 23.45% to close the trading session at $6.95, but not before hitting new 52-week highs of $7.95 during intraday hours. Shares are up over 150% already this year and as the COVID-19 pandemic continues to hit our world hard, healthcare and biogenomics are at the forefront of investor interest.

That interest was clear as BioNano Genomics presented its Saphyr platform at the Next-Generaton Cytogenics Symposium this year and impressed medical professionals with its accuracy in detecting tumors, as well as saving doctors time and money without having to run extra costly tests or scans. BNGO also announced that it would be revealing information on how Saphyr can detect genetic drivers that lead to increased susceptibility to COVID-19. The Saphyr platform is able to identify structural variants in our genes that have control over potential immune system responses. The importance of this? Determining why some people react severely to COVID-19, while some remain symptomatic.

BNGO stock price

If all of that is not enough for investors, noted genomics industry investors ARK invest have also apparently been keen to know more about BNGO. ARK investor Simon Barnett was reported to be interested in speaking with BNGO’s CEO Dr. Robert Erik Holmlin late in 2020, so investors are anticipating that BNGO could be added to ARK’s genomics ETF ARK.G at some point in the near future, especially after its impressive showing at the symposium.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet