Bitfarms Ltd. ($BITF) can reach $4.20 as Elliott Wave signals a bullish move

Today, we will look at the Daily Elliott Wave structure of Bitfarms Ltd ($BITF) and explain why the stock is primed for more upside.

Bitfarms, a global and publicly traded Bitcoin mining company, develops, owns, and operates vertically integrated mining farms. Their operations, which have in-house management and company-owned electrical engineering and repair centers, use a proprietary data analytics system that delivers best-in-class performance and uptime. Currently, Bitfarms operates 10 farms in four countries: Canada, the United States, Paraguay, and Argentina.

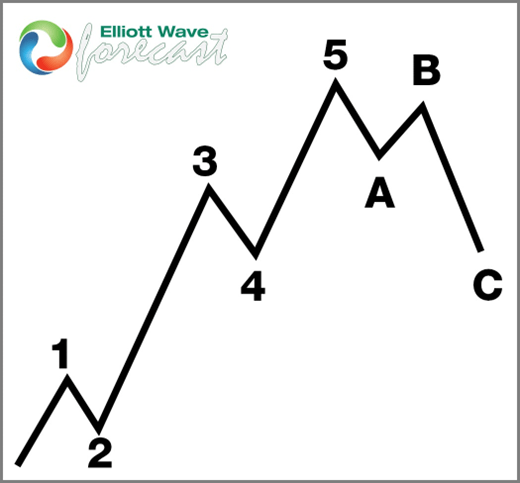

We’ll review how the rally out of December 2022 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

5 wave impulse structure + ABC correction

$BITF daily Elliott Wave chart 8.19.2025

Breaking down $BITF’s recent price action

Based on a detailed Elliott Wave analysis, the Bitfarms Ltd. ($BITF) stock is in a strong bullish trend. The stock first completed an initial rally, following a classic 5-wave impulse pattern that began in December 2022. Next, a 3-swing correction (ABC) brought the price to a crucial support zone. This was the Blue Box extreme area, between $0.89 and $0.38. Therefore, this area represents a key turning point.

As a result, after wave (2) finished at the June 2025 low, the stock began the next major leg higher. This is wave (3). Furthermore, our proprietary RSI Pivot System has confirmed this move. The system provides a bullish signal for the start of this new rally. This next leg could potentially drive the price back toward its previous high near $4.20.

Conclusion

For this bullish outlook to remain intact, the price must hold above the invalidation level of $0.38. A drop below this level would require a new analysis of the wave count. Consequently, traders should focus on buying opportunities and avoid short-selling. Pullbacks are likely to be temporary within this established bullish sequence. In conclusion, the path of least resistance for $BITF is to the upside, with significant potential for further gains.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com