Best growth stocks to buy for January 2nd

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today January 2nd:

RenaissanceRe (RNR): This company, which provides property-catastrophe reinsurance to insurers and reinsurers globally on the basis of excess of loss (coverage of losses over a specified limit), carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.9% over the last 60 days.

RenaissanceRe Holdings Ltd. price and consensus

RenaissanceRe has a PEG ratio of 1.67 compared with 1.82 for the industry. The company possesses a Growth Score of A.

RenaissanceRe Holdings Ltd. PEG ratio (TTM)

Great Lakes Dredge & Dock (GLDD): This company, which is the largest provider of dredging services in the US conducting business to maintain and deepen shipping channels, reclaim land from the ocean, and renourish storm damaged coastline, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.9% over the last 60 days.

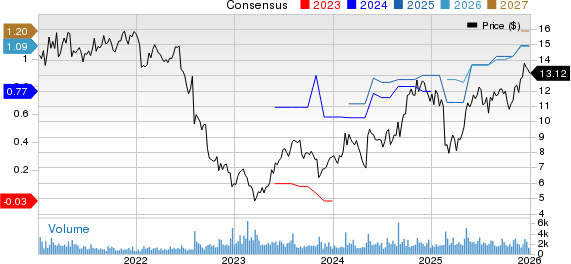

Great Lakes Dredge & Dock Corporation price and consensus

Great Lakes Dredge & Dock has a PEG ratio of 1.01 compared with 3.03 for the industry. The company possesses a Growth Score of A.

Great Lakes Dredge & Dock Corporation PEG ratio (TTM)

Phibro Animal Health (PAHC): This leading global diversified animal health and mineral nutrition company, which provides a broad range of products for food animals including poultry, swine, beef and dairy cattle and aquaculture, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.1% over the last 60 days.

Phibro Animal Health Corporation price and consensus

Phibro Animal Health has a PEG ratio of 1.06 compared with 2.44 for the industry. The company possesses a Growth Score of B.

Phibro Animal Health Corporation PEG ratio (TTM)

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Author

Zacks

Zacks Investment Research

Zacks Investment Research provides unbiased investment research and tools to help individuals and institutional investors make confident investing decisions.