Australian Dollar holds gains as US Dollar remains weaker, Q1 GDP Annualized eyed

- The Australian Dollar extends its winning streak for the fourth successive session on Thursday.

- The Reserve Bank of Australia is expected to deliver a 25 basis point rate cut in July.

- The US and Iran may meet next week, but Trump expressed doubts about the necessity of a diplomatic solution.

The Australian Dollar (AUD) advances against the US Dollar (USD) on Thursday, continuing its winning streak for the fourth consecutive day. The AUD/USD pair remains stronger amid improving risk appetite, driven by a fragile US-brokered Israel-Iran ceasefire. Traders will likely focus on the developments surrounding US-Iran talks and Middle East conflicts.

US President Donald Trump noted that the United States (US) and Iran would hold a meeting next week but questioned the need for a diplomatic solution on Iran's nuclear program, citing the damage that American bombing had done to key sites, per Bloomberg.

Australian Bureau of Statistics (ABS) reported vacancies rose by 2.9% in the three months to May, partly recovering from a 4.3% decline in the previous quarter ended February. Australia’s labor demand remained resilient despite a soft economy as job vacancies rebounded in the May quarter, driven by openings in the construction and professional sectors. However, job openings stood at 339,400 in May, down 2.8% from a year earlier, the smallest annual decline in the past two years.

Australia’s softer inflation data, along with recent weaker-than-expected GDP figures, reinforces expectations of the Reserve Bank of Australia’s (RBA) 25 basis point rate cut in July. Traders are also expecting a total of 73 bps interest rate cuts by the end of the year.

Australian Dollar appreciates as US Dollar struggles amid a cautious tone from Fed Chair Powell

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading at around 97.60 at the time of writing. Traders await the US Gross Domestic Product Annualized for the first quarter due on Thursday.

- US President Donald Trump may announce a successor for Federal Reserve (Fed) Chair Jerome Powell by September or October. Trump might consider former Fed Governor Kevin Warsh and National Economic Council Director Kevin Hassett, according to the Wall Street Journal.

- Fed Chair Jerome Powell noted on Wednesday that Trump's tariff policies may cause a one-time price hike, but they could also lead to more persistent inflation. The Fed should be careful in considering further rate cuts.

- Fed’s Powell highlighted during his testimony before the congressional budget committee on Tuesday, strengthening his case for delaying rate cuts, likely until sometime in the fourth quarter. Powell added, “When the time is right, expect rate cuts to continue.” He also said that data suggests that at least some of the tariffs will hit consumers and will start to see more tariff inflation starting in June.

- Minneapolis Fed President Neel Kashkari reaffirmed the Fed's wait-and-see stance on potential tariff impacts on inflation and the broader economy in general before making any hard decisions on moving interest rates.

- Kansas City Fed President Jeff Schmid said early Wednesday that the central bank should wait to see how uncertainty surrounding tariffs and other policies impacts the economy before adjusting interest rates. Schmid added that the resilience of the economy gives us the time to observe how prices and the economy develop, per Bloomberg.

- A US intelligence report indicated that US strikes on Iranian nuclear sites have set back Tehran's program by only a matter of months, per Reuters. Additionally, Iranian Foreign Minister Abbas Araghchi said that the country's nuclear program continues, per the local news agency Al Arabiya.

- China’s state planner, the National Development and Reform Commission (NDRC), said on Thursday, they are “confident in minimizing uncertainty and negative impact of external shocks.” They also noted that “With policy implementation and introduction, we are confident and capable of minimizing the adverse impacts from external shock.”

- China’s Premier Li Qiang made some encouraging comments on the economic outlook in his appearance on Thursday. Li said that the domestic economy shows strong resilience and development potential. China’s economic data shows stability in Q2, he added.

- Australia’s Monthly Consumer Price Index (CPI) rose 2.1% year-over-year in May. The inflation came in softer than market expectations of a 2.3% rise and the 2.4% prior, easing after remaining consistent for three successive months.

- S&P Global Australia Manufacturing Purchasing Managers Index remained consistent at a 51.0 reading in June. Meanwhile, the Services PMI edged higher to 51.3 from the previous reading of 50.6, while the Composite PMI improved to 51.2 in June from 50.5 prior.

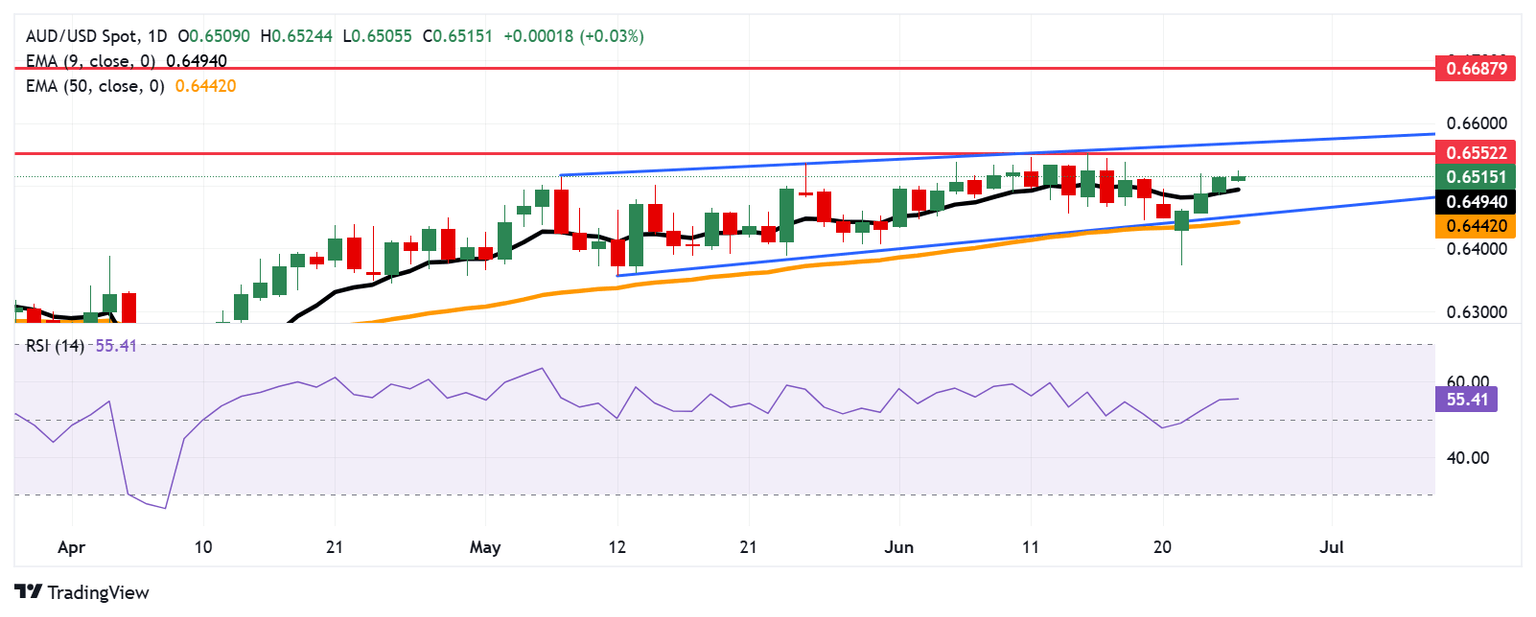

Australian Dollar holds position above 0.6500 support near nine-day EMA

AUD/USD is trading around 0.6510 on Thursday. The technical analysis of the daily suggests a persistent bullish bias as the pair remains within the ascending channel pattern. The 14-day Relative Strength Index (RSI) is positioned above the 50 mark. Additionally, the pair stays above the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is stronger.

On the upside, the AUD/USD pair may target the seven-month high of 0.6552, which was recorded on June 16, followed by the ascending channel’s upper boundary around 0.6570.

The immediate support appears at the nine-day EMA of 0.6494. A break below this level would weaken the short-term price momentum and put downward pressure on the AUD/USD pair to test the lower boundary of the ascending channel around 0.6460, aligned with the 50-day EMA at 0.6442.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | -0.32% | -0.48% | -0.06% | -0.24% | -0.13% | -0.10% | |

| EUR | 0.10% | -0.16% | -0.40% | 0.07% | -0.10% | -0.02% | 0.02% | |

| GBP | 0.32% | 0.16% | -0.24% | 0.22% | 0.06% | 0.16% | 0.18% | |

| JPY | 0.48% | 0.40% | 0.24% | 0.43% | 0.26% | 0.33% | 0.39% | |

| CAD | 0.06% | -0.07% | -0.22% | -0.43% | -0.16% | -0.16% | -0.04% | |

| AUD | 0.24% | 0.10% | -0.06% | -0.26% | 0.16% | 0.00% | 0.11% | |

| NZD | 0.13% | 0.02% | -0.16% | -0.33% | 0.16% | -0.00% | 0.12% | |

| CHF | 0.10% | -0.02% | -0.18% | -0.39% | 0.04% | -0.11% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Jun 26, 2025 12:30

Frequency: Quarterly

Consensus: -0.2%

Previous: -0.2%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.