Australian Dollar trims intraday gains amid a firmer US Dollar, ISM PMI awaited

- Australian Dollar gains ground on encouraging Chinese PMI data.

- RBA Meeting Minutes will be awaited to be released on Tuesday.

- China's Caixin Manufacturing PMI came in at 51.1, against the expected 51.0 and 50.9 prior.

- US Dollar faces challenges after dovish remarks from Fed Chair Powell.

The Australian Dollar (AUD) retraces its recent losses on Monday, possibly bolstered by positive Chinese Purchasing Managers Index (PMI) figures. Moreover, the US Dollar (USD) faced downward pressure due to decreased US Treasury yields, lending support to the AUD/USD pair. Trading activity is anticipated to be subdued due to Easter Monday.

The Australian Dollar encountered challenges amidst weaker Consumer Inflation Expectations, possibly signaling expectations for interest rate cuts by the Reserve Bank of Australia (RBA) in late 2024. Investors are likely to closely monitor the release of the RBA Meeting Minutes scheduled for Tuesday.

The US Dollar Index (DXY) struggled on dovish remarks from the Federal Reserve (Fed) Chairman Jerome Powell on Friday. He stated that the recent US inflation data aligned with the desired trajectory, affirming the Federal Reserve's stance on interest rate cuts for the year. Personal Consumption Expenditures Price Index (PCE) data from the United States (US) met expectations in February.

Daily Digest Market Movers: Australian Dollar increases on positive Chinese PMI figures

- Australia's Consumer Inflation Expectations came in at 4.3% in March, a slight decrease from the previous increase of 4.5%.

- On Sunday, China's National Bureau of Statistics (NBS) announced that the monthly NBS Manufacturing PMI rose to 50.8 in March from 49.1 in the prior month. Additionally, the NBS Non-Manufacturing PMI increased to 53.0 in March from 51.4 in February.

- On Thursday, San Francisco Federal Reserve (Fed) President Mary C. Daly emphasized that although the Fed stands prepared to decrease rates when data supports such action, there's no need for haste as the US economy remains robust with minimal risk of weakening.

- Federal Reserve Board Governor Christopher Waller still sees 'no rush' to cut rates amid sticky inflation data.

- US Core PCE came at 0.3% (MoM) in February against January’s 0.5%, aligned with the market consensus. The annual index rose by 2.8% as expected, compared to the previous increase of 2.9%.

- US Headline PCE (MoM) increased by 0.3%, slightly lower than expected and a previous rise of 0.4%. The year-over-year PCE increased by 2.5%, as expected.

- US Gross Domestic Product Annualized expanded by 3.4% in the fourth quarter of 2023. The market expectation was to be unchanged at a 3.2% increase.

- The US Gross Domestic Product Price Index remained consistent at a 1.7% increase, as expected in Q4.

- Core Personal Consumption Expenditures (QoQ) came in at 2.0% in the fourth quarter, slightly below the expected and previous reading of 2.1%.

- US Initial Jobless Claims fell to 210K in the week ending on March 22, against the expected increase to 215K from 212K prior.

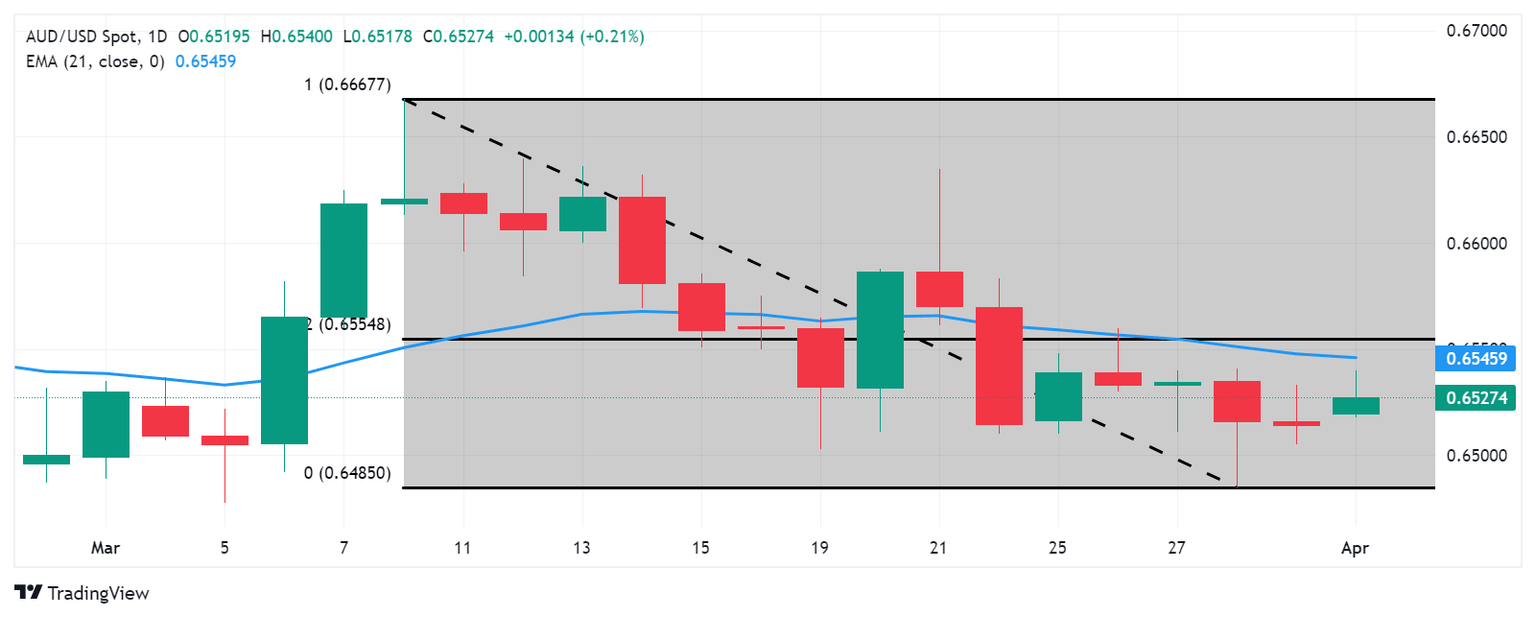

Technical Analysis: Australian Dollar rises to near 0.6530; next barrier at 21-day EMA

The Australian Dollar hovers near 0.6530 on Monday. Immediate resistance is observed near the 21-day Exponential Moving Average (EMA) at 0.6546, coinciding with a major barrier at 0.6550. A breach above this level could lead the AUD/USD pair to surpass the 38.2% Fibonacci retracement level of 0.6554, potentially leading towards the psychological level of 0.6600. On the downside, notable support lies at the psychological threshold of 0.6500, followed by March’s low at 0.6477.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.07% | 0.09% | 0.09% | 0.24% | -0.01% | 0.16% | 0.01% | |

| EUR | -0.07% | 0.01% | 0.02% | 0.18% | -0.09% | 0.07% | -0.06% | |

| GBP | -0.08% | 0.00% | 0.00% | 0.15% | -0.10% | 0.08% | -0.09% | |

| CAD | -0.09% | -0.01% | 0.01% | 0.14% | -0.10% | 0.06% | -0.09% | |

| AUD | -0.24% | -0.15% | -0.15% | -0.13% | -0.24% | -0.08% | -0.23% | |

| JPY | 0.00% | 0.10% | 0.10% | 0.10% | 0.28% | 0.17% | 0.01% | |

| NZD | -0.16% | -0.08% | -0.07% | -0.06% | 0.09% | -0.18% | -0.16% | |

| CHF | -0.01% | 0.08% | 0.10% | 0.09% | 0.24% | -0.01% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate, and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods, and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought-after exports, then its currency will gain in value purely from the surplus demand created by foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.