AUD/USD retreats as solid US economic data offset Aussie’s jobs report

- AUD/USD gains 0.28% on robust US economic data, including a PPI jump of 1.6% YoY and better-than-expected Retail Sales.

- Australian employment data impresses with 64.9K new jobs, but ANZ analysts expect the RBA to hold rates at 4.10%.

- Market participants remain cautious; the CME FedWatch Tool shows a 35% chance of a Fed rate hike in November, uncertain the pair’s direction.

The AUD/USD enjoyed a good uptick in Thursday’s session, supported by solid economic data from the United States (US) despite a solid Aussie’s jobs report. However, the pair ended with gains of 0.28%, and as the Asian session began, it exchanges hands at 0.6436, registering minuscule losses of 0.05%.

AUD/USD ended Thursday with modest gains, but the pair’s future remains uncertain amid conflicting economic indicators from the US and Australia

The economy in the US remains resilient, as shown by the latest week’s figures, with consumer inflation climbing as expected, which would keep the Federal Reserve vigilant of upcoming economic developments. Thursday’s data revealed that August’s Producer Price Index (PPI) jumped by 0.7% MoM and 1.6% YoY, exceeding the consensus, while Retail Sales grew by 0.6% MoM, above estimates of 0.2%.

In other data, the labor market remains tight, as revealed by Initial Jobless Claims for the last week, showing 220K people filed for unemployment insurance, below the street’s consensus of 225K.

Although the data supports another rate hike by the Fed, market participants remain hesitant to adopt a stance, as shown by the CME FedWatch Tool. Odds for a 25 bps rate hike by the Fed peaked at around 35% for the November meeting, but it’s too early to declare victory. Given that data remained volatile during the last two months, the Fed would have to dig into additional data before deciding the best path of monetary policy.

Regarding the released data in the US, ANZ analysts expect no more hikes by the Fed. They wrote, “Our view is the Fed is done with its tightening cycle, but risks remain that further rises may be needed. We continue to see Fed policy as highly data dependent, at the same time patient, with most officials open to further rate hikes if appropriate.”

Aside from this, employment data in Australia was solid and spurred a leg-up in the AUD/USD pair during Thursday’s Asian session, reversed with the US economic data release. The Aussie economy created 64.9K jobs while the unemployment rate remained at 3.7%. Even though more jobs were added than foreseen, ANZ analysts noted that they expect the Reserve Bank of Australia (RBA) to hold rates unchanged at 4.10%.

Therefore, if the RBA is set to keep rates unchanged and the Fed maintains its options open, additional AUD/USD downside could be expected, with interest rates favoring the Greenback (USD).

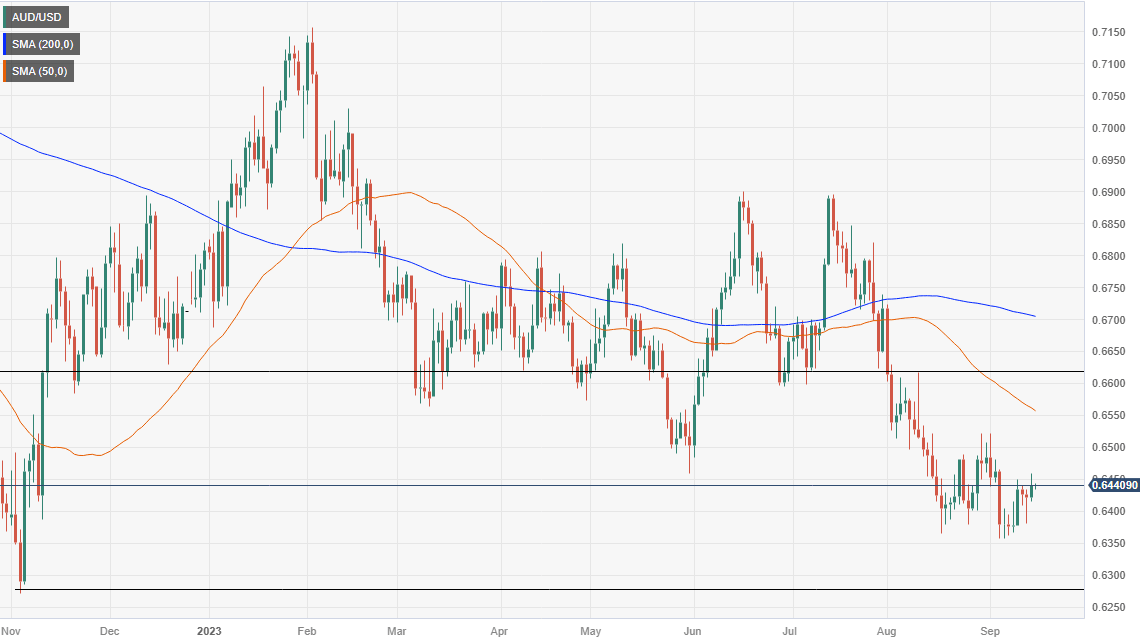

AUD/USD Price Analysis: Technical outlook

Given the fundamental backdrop, from a technical standpoint, the pair could be testing the year-to-date (YTD) low of 0.6357. A breach of the latter would expose key last year’s support levels at a November 22 low of 0.6272, followed by the October 21 swing low at 0.6210.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.