AUD/USD retreats amid resilient US economy as the soft landing scenario gains traction

- AUD/USD drops to 0.632, down 0.12%, reversing earlier gains spurred by positive economic data from China, Australia’s largest trade partner.

- US manufacturing and industrial data beat expectations, raising the odds for a soft landing by the Federal Reserve despite tightening.

- Market futures indicate a 32.45% chance of a Fed rate hike in November, while the September hike is largely ruled out.

The Australian Dollar reversed its course against the US Dollar after registering gains during the Asian session. Late in the North American session, the AUD/USD is trading at 0.632, losing 0.12% after reaching a daily high of 0.6473.

Australian Dollar loses steam against the US Dollar as strong US manufacturing and industrial data fuel optimism for a Fed soft landing

The economy in the United States (US) keeps surprising economists, as it remains more resilient than expected despite 525 basis points of tightening by the US Federal Reserve. Two indicators of manufacturing and industrial activity came better than expected, while Americans are optimistic that elevated prices would wane, as revealed by a University of Michigan poll.

The New York Fed revealed the Empire State Manufacturing Index, which improved after printing a mediocre -21 print in August, improved to 1.9, beating forecasts of a -10 plunge. At the same time, the Federal Reserve showed that Industrial Production expanded by 0.4% MoM, beneath July’s 1% but above the consensus forecasts.

The University of Michigan recently revealed that although inflation expectations remain not as close to the Fed’s 2% goal, they have subsided. Americans estimate inflation in one year at 3.1%, below August’s 3.5, while for ten years, they expected prices to drop to 2.7%. Regarding how they feel about the economy, known as Consumer Sentiment, the index deteriorated from 69.1 forecasts to 67.7.

Today’s data, summed up with the previous one revealed in the week, raised speculation the Fed might achieve a soft landing. In the meantime, money market futures remain certain the Fed would skip hiking rates in September, but odds for a 25 bps hike at the November meeting lie at a decent 32.45% chance.

Earlier, the additional stimulus provided by Chinese authorities is giving results on its economy, as revealed by the latest economic figures, which bolstered the Aussie, as China is Australia’s largest trade partner. Industrial Production in August rose above the prior’s reading and estimates, and retail sales jumped by 4.6% YoY, up from July 2.5% exceeding estimates.

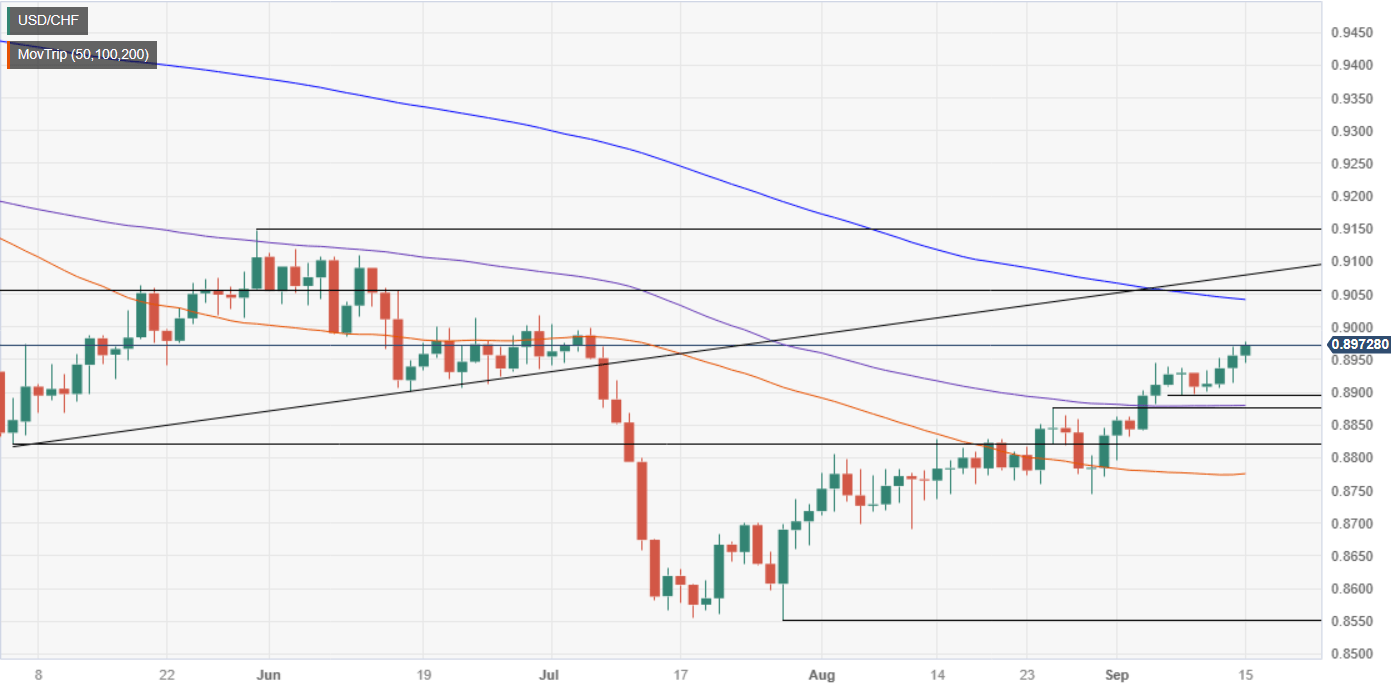

AUD/USD Price Analysis: Technical outlook

The daily chart portrays the US Dollar might continue to appreciate against the Aussie, with next week’s Fed decision looming. The major remains downward biased, with the 200 and 50-day Moving Averages (DMAs) slopes aiming south while price action continues to dive lower, approaching the year-to-date (YTD) low of 0.6357. As of writing, the first support would be 0.6400, followed by the latter, and the next floor would be the November 22 swing low of 0.6272.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.