AUD/USD Price Forecast: Falls back inside range signaling possible bearish reversal

- AUD/USD stalls at upside resistance and reverses lower, falling back inside its range.

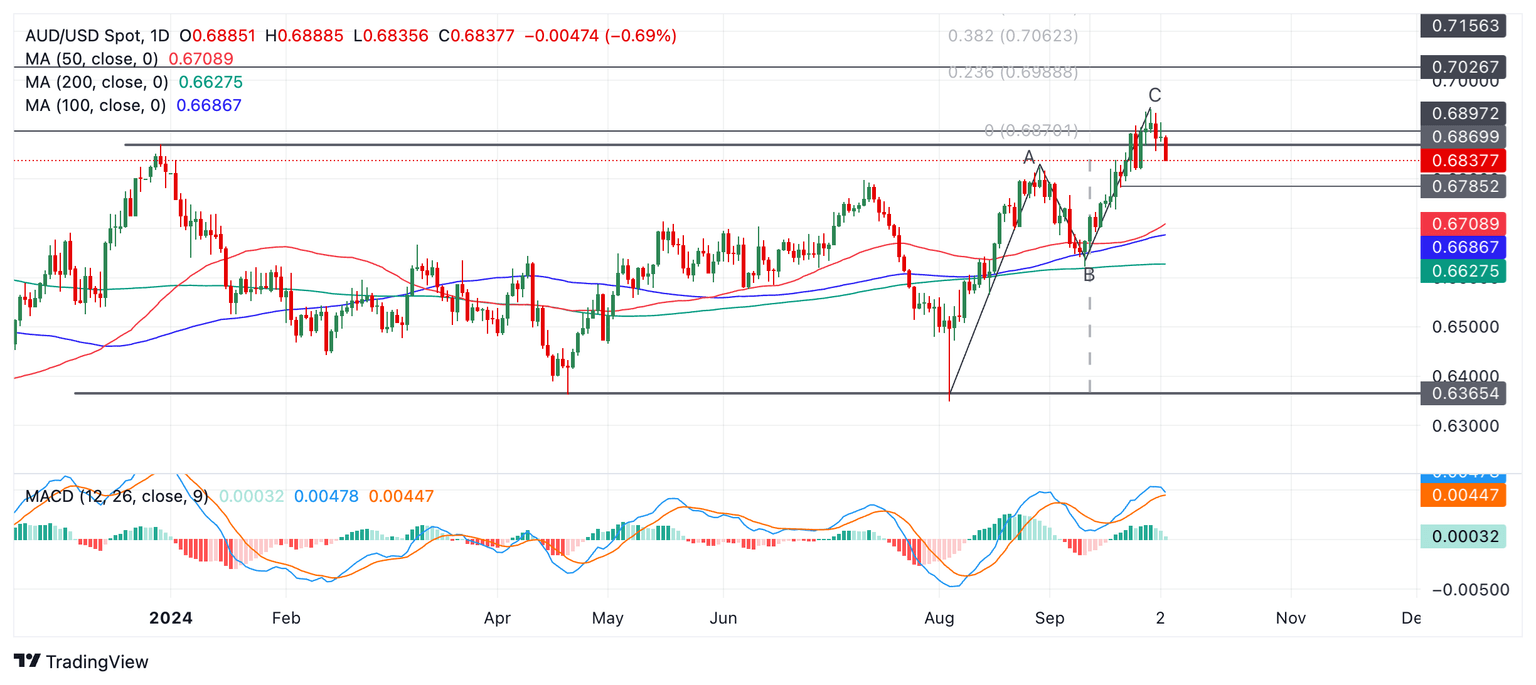

- It is threatening a short-term trend reversal and MACD is about to cross below its signal line.

AUD/USD reverses and starts falling after what appears to be a false breakout above the top of the range.

AUD/USD Daily Chart

The Aussie pair has now started falling back inside the range. It is possible this could be the start of a new short-term downtrend that might take AUD/USD back down towards the range lows in the 0.63s, however, it is still too early to say with any confidence.

The blue Moving Average Convergence Divergence (MACD) line is threatening to cross below the red signal line and if it does that would add further evidence to the argument that AUD/USD is reversing trend.

AUD/USD may have formed a Measured Move pattern during August and September as it rose from the bottom to the top of the range. Such patterns resemble zig-zags and lengths of waves A and C are similar or related by Fibonacci.

The Aussie pair reached an initial upside target based on extrapolating wave A of the Measured Move higher by a 61.8% Fibonacci. This target lies at around 0.6115. This is further evidence the uptrend may have reached its zenith and a new downtrend is currently forming. For more confirmation price would have to break below the 0.6785 level (September 20 swing low). Such a move would be expected to reach an initial downside target of 0.6709, the level of the 50-day Simple Moving Average (SMA).

Until then, there is still a risk the move down could stall and the uptrend resume, taking AUD/USD higher again. A break above the 0.6942 September 30 peak would confirm a resumption of the uptrend and target 0.6988 (14 February ‘23 swing high), followed by 0.7156 in a bullish case (2 February ‘23 high).

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.