AUD/USD Price Forecast: Aussie recovery rally extends

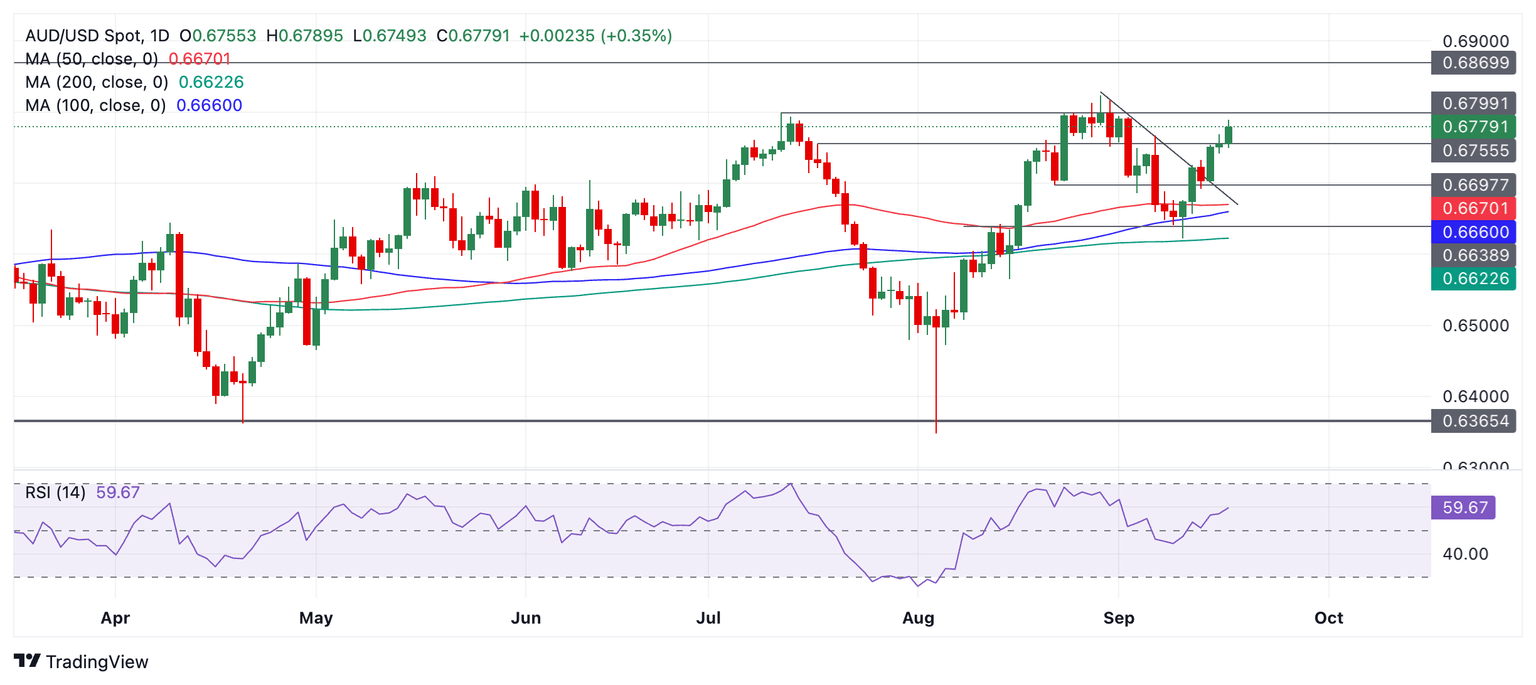

- AUD/USD is extending its recovery move from the September 11 lows.

- It will probably go a little higher until it reaches the July or August highs.

AUD/USD continues rallying as it climbs from the bottom it formed on September 11. The new up leg has broken above a key trendline for the correction of the August rally. This is a bullish sign and suggests it is now in a short-term uptrend.

AUD/USD Daily Chart

Given it is a principle of technical analysis that “the trend is your friend” the Aussie is likely to continue going higher. It could match or almost match the 0.6824 August 29 high. The resistance level at 0.6799 ( July high) is another potential target and could provide firm resistance to bulls.

Momentum, as measured by the Relative Strength Index (RSI) is slacking off a little and suggests some caution before adopting an overly bullish stance, however, it is broadly mirroring price, a fact that is supportive of the current mini-rally.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.