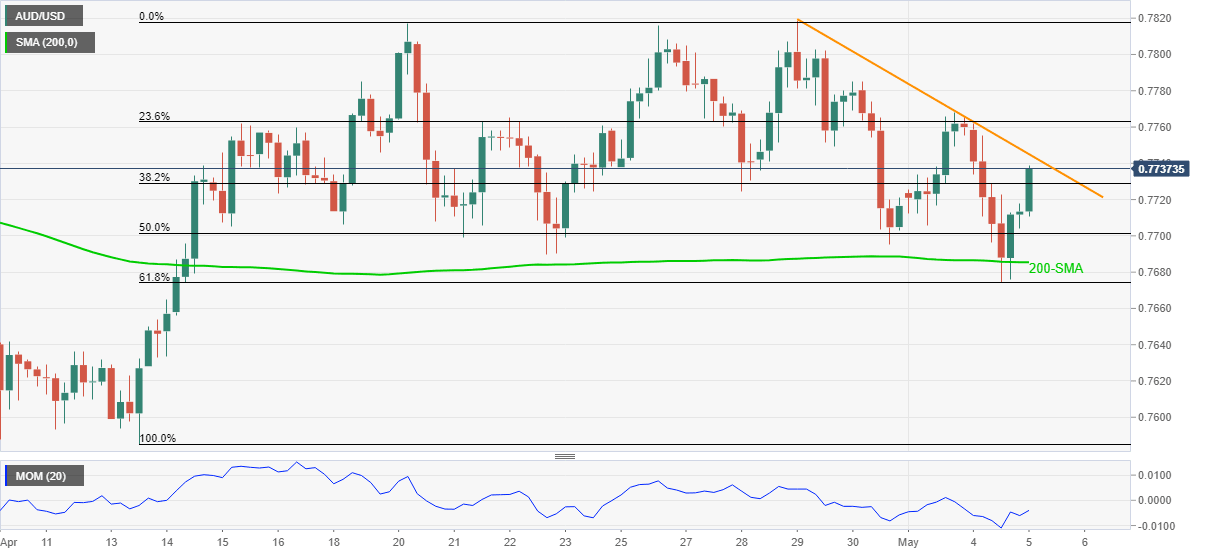

AUD/USD Price Analysis: On the way to monthly resistance line around mid-0.7700s

- AUD/USD remains well-bid, refreshes intraday top following the previous day’s bounce.

- Recovery in Momentum indicator also backs the bulls.

- 200-SMA, 61.8% Fibonacci retracement level become the key support.

AUD/USD takes the bids to 0.7738, up 0.41% intraday, during early Wednesday. In doing so, the quote justifies the previous day’s U-turn from 61.8% Fibonacci retracement of April 13-29 upside, not to forget 200-SMA, amid a recovery in the Momentum line.

It should, however, be noted that a downward sloping trend line from April 29, around 0.7745, guards the pair’s immediate upside.

Following that, the monthly top near 0.7770 and the 0.7800 round figure may entertain AUD/USD buyers before pushing them to the previous month’s top near 0.7820.

Meanwhile, pullback moves may initial battle 50% Fibonacci retracement level of 0.7700 before retesting the late April lows near 0.7690.

Though, any further downside past-0.7690 will have to close below the 200-SMA level of 0.7685, as well as 61.8% Fibonacci retracement level near 0.7670, to recall the AUD/USD bears.

To sum up, AUD/USD is likely to stay in the recovery mode but a bumpy road can’t be ruled out.

AUD/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.