AUD/USD Price Analysis: Needs to set a platform for a breakout above 0.6900

- AUD/USD is expected to shift into an inventory accumulation process for a breakout above 0.6900.

- The US Dollar Index has dropped to near 103.70 as the overall risk profile is solid.

- An oscillation in the 40.00-60.00 range by the RSI (14) indicates a consolidation ahead.

The AUD/USD pair has displayed a gradual decline and has slipped to near 0.6820 in the Tokyo session after facing barricades around 0.6890. The Aussie asset has corrected but has not surrendered its upside bias amid an overall risk appetite theme.

Meanwhile, S&P500 futures have sensed some sell-off in Asia after failing to extend its recovery recorded on Wednesday, showing some caution in underpinning the risk-on profile. The US Dollar Index (DXY) has dropped significantly to near 103.70 as investors didn’t find any hawkish cues in the Federal Open Market Committee (FOMC) minutes apart from Federal Reserve (Fed) chair Jerome Powell’s commentary in December’s monetary policy meeting.

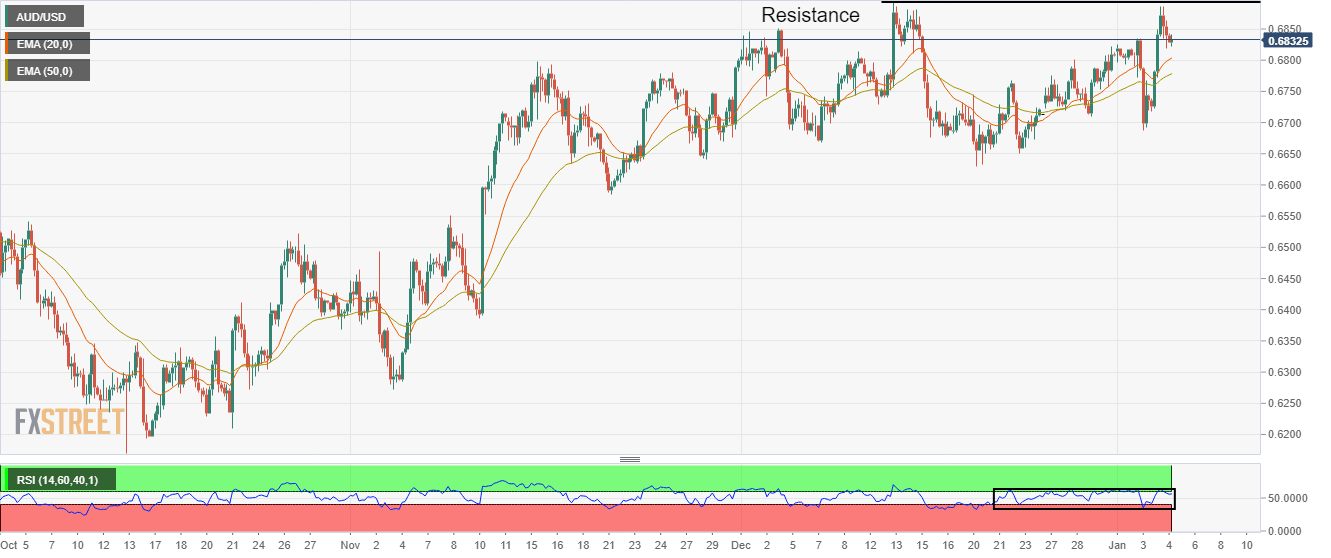

AUD/USD has sensed some sell-off while attempting to recapture the horizontal resistance plotted from December 13 high at 0.6893 on a four-hour scale. On a usual basis, inventory accumulation below potential resistances is healthy for a confident breakout. The absence of bearish reversal signs is bolstering the fact of a rangebound action ahead.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at 0.6805 and 0.6780 respectively add to the upside filters.

The Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates the absence of a potential trigger for a decisive move.

For a fresh rally, the Aussie asset needs to deliver a decisive break above December 13 high at 0.6893, which will drive the major towards August 30 high at 0.6956 and the psychological resistance at 0.7000.

On the contrary, a downside move below December 29 low at 0.6710 will drag the major further towards December 22 low at 0.6650 followed by November 21 low at 0.6585.

AUD/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.