AUD/USD Price Analysis: Dives to two-week lows, further below 0.7700 mark

- AUD/USD witnessed some heavy selling on Tuesday and tumbled below the 0.7700 mark.

- The technical set-up favours bearish traders and supports prospects for further weakness.

- A subsequent slide below the 0.7620 area (monthly lows) would mark a fresh bearish break.

The AUD/USD pair weakened further below the 0.7700 mark and dropped to near two-week lows heading into the European session. The pair was last seen trading near the 0.7680-75 region, down around 0.85% for the day.

A rare coordinated move by the US, Canada, UK and EU to impose sanctions on Chinese officials over human rights violations in Xinjiang took its toll on the China-proxy aussie. Apart from this, a softer risk tone provided a modest lift to the safe-haven US dollar and further drove flows away from the perceived riskier Australian dollar.

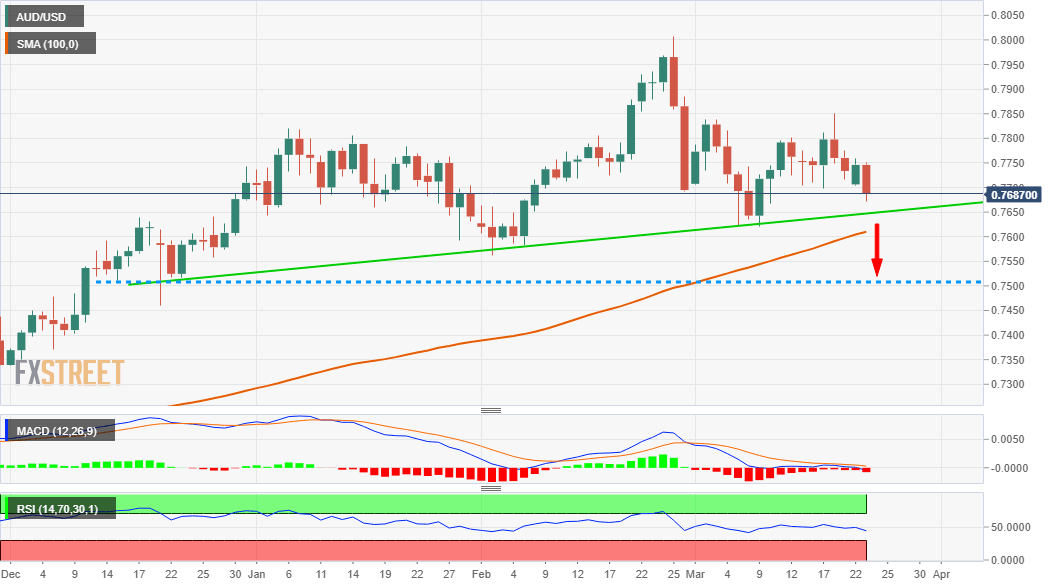

From a technical perspective, a sustained break below the 0.7700 strong horizontal support was seen as a fresh trigger for bearish traders. This, in turn, might have already set the stage for additional Weakness. The bearish outlook is reinforced by the fact that technical indicators on the daily chart have just started drifting into the negative territory

Hence, a subsequent slide towards monthly swing lows, around the 0.7620 region touched on March 5, now looks a distinct possibility. The latter coincides with the 100-day SMA support, which if broken decisively should pave the way for an extension of the recent sharp pullback from the key 0.8000 psychological mark, or the highest level since February 2018.

The AUD/USD pair might then turn vulnerable to slide further below the 100-day SMA support, around the 0.7600 mark and aim to test the next relevant support near the 0.7530-25 horizontal zone.

On the flip side, any attempted recovery move might now be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Bearish traders would look to enter near the 0.7700 mark and any subsequent move up is more likely to remain capped near the 0.7745-50 supply zone.

AUD/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.