AUD/USD Price Analysis: Battles 0.7200, upside remains favored above 50-DMA

- AUD/USD is consolidating the recent rebound from 0.7150 levels.

- The risk sentiment fares better on hopes for diplomacy over Ukraine tensions.

- The aussie risks upside, 50-DMA support should hold fort on a daily closing basis.

AUD/USD is battling 0.7200, trimming a minor portion of its Asian advance, as bulls turn cautious heading into European trading.

Despite the minor pullback from daily highs of 0.7210, the aussie remains well bid amid a stabilizing risk sentiment following Thursday’s broader market sell-off on the Ukrainian firing news and US’ warnings over an imminent Russian invasion.

Investors found comfort from the announcement of a meeting between US Secretary of State Antony Blinken and his Russian counterpart Sergey Lavrov late next, sparking a ray of optimism for diplomacy and de-escalation.

However, the latest reports of selling in East Ukraine somewhat tempered the upbeat mood, as bulls take a breather ahead of the meeting between the US President Joe Biden and other international leaders to discuss a potential war-like situation, concerning Russia and Ukraine.

Meanwhile, the US dollar extends its subdued trading activity, with the upside capped by receding expectations of 50-basis points March Fed rate hike and geopolitical tensions.

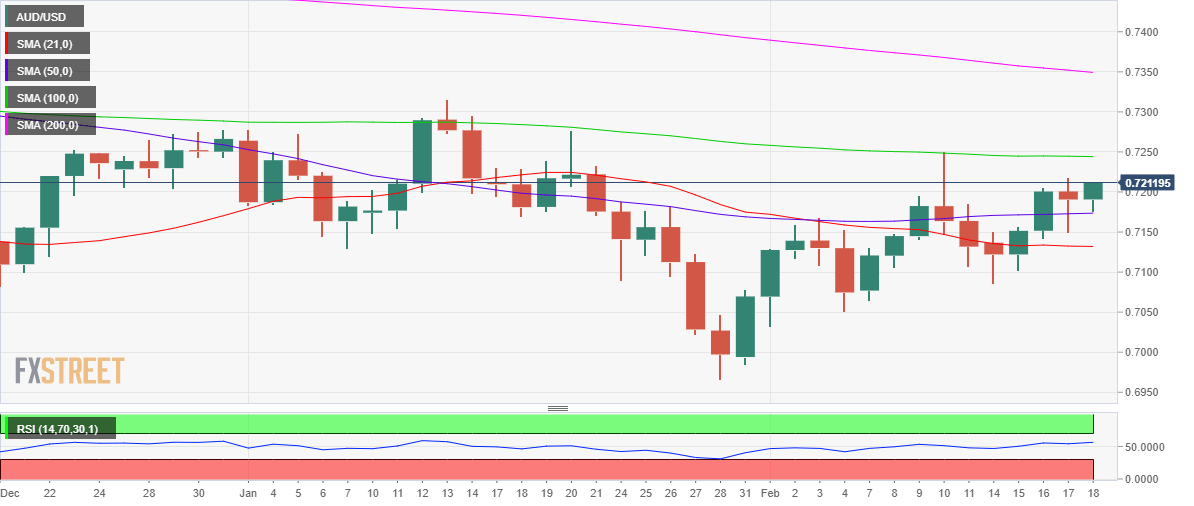

Technically, AUD/USD needs to clear Thursday’s high of 0.7218 to challenge the horizontal 100-Daily Moving Average (DMA) at 0.7244.

The next relevant upside target for AUD bulls is seen at the January 20 highs of 0.7277.

The 14-day Relative Strength Index (RSI) is looking slightly north while above 50.00, suggesting that the rebound is likely to extend going forward.

AUD/USD: Daily chart

On the flip side, bears need a daily closing below the 50-Daily Moving Average (DMA), now at 0.7174 to resume Thursday’s pullback.

The previous day’s low of 0.7150 will be tested thereafter, opening floors towards the mildly bearish 21-DMA at 0.7132.

AUD/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.