AUD/USD is poised for a bearish start to the week

- AUD/USD may find strong resistance from the bears.

- Wall Street's benchmarks hit all-time highs of Friday, but the technical environment for the high beta curreny is bearish.

AUD/USD ended on Friday at 0.7617 and down by some 0.44% having fallen from a high of 0.7661 to a low of 0.7588.

For the open, there has been little in the way of fundamental weekend news as a catalyst for traders seeking an opportunity.

While Friday's North American equity markets finished the week with a positive tone, with the SPX gaining 0.8% and the DJIA hitting a fresh all-time high, technically, the pair may struggle to maintain a bid tone for long.

That being said, a positive close on Wall Street leaves the pair's upside exposed due to its higher-beta status.

Moreover, the reassuring message from Federal Reserve officials over the course of last week will possible contribute to a positive risk sentiment start for the week.

Also, given how much the Aussie has languished of late, there are prospects of a positive correction vs the greenback.

However, That there is a compelling topping formation on the weekly charts and nearer-term resistance could prove to be an obstacle for the bulls. See the technical outlook below.

Meanwhile, the data ahead for the week will be important for both the USD and AUD. Particularly US Consumer Price Index and Aussie Unemployment.

''While we see a data beat in Australian employment, the inability to rally on a realization should magnify 0.7580/00 supports,'' analysts at TD Securities said.

AUD/USD technical analysis

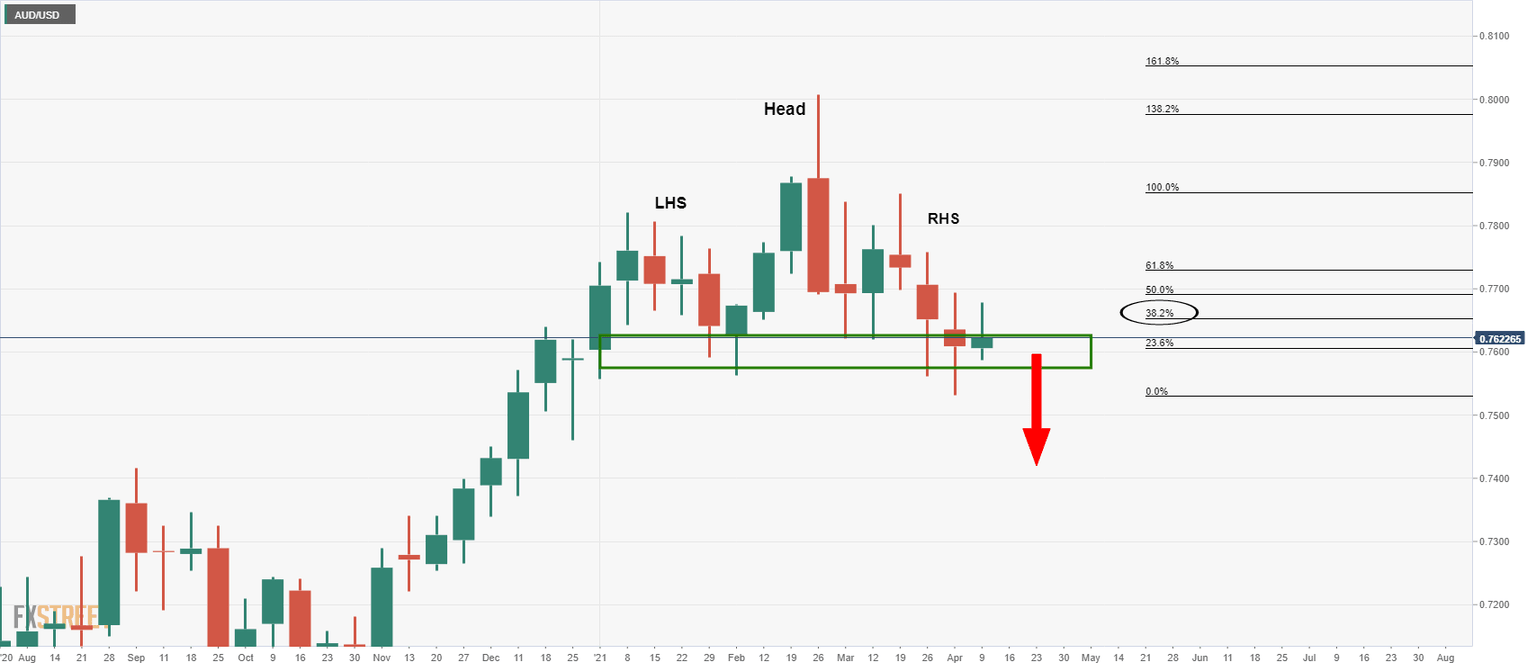

The weekly chart above, as referred to above, shows a bearish head and shoulders topping pattern which exposes the support structure for a significant test in the days to come.

Failures there will open prospects of a break to the downside.

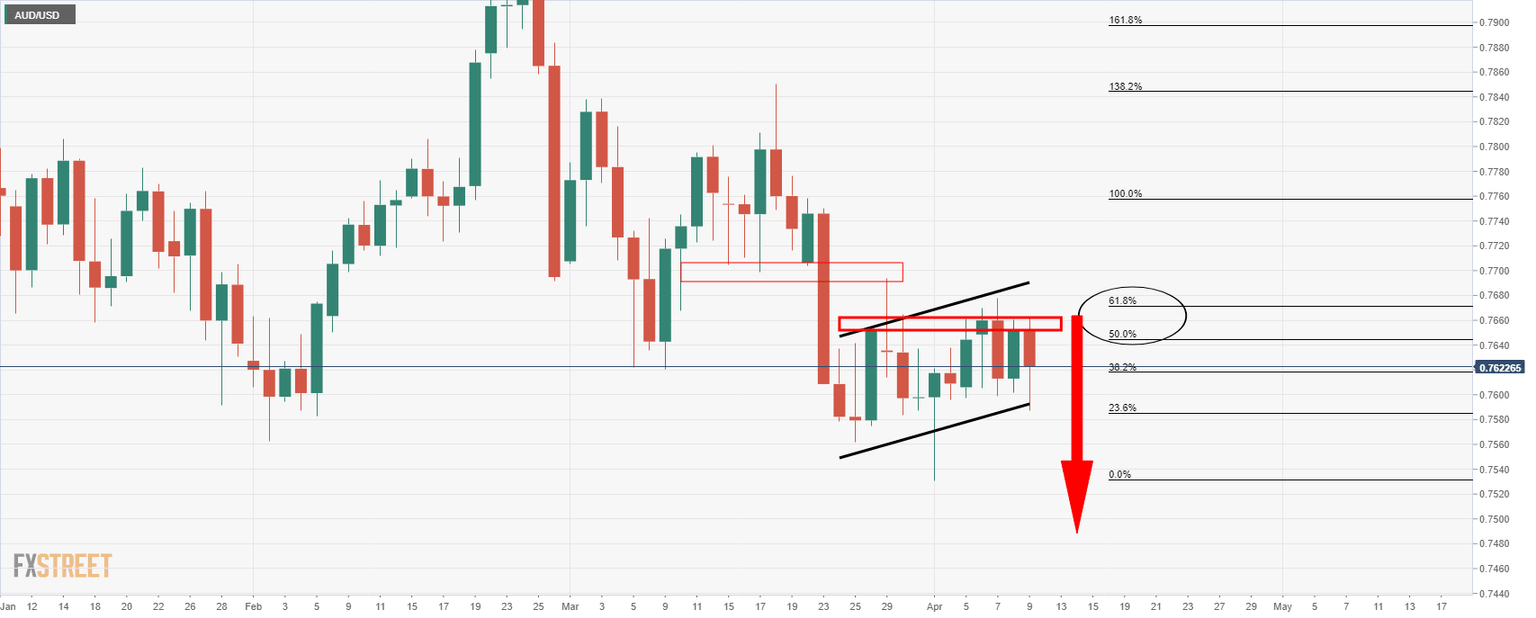

From a daily perspective, the price is channelled to the upside but is facing a wall of resistance:

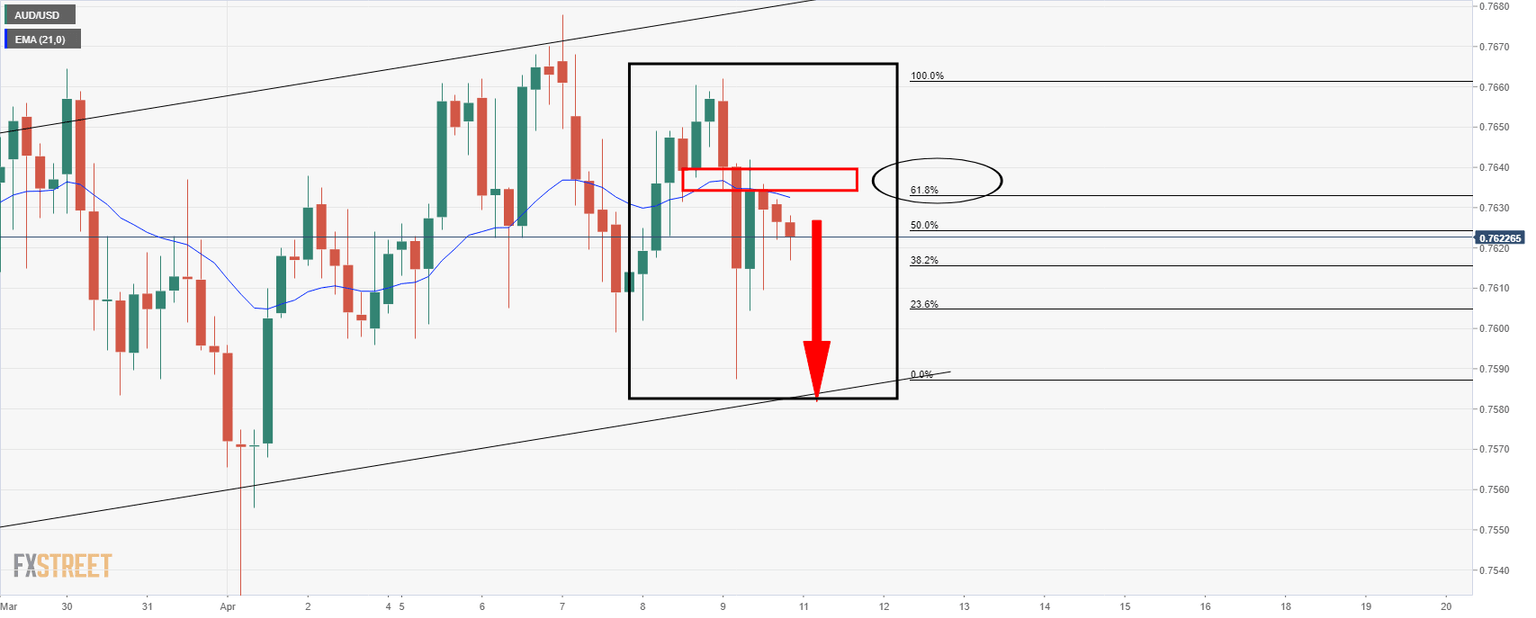

From a 4-hour perspective, the price has completed an M-formation to the neckline and a 61.8% Fibonacci retracement.

This leaves the emphasis on the downside:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.