AUD/NZD Price Analysis: Bearish signals deepen as Aussie struggles against Kiwi

- AUD/NZD trades near the 1.0700 area, retreating from intraday highs ahead of the Asian session.

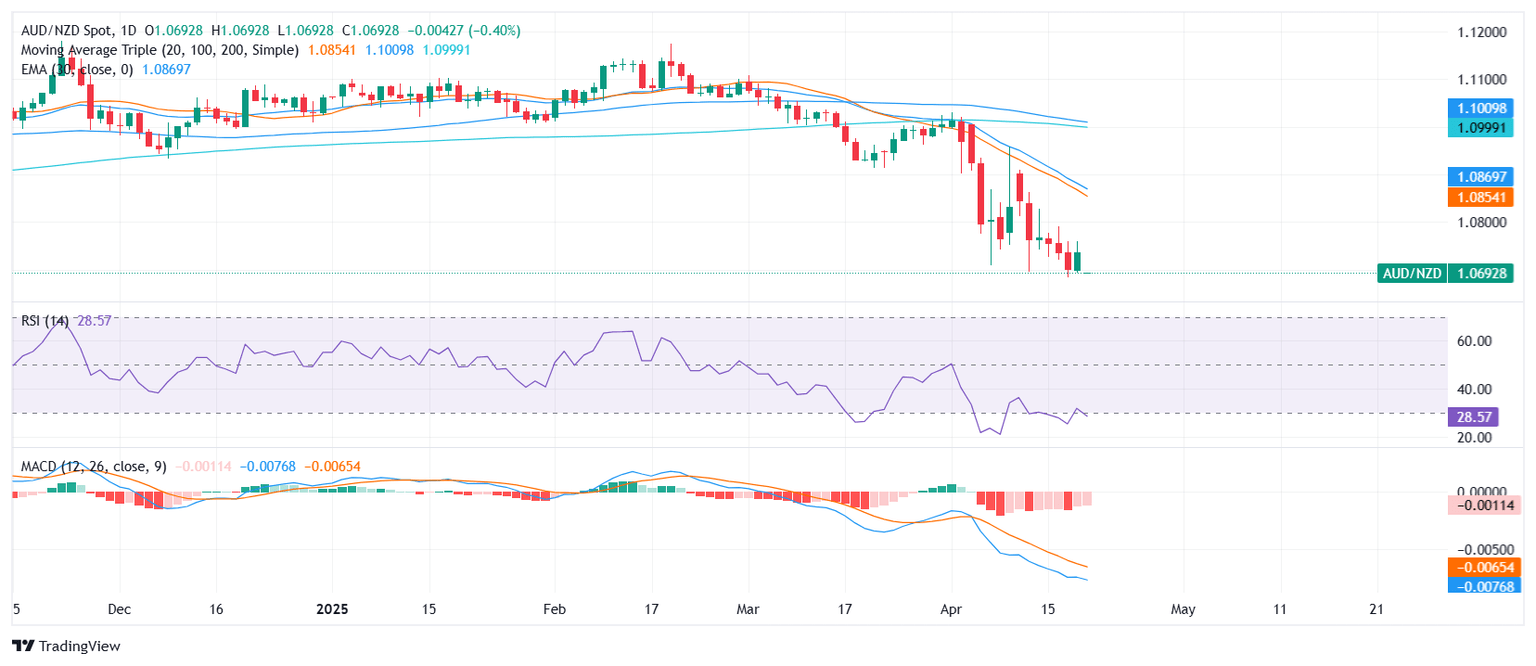

- Overall bearish sentiment persists despite neutral oscillators, with all key moving averages pointing to downside pressure.

- Support lies at 1.06949, while resistance levels are seen at 1.07691, 1.07711, and 1.08238.

The AUD/NZD pair is exhibiting bearish signals, currently trading around 1.0700, down 0.40% today, and positioned mid-range between 1.06784 and 1.07439 during Monday’s session. The pair's inability to hold higher ground underlines the weight of selling pressure as the broader trend continues to favor the downside.

Momentum indicators provide mixed but cautious readings. The Relative Strength Index (RSI) stands at 31, close to oversold territory yet still holding a neutral bias. The Moving Average Convergence Divergence (MACD) continues to flash a sell signal, in alignment with the Awesome Oscillator at -0.0185, which also suggests downside continuation. Meanwhile, the Stochastic %K at 9.2611 remains neutral, lacking clear directional conviction.

The moving averages confirm the bearish technical structure. All key SMAs — 20-day at 1.0859, 100-day at 1.1010, and 200-day at 1.1000 — are sloping downward, along with shorter-term indicators like the 10-day EMA at 1.0769 and 10-day SMA at 1.0771, which further validate the dominant bearish bias.

Support is found at 1.06949. Resistance is capped at 1.07691, followed by 1.07711 and 1.08238. If selling continues and the pair slips below the 1.0690 zone, a fresh wave of downside could be triggered.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.