AUD/NZD Price Analysis: Aussie stalls near 1.0800 as bearish pressure builds

- AUD/NZD trades around the 1.0800 zone after modest gains ahead of the Asian session.

- Bearish bias holds despite short-term momentum stabilizing.

- Key moving averages above price reinforce resistance, while support remains close below.

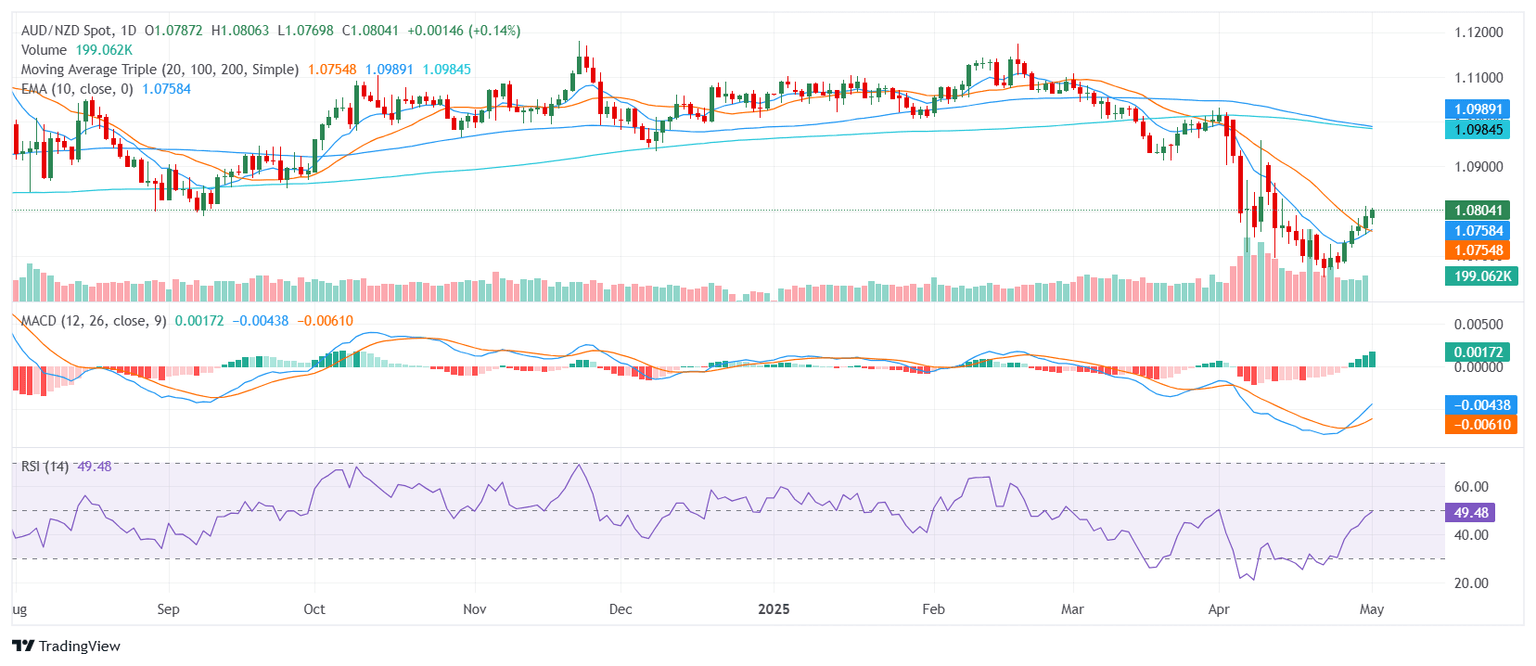

The AUD/NZD pair edged slightly higher on Thursday, trading near the 1.0800 area as the market transitions into the Asian session. While the move shows mild intraday strength, the broader technical setup remains tilted to the downside. Mixed signals from short-term indicators clash with the clearly defined bearish structure shaped by longer-term trendlines and overhead resistance.

Technically, AUD/NZD is flashing a bearish signal. The Moving Average Convergence Divergence currently gives a soft buy signal, while the Relative Strength Index remains neutral just below the 50 line. The Stochastic RSI Fast and Average Directional Index are also neutral, indicating that despite the day’s gains, momentum remains capped and trend conviction limited.

The bearish outlook is underpinned by the configuration of key moving averages. Both the 30-day Exponential and Simple Moving Averages are positioned above the current price, capping any upward extension. More significantly, the 100-day and 200-day SMAs — aligned near the 1.0990 area — add longer-term resistance to the structure. The only supportive element comes from the 20-day SMA, which offers a soft floor just beneath current levels, but lacks the weight to counter the broader trend.

Immediate support is located at 1.0784, 1.0776, and 1.0760. Resistance awaits at 1.0804, 1.0820, and 1.0833.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.