AUD/NZD Price Analysis: Aussie drifts near 1.0800 as bullish structure faces mixed signals

- AUD/NZD trades near the 1.0800 zone after a muted Monday session ahead of Asia.

- Bias remains bullish overall, but short-term momentum indicators are divided.

- Dynamic support holds below while key resistance from long-term averages caps upside.

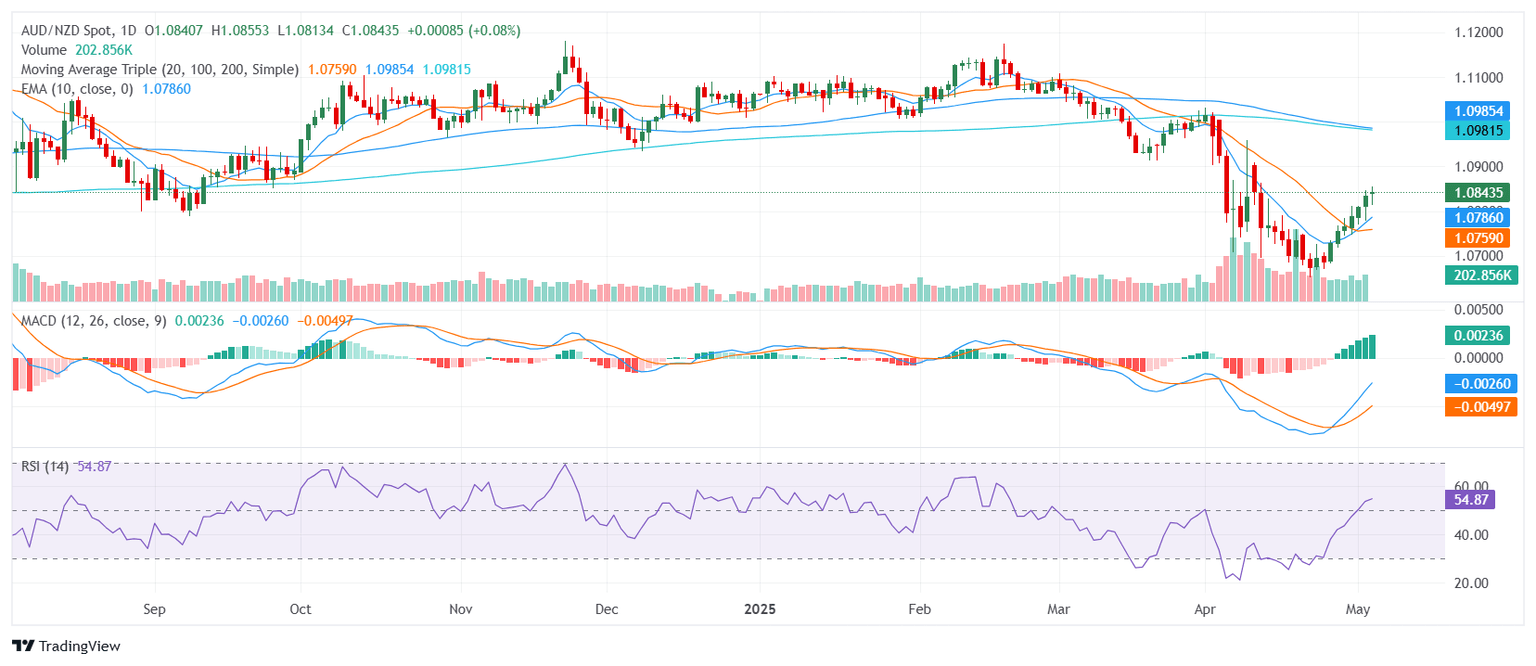

The AUD/NZD pair hovered around the 1.0800 mark on Monday after the European session, slipping slightly but staying within a narrow mid-range as the market heads into Asia. While price action has remained steady, the technical landscape presents a mix of signals — with a bullish structure underpinned by rising short-term averages, yet some indicators showing emerging pressure.

From a momentum standpoint, the outlook is conflicted. The Relative Strength Index holds a neutral stance near 54, suggesting a balanced market. The Moving Average Convergence Divergence continues to flash a buy signal, pointing to latent upward momentum. However, the Bull Bear Power and Williams Percent Range have turned negative, indicating that intraday strength may be waning.

Structurally, the bullish case is still intact. The 10-day Exponential and Simple Moving Averages, along with the 20-day SMA, all sit below current levels and are pointing upward — helping to maintain directional support. That said, longer-term resistance looms overhead, with both the 100-day and 200-day Simple Moving Averages positioned well above, limiting scope for sustained rallies unless broken decisively.

Support levels are identified at 1.0826, 1.0823, and 1.0796. Resistance aligns at 1.0842, 1.0853, and 1.0873. Traders may watch for consolidation within this zone unless a catalyst breaks the pair out of its current range.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.