AUD/NZD Price Analysis: Bearish signals emerge ahead of Asia open

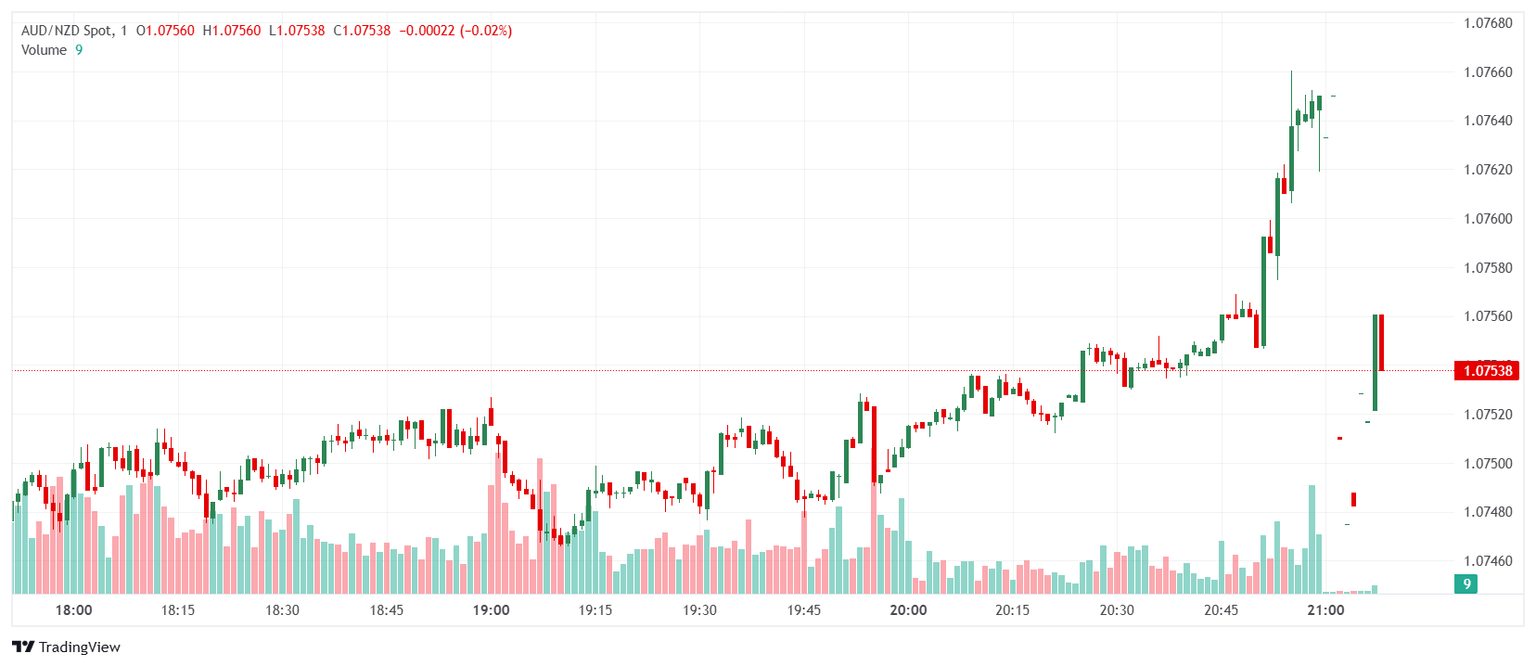

- AUD/NZD was seen trading around the 1.07 area, registering a slight decline on the day.

- The overall technical outlook suggests a bearish bias for the currency pair.

- Key Simple Moving Averages point to selling pressure, while the Relative Strength Index remains neutral, and the Moving Average Convergence Divergence shows a buy signal.

The AUD/NZD has experienced some downward pressure, hovering near the 1.07 zone on Tuesday. Despite mixed signals from some momentum indicators, the longer-term technical picture appears to favor the bears, with several moving averages reinforcing this sentiment.

The AUD/NZD pair is currently exhibiting a bearish technical bias. While the Moving Average Convergence Divergence indicator is flashing a buy signal, suggesting potential short-term upward momentum, the broader context leans negative. The Relative Strength Index sits in neutral territory around the 42 level, offering little directional conviction at present. However, both the 20-day, 100-day, and 200-day Simple Moving Averages are indicating sell positions, highlighting sustained bearish momentum over different timeframes. Similarly, the 30-day Exponential Moving Average and Simple Moving Average also point towards further declines.

Looking at potential price movements, immediate support is observed at 1.0746, followed by 1.0739 and then a lower level at 1.0717. On the upside, initial resistance can be found at 1.0774, with subsequent resistance levels at 1.0781 and 1.0786.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.