AUD/JPY recovering steadily as investors ease back into the Aussie

- AUD/JPY trading into the upside, but momentum remains limited.

- Aussie trade figures are helping prop the AUD back up.

- Tuesday's wild chart spike is still engulfing price action, breaking technical indicators and throwing average into a tailspin.

The AUD/JPY caught some restrained lift on Thursday, climbing into an intraday high of 94.70 and heads into the Friday Asian market session trading just shy of 94.60.

Australian Trade Balance numbers on Thursday broadly beat expectations, showing a surprise surge in exports of 4% and sending the Aussie Trade Balance to a new reading of 9.64 billion AUD, a notable jump from the previous reading of 7.324 billion and handily vaulting over the forecast 8.725 billion.

Up next rounding the corner heading into Tokyo's Friday market will be Japan's Labor Cash Earnings for the annualized period into August, which is forecast to tick upwards from 1.3% to 1.5%.

The Aussie saw intense knockback after Tuesday's mystery market spike sent the pair tumbling into 93.05 in a matter of seconds, and initial market reaction assumed a Bank of Japan (BoJ) market intervention to defend the Yen (JPY). However, reporting by Reuters suggests this may not be the case, as Japanese investment figures printed broadly in-line with estimates, a feat that would not be entirely possible if the BoJ engaged in emergency FX market intervention.

AUD/JPY technical outlook

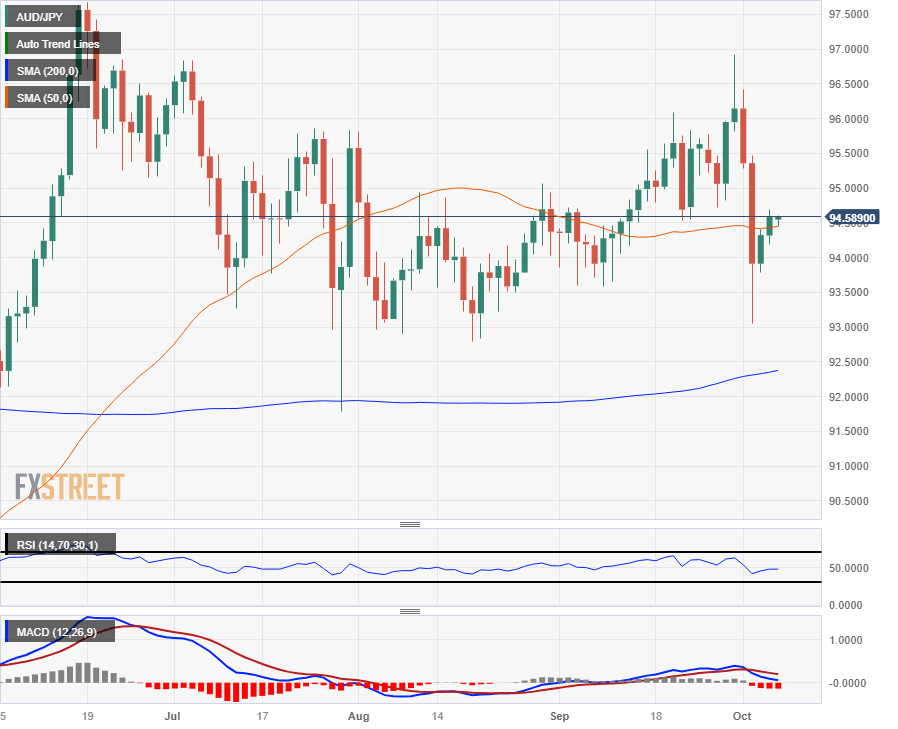

Despite Tuesday's seconds-long collapse and the ensuing lift back towards the 95.00 handle, the AUD/JPY pair remains firmly entrenched in medium-term consolidation, with the pair floating within well-trodden levels ever since the pair tumbled away from June's peak of 97.67.

Price action is currently trapped into the 100-day Simple Moving Average (SMA) as market momentum drains out of the Aussie-Yen pairing, and the 200-day SMA is currently acting as technical support, bolstering the pair from below near 92.50.

AUD/JPY daily chart

AUD/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.