AUD/JPY Price Forecast: The crucial support level emerges near 100.00

- AUD/JPY edges lower to around 101.05 in Thursday’s early European session.

- Further consolidation cannot be ruled out as the RSI emerges in the neutral zone.

- The first upside barrier emerges at 101.80; the key support level is seen at 100.00.

The AUD/JPY cross trades in a narrow range near 101.05 during the early European session on Thursday. Traders will monitor the speeches from the Bank of Japan (BoJ) Governor Kazuo Ueda and the Reserve Bank of Australia (RBA) Governor Michele Bullock later on Thursday, which might offer some insights on inflation and rate hike expectations.

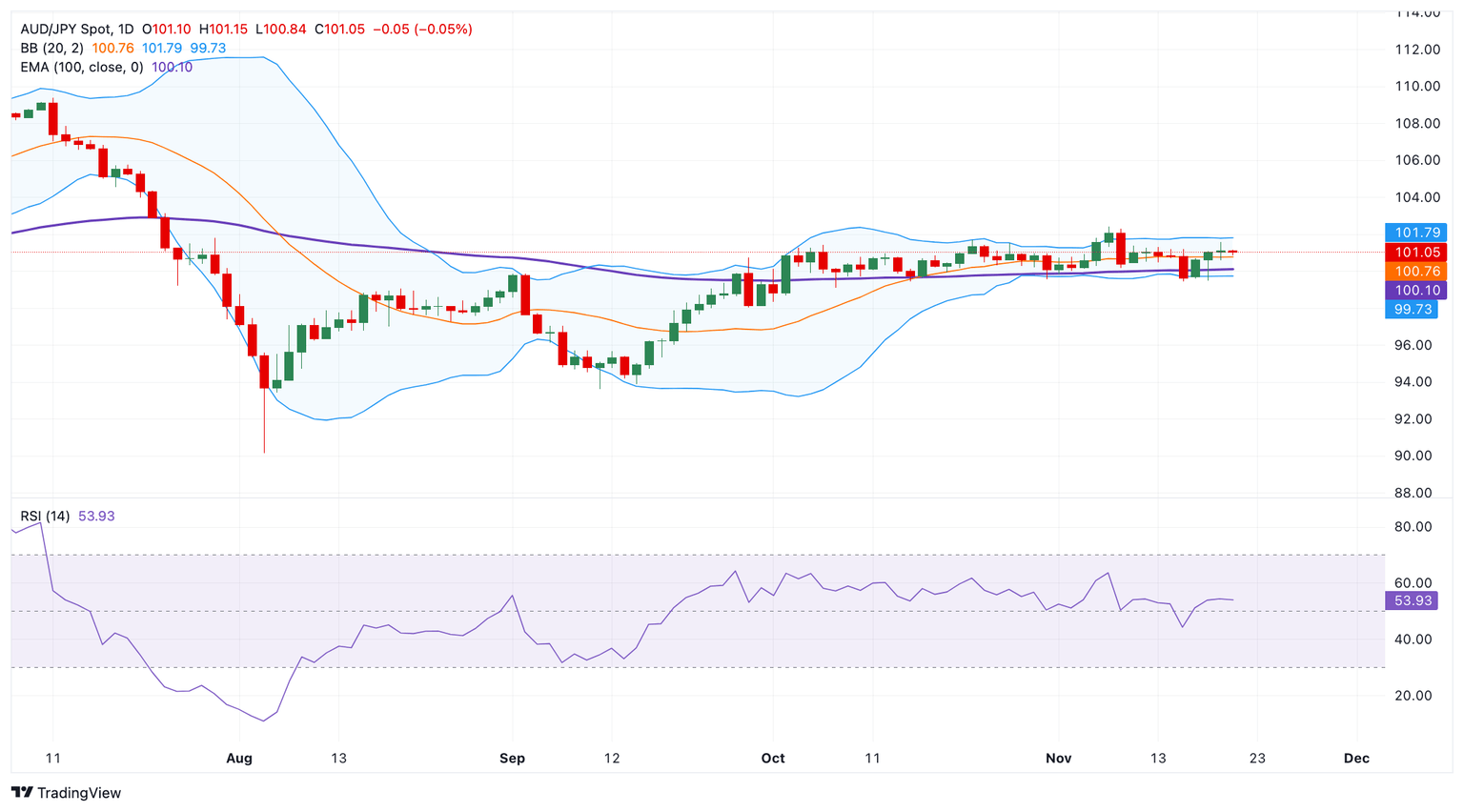

According to the daily chart, the cross remains above the key 100-day Exponential Moving Average (EMA), suggesting the support level is likely to hold rather than break in the near term. However, further consolidation cannot be ruled out as the 14-day Relative Strength Index (RSI) hovers around the midline, indicating the neutral momentum of the cross.

The upper boundary of the Bollinger Band near 101.80 acts as an immediate resistance level for AUD/JPY. Extended gains above this level could see a rally to 102.40, the high of November 7. The additional upside filter to watch is 103.36, the low of July 23.

On the flip side, the key support level is seen at the 100.00 psychological level. A breach of this level could pave the way to 99.42, the low of November 15. Further north, the next downside target emerges at 98.03, the low of September 27.

AUD/JPY 4-hour chart

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is "..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.