AUD/JPY Price Analysis: Tumbles below 97.50, dropping to four-day lows

- AUD/JPY pair is experiencing a downward trend, struggling to regain momentum, staying below the crucial 97.50 level.

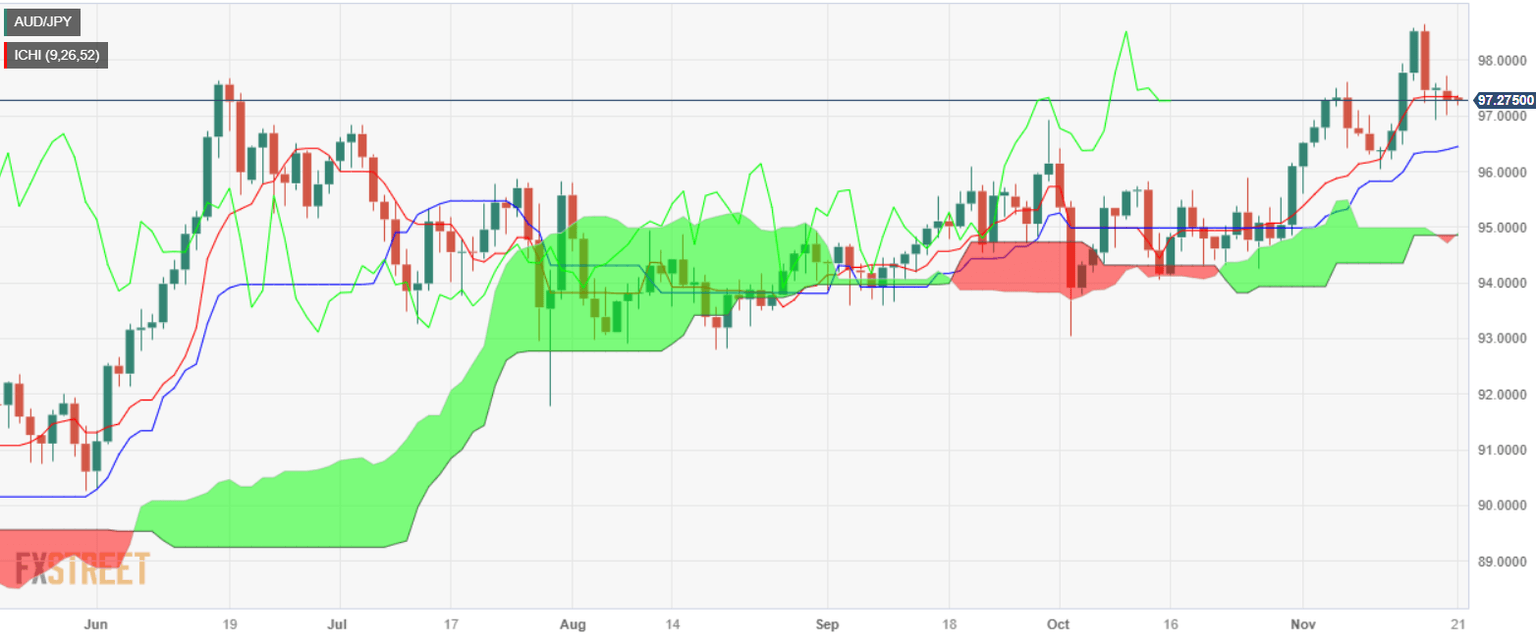

- Technical analysis indicates an overall upward bias for the pair, but recent movements have seen it drop below the Tenkan-Sen at 97.31, signaling the potential for further declines.

- On the flip side, a recovery above the recent high of 97.72 could pave the way for testing the 98.00 resistance level.

The AUD/JPY post of four straight days of losses stays below the 97.50 area on Monday, breaking below a key support level at the time of writing. The AUD/JPY is trading at 97.24, down y 0.01%, as Tuesday’s Asian session begins.

From a daily chart perspective, the pair is upward biased, but it fell below the Tenkan-Sen at 97.31, which could exacerbate a test of the 97.00 figure. The pair would witness further downside action below the latter, like the Senkou Span A at 96.86, before slumping toward the Kijun-Sen at 96.41. Once cleared, up next would be. the 96.00 mark.

On the other hand, if AUD/JPY climbs past the November 20 high at 97.72, that could exacerbate a test of the 98.00 figure. Once cleared, up next would be the year-to-date (YTD) high at 98.60, ahead of the 99.00 figure.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.