AUD/JPY Price Analysis: Struggles to hold ground ahead of the Asian session

- The AUD/JPY trades near the 91.30 zone with minimal gains during Monday’s session.

- Overall bias remains bearish despite mixed technical signals.

- Key resistance lies near 91.80, while support is seen closer to 91.10.

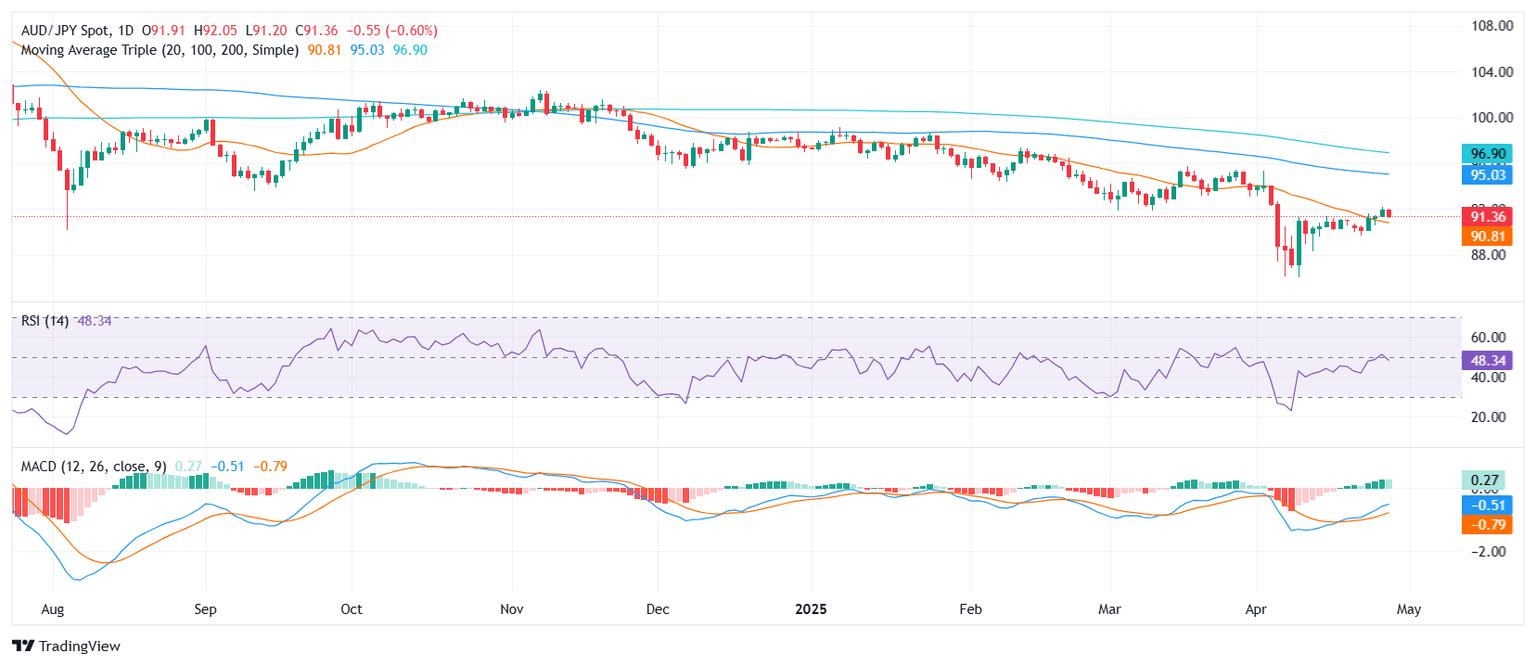

The AUD/JPY is trading close to the 91.30 area on Monday, showing very limited movement ahead of the Asian session. The pair remains stuck mid-range after a session characterized by low volatility. Despite a marginal daily gain, technical indicators provide a mixed picture: the Relative Strength Index (RSI) stays neutral around 48, the Moving Average Convergence Divergence (MACD) flashes a buy signal, while momentum and stochastic oscillators hint at mounting selling pressure. A bearish tilt remains dominant, reinforced by the 30-day Exponential Moving Average (EMA) and Simple Moving Average (SMA), as well as the 100-day and 200-day SMAs, all indicating further downside risks.

Looking deeper into the technical setup, selling signals persist as the 30-day EMA at 91.77 and 30-day SMA at 91.88 lean toward further declines. Longer-term trends also add to the bearish bias, with the 100-day SMA at 94.99 and the 200-day SMA at 96.92 firmly indicating selling pressure. Even though the 20-day SMA, positioned lower around 90.65, suggests short-term buying interest, it seems insufficient to overturn the broader negative sentiment.

Momentum indicators bolster the bearish case, with the 10-period momentum showing weakness and the stochastic %K hovering at elevated but downward-leaning levels near 86, typically a signal of potential reversal from overbought conditions. On the flip side, the MACD’s buy signal tempers the bearish outlook somewhat, hinting at possible short-term stabilization.

In terms of levels to watch, support is seen around 91.33, 91.13, and deeper near 90.98. Meanwhile, resistance is stacked near the 91.77, 91.81, and 91.88 zones, suggesting that any upside attempt could face challenges relatively quickly.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.