AUD/JPY Price Analysis: Continues to decrease after severe weekly loss

- AUD/JPY persists downwards, dropping to 104.30, marking the lowest level since June 18.

- The negative short-term outlook remains steady as the pair tallied seven losing days out of the last eight.

In Monday's trading, the AUD/JPY pair has continued its downward trend, declining by more than 0.90% to touch 104.30. This substantiates the dominance of the bears and magnifies the prevailing negative short-term outlook as the pair reaches new lows.

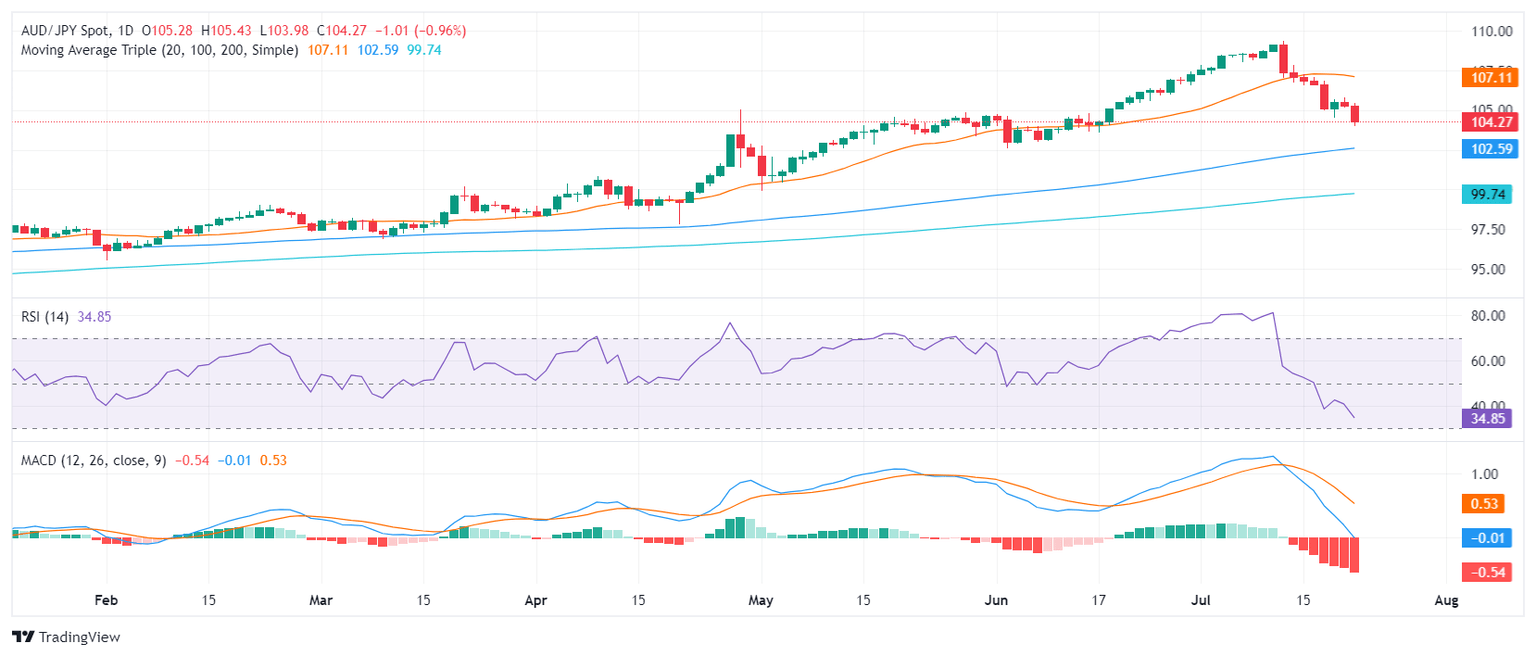

The daily Relative Strength Index (RSI) currently stands at 35, falling even further below Friday’s reading of 42, indicating the strengthening of the negative momentum. The same trend is implied by the Moving Average Convergence Divergence (MACD) which continues to print rising red bars, suggesting a resumption of the selling activity, despite any minor rebounds.

AUD/JPY daily chart

When analyzed from a broader perspective, the AUD/JPY's short-term bearish momentum seems to endure, with the pair further below the 20-day Simple Moving Average (SMA). However, it remains above both the 100 and 200-day SMA which suggests an overall positive outlook. Looking towards the future, immediate support levels seem to have been established around 104.30, which buyers must attempt to maintain to fend off a deeper correction. Speaking of recovery, the bulls must target the 104.50 area, and subsequently, regain the previous support of 105.00 to moderate the potential losses.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.