AUD/JPY Price Analysis: Consolidation phase continues, bearish pressure observed

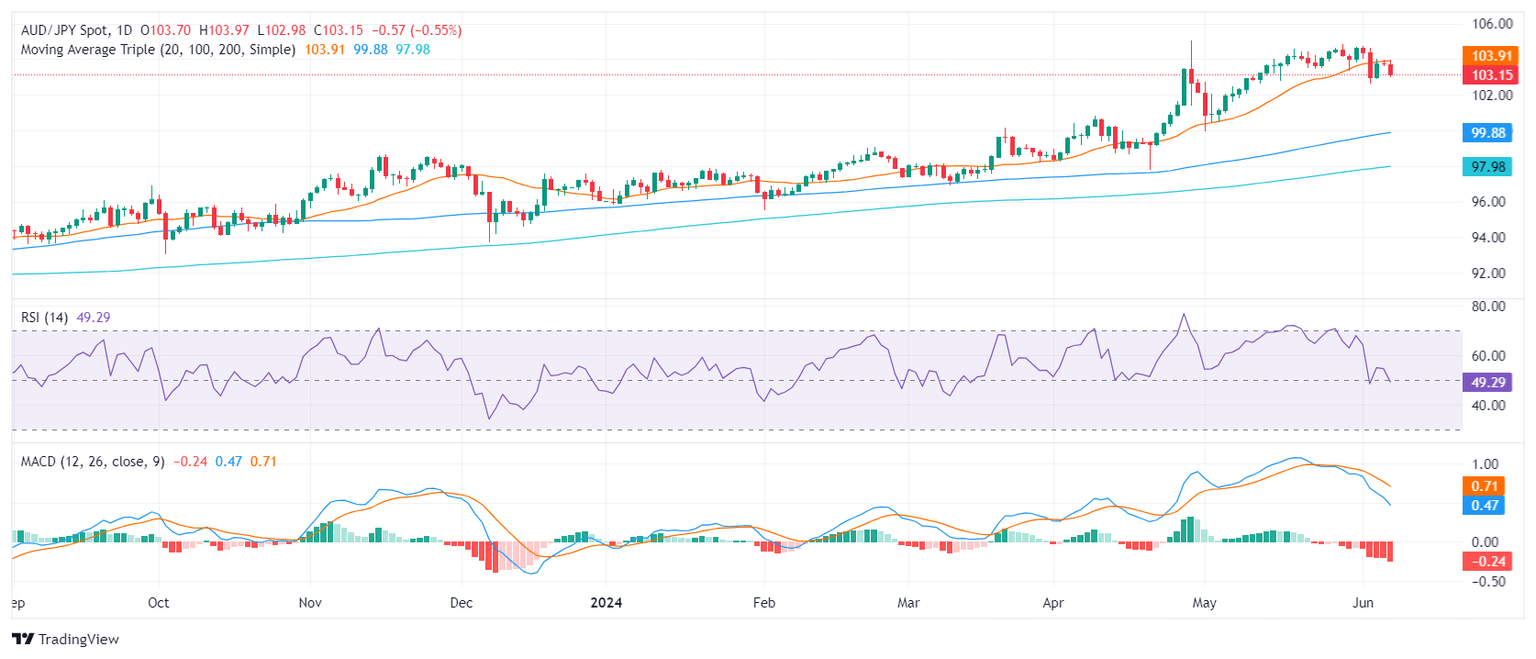

- Daily chart indicators reveal a neutral period for the pair; RSI stands at 49, showcasing no strong directional bias.

- Signs of a bearish takeover are emerging, suggesting possible short-term bearish pressure or further consolidation.

- The pair now interacts with the important 20-day SMA at 103.90, which currently serves as resistance to recover.

During the last trading sessions of this week, the AUD/JPY pair is maneuvering around the 103.00 level. This is indicative of an ongoing consolidation period following the impressive rally since early May.

Shifting the attention to the daily Relative Strength Index (RSI) analysis, the index is sitting at 49. When compared to the previous readings, a clear decline suggests that the pair has entered a bearish momentum in the short term. Moreover, the Moving Average Convergence Divergence (MACD) has started printing flat red bars, signaling that the market is experiencing steady selling activity.

AUD/JPY daily chart

Should the pair suffer further losses, the 100 and 200-day SMAs are readily available as buffering units. These averages are situated at about 99.80 and 97.98, respectively. Conversely, any attempt by the bulls to push the pair above the aforementioned 20-day SMA and further to the 105.00 level will be met with resistance. If these resistance barriers remain unbroken, the AUD/JPY pair might extend its consolidation phase.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.