AUD/JPY Price Analysis: Bullish harami emerged amidst sentiment improvement

- AUD/JPY formed a bullish harami candle pattern, suggesting the pair is upward biased.

- However, oscillators are still pointing south, so caution is warranted.

- AUD/JPY Price Analysis: Once it clears 89.00, that would pave the way toward 90.00.

The AUD/JPY trimmed some of its Monday losses on Tuesday and gained 0.16%. The pair formed a bullish harami two-candle pattern that could open the door for further gains, but firstly it needs to the region the 89.00 figure. At the time of writing, the AUD/JPY is trading at 88.32, up 0.01% as the Asian session begins.

AUD/JPY Price action

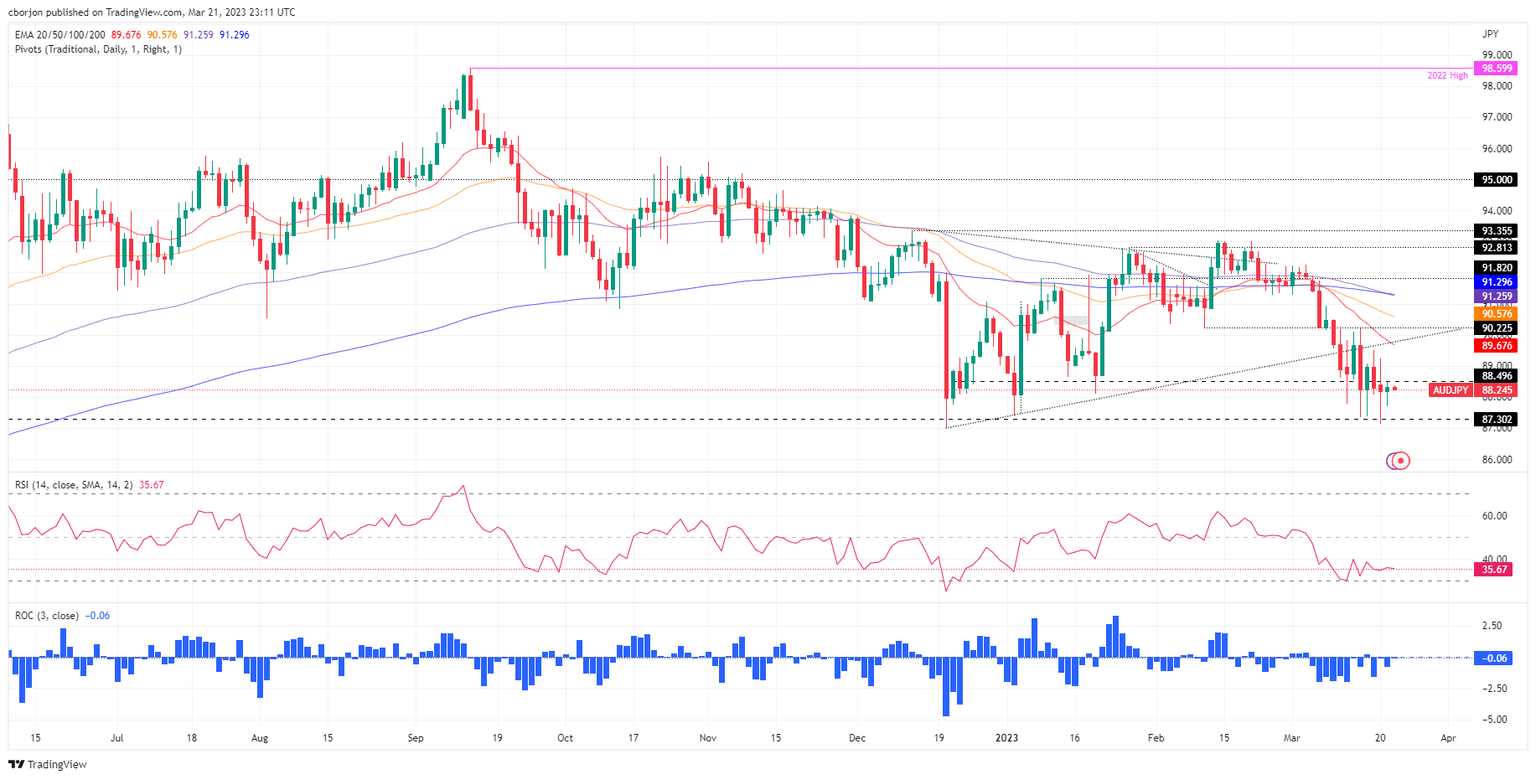

On Monday, the AUD/JPY printed a new YTD low at 87.12, then rallied above the 88.00 mark and registered a huge spinning top candlestick. On Tuesday, price action shrank, as usual, ahead of the US Federal Reserve’s (Fed) monetary policy meeting and formed a hammer. Additionally, price action was well contained within the previous day and formed a bullish harami. That said, the AUD/JPY is headed upward, although oscillators, such as the Relative Strength Index (RSI), stay in bearish territory.

Therefore, the AUD/JPY first resistance would be the March 21 high at 88.50, followed by the 89.00 mark. Once broken, the AUD/JPY would challenge the March 20 high at 89.23. A breach of the latter will expose the 20-day Exponential Moving Average (EMA) at 89.67. ahead of reaching 90.00.

In an alternate scenario, an AUD/JPY bearish continuation could happen if the pair dives below the March 21 lows of 87.71, putting into play a fall toward new YTD lows at 87.12.

AUD/JPY Daily chart

AUD/JPY Technical levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.