AUD/JPY Price Analysis: Bears take control as the pair struggles to hold above 93.00

- AUD/JPY was seen trading near the 92.50 area ahead of the Asian session, extending its losing streak to three consecutive sessions.

- The pair continues to face downward pressure, struggling to hold above the 93.00 level as sellers dominate price action.

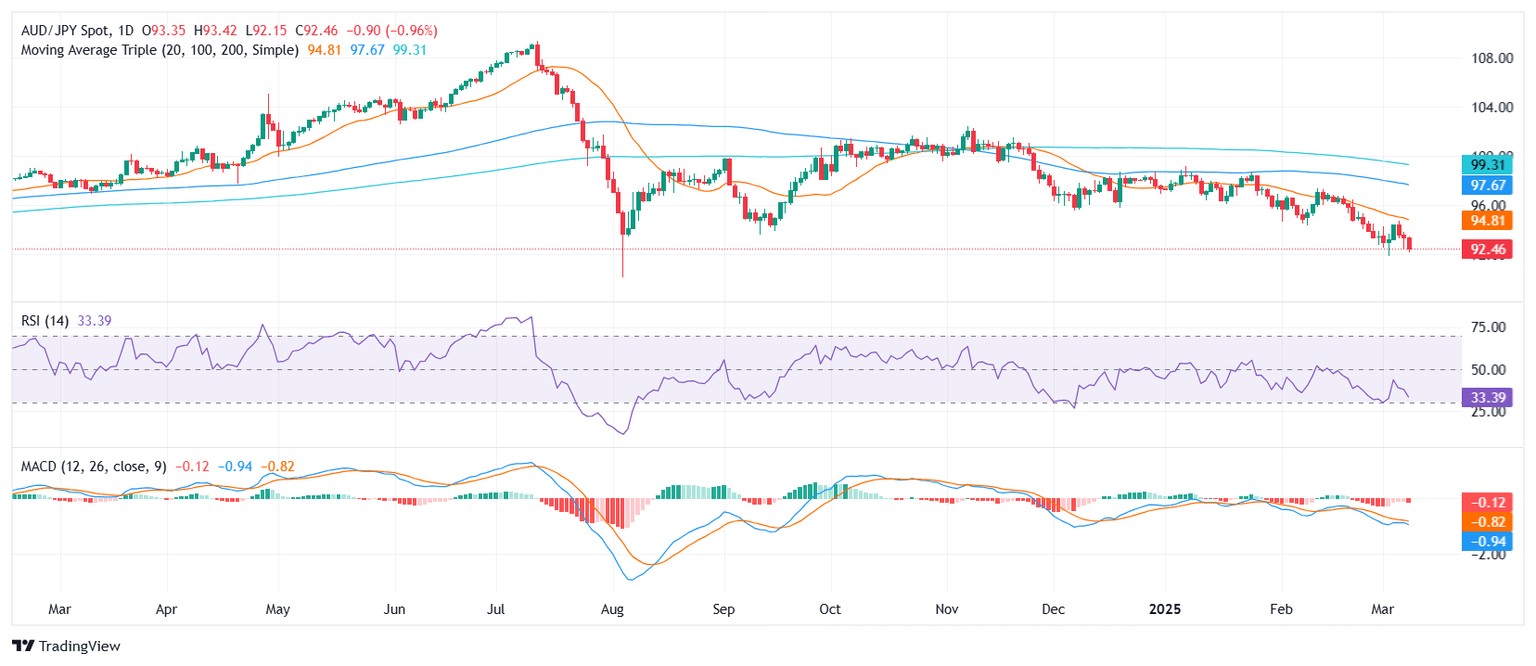

- Technical indicators suggest persistent bearish momentum, with the RSI approaching oversold conditions and the MACD showing weakening downside pressure.

The AUD/JPY pair extended its decline on Monday ahead of the Asian session, falling toward the 92.50 zone and marking a third straight day of losses. The downward momentum remains strong as the pair struggles to maintain levels above 93.00, with bearish sentiment prevailing in the short term. Risk-off flows and weak demand for the Australian Dollar continue to weigh on the pair.

From a technical perspective, the Relative Strength Index (RSI) is nearing oversold territory, currently declining sharply, which may suggest that further downside could be limited. Meanwhile, the Moving Average Convergence Divergence (MACD) is printing decreasing red bars, indicating that while bearish momentum persists, selling pressure could be moderating.

Key support levels to monitor include the 92.00 psychological area, which, if breached, could open the door for further declines toward the 91.50 zone. On the upside, the first resistance is seen around the 93.00 level, followed by stronger resistance at the 20-day Simple Moving Average (SMA) near 95.00.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.