AUD/JPY Price Analysis: Bearish pressure builds as pair slips below 94.00 zone

- AUD/JPY trades near the 93.80 area ahead of the Asian session, posting losses within the lower end of its daily range.

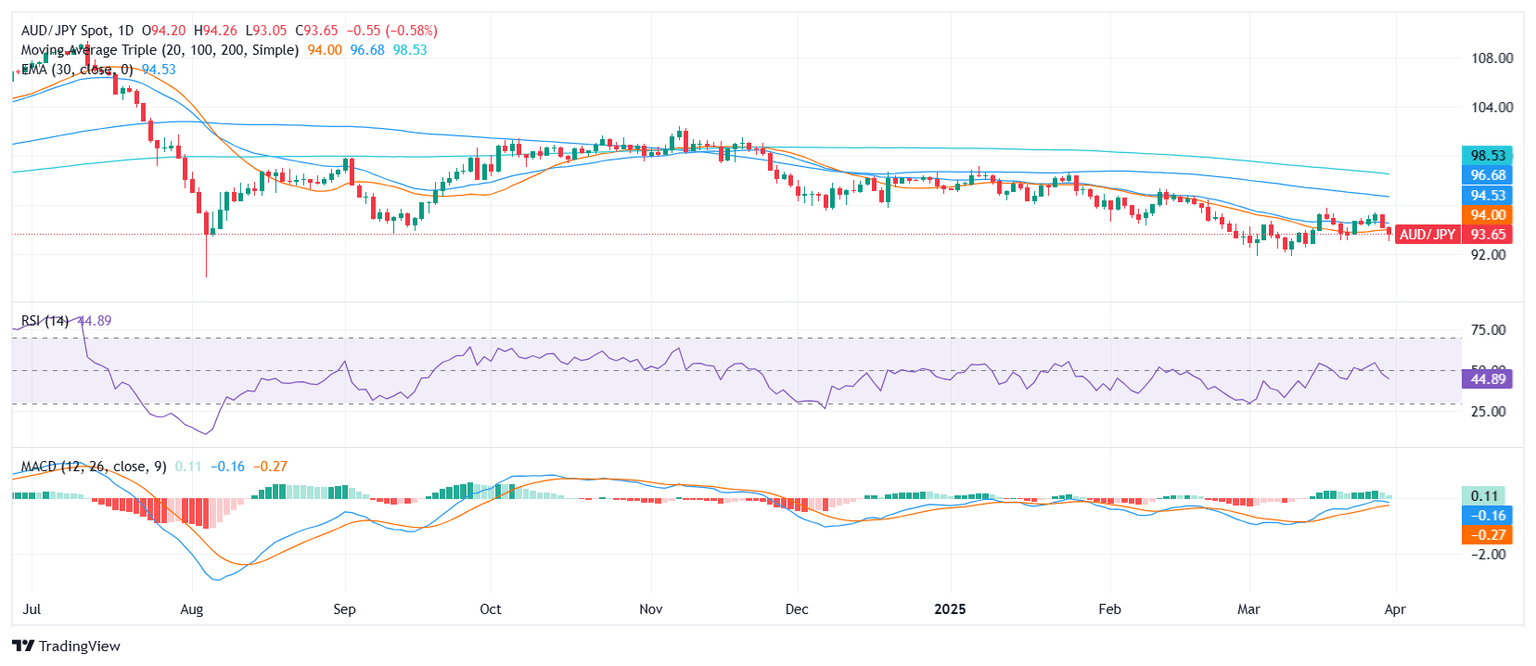

- The pair is flashing bearish signals despite a buy reading from the MACD, with momentum indicators and moving averages skewing negative.

- Support lies near 93.78, while resistance appears around the 94.05–94.27 zone.

The AUD/JPY pair drifted lower on Monday’s session ahead of the Asian open, trading around the 93.80 zone and extending its decline toward the bottom of its intraday range. The pair remains under mild pressure as market sentiment turns cautious. Technical indicators and trend signals are increasingly skewed to the downside, even though some momentum readings offer mixed signals.

Daily chart

Looking at trend indicators, all key moving averages reinforce selling pressure. The 20-day SMA at 94.05, 100-day SMA at 96.76, and 200-day SMA at 98.63 are all tilted downward, with shorter-term averages like the 10-day EMA (94.33) and SMA (94.43) also pointing south. These align with the broader bearish technical tone for the pair.

Immediate support can be found at 93.78, with further downside targets near 93.05. On the upside, resistance levels are stacked at 93.92, 94.05, and 94.26. Unless the pair reclaims ground above these zones, the path of least resistance remains to the downside.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.